Question 76

Two competing companies sell very similar products that are manufactured in plants located near each other in the United States. Company A values inventory using last-in, first-out (LIFO) and uses accelerated depreciation for plant assets. Company B values inventory using first-in, first-out (FIFO) and uses straight-line depreciation. From this information, what conclusions can an analyst draw about the gross margin reported for the two companies?

Question 77

A stockbroker wishes to examine the relationship between merger failures and stock prices. For 30 days, data were collected for closing stock prices each day and the number of merger failures announced that day. After reviewing the data, the stockbroker believes that merger failures affect stock market prices for more than one day. Which of the following measures would help the stockbroker incorporate that effect into the regression model?

Question 78

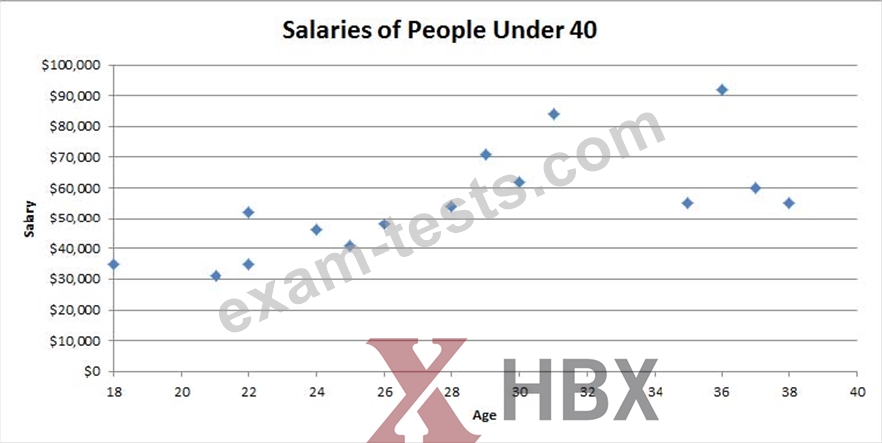

An individual interviews 15 people under the age of 40 and asks each for their age and salary. The resulting scatter plot is shown below.

Based on this graph, the correlation between age and salary appears to be approximately:

Based on this graph, the correlation between age and salary appears to be approximately:

Question 79

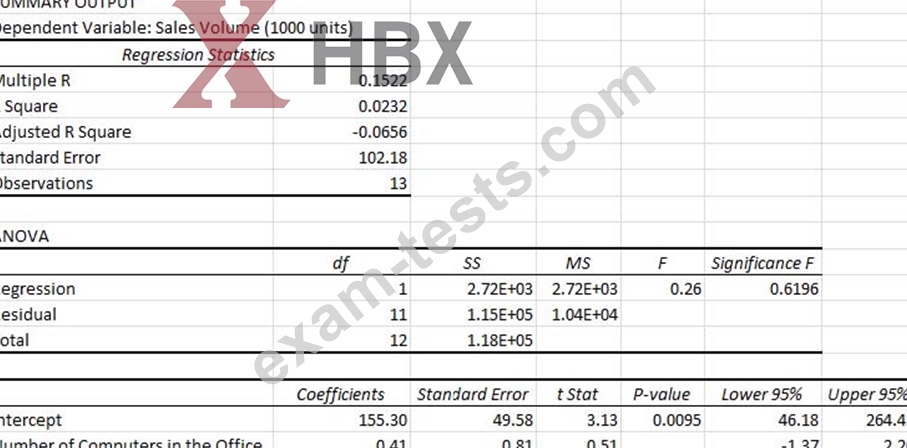

A company manager commissions a report to study the relationship between sales volume (in thousands of units) and the number of computers in each of the company's offices.

When the manager receives the report, however, the p-value for the independent variable is missing. Based on the rest of the regression output, which of the following numbers is the correct p-value?

When the manager receives the report, however, the p-value for the independent variable is missing. Based on the rest of the regression output, which of the following numbers is the correct p-value?

Question 80

A company owns an empty office building and is deciding how to use it next year. It would cost $100,000 to staff the office and $15,000 for equipment. The revenues would be $160,000. Meanwhile, it could rent the office to another company for $75,000 in revenues. In both cases, the company must pay $5,000 for the building's electricity. If the company is seeking to maximize its economic profit, which course should it pursue and what is the outcome?