Question 216

Company XYZ offers a retirement plan wherein the value of the plan's assets and liabilities is measured separately. The plan's funding and valuation can have a significant impact on the financial condition of the company. Company ABC offers a retirement plan wherein the amount owed to the participants at retirement is based solely on the account balance at the time of withdrawal with participants often bearing the responsibility for managing the investments in their account. Which of the following BEST describes the above two retirement plans and which act governs them?

Question 217

Which of the following is normally MORE significant for a corporation?

Question 218

In terms of targeting a company's capital structure, when is it beneficial to assume a high level of financial risk?

Question 219

In a private label financing arrangement, the seller does which of the following?

Question 220

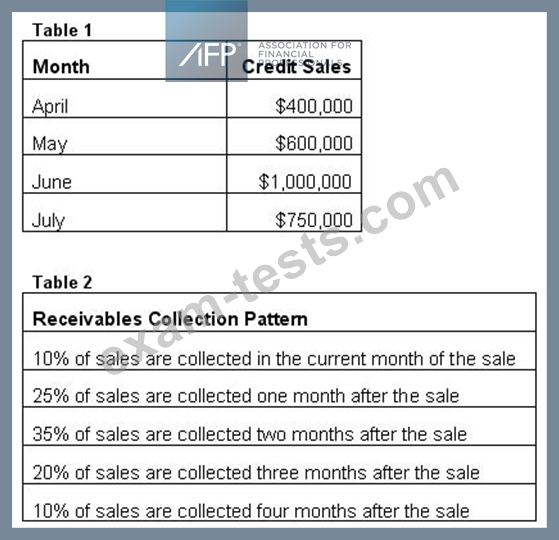

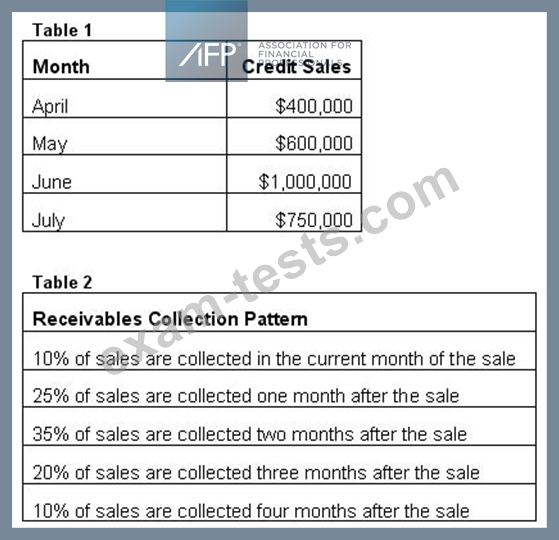

The company's monthly credit sales are in Table 1 and its receivables collection pattern is in Table

2. If this company wishes to achieve a second quarter (April-June) DSO of 60 days, what would its ending accounts receivable balance need to be?

Assume a 90-day quarter.

2. If this company wishes to achieve a second quarter (April-June) DSO of 60 days, what would its ending accounts receivable balance need to be?

Assume a 90-day quarter.