Question 231

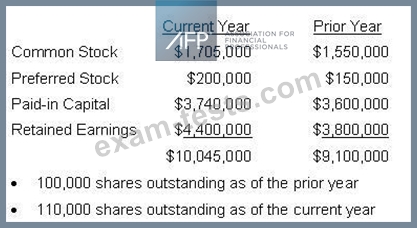

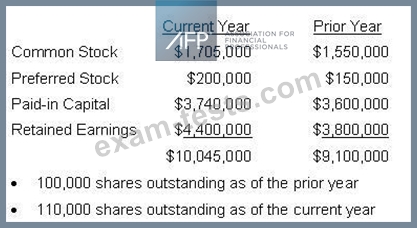

Equity section of Fisher, Inc. Financial Statement

If an investor paid $1,400.00 (excluding fees) for 75 shares of common stock, what was the market value of Fisher, Inc. at the time of purchase?

If an investor paid $1,400.00 (excluding fees) for 75 shares of common stock, what was the market value of Fisher, Inc. at the time of purchase?

Question 232

A bank's reserve requirement on demand deposits is 10%, and its earnings credit rate is 6%. If a company uses bank services amounting to $2,600 and has an excess of $550 in earnings credit, what is the average collected balance in the account based on a 30-day month?

Question 233

Which two of the following are optimal uses for short-term excess cash?

I. Pay down credit lines.

II. Make overnight investments.

III. Repurchase stock.

IV.

Make capital expenditures.

I. Pay down credit lines.

II. Make overnight investments.

III. Repurchase stock.

IV.

Make capital expenditures.

Question 234

Which of the following is NOT a component of the operating cycle?

Question 235

A portfolio manager would like to purchase U.S. 50 million of 10-year notes 3 months from now, but has heard news that the Federal Reserve will start a purchasing program of longer term treasuries that will include 10-year notes. The purchase program would likely cause a lowering of market interest rates. The manager would also like to avoid having to use margin on a daily basis. To remove the price risk that may be associated with the Federal Reserve purchasing program, the portfolio manager would MOST LIKELY enter into an: