Question 226

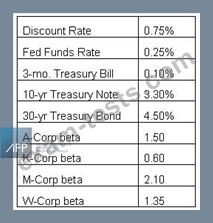

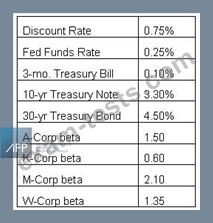

The historic rate of return in the U.S. stock market is 8%. An investment portfolio has a mix of equity investments consisting of 40% A-Corp stock, 30% K-Corp stock, 10% M-Corp stock and 20% W-Corp stock. The investment portfolio manager tends to buy and hold the equity investment position for 3 years on average. To calculate the required rate of return for this investment portfolio, what rate from the table would be used as the risk-free rate?

Question 227

All of the following are objectives of credit management EXCEPT:

Question 228

Which of the following methods of compensation is NOT used by banks in the United States?

Question 229

A company has negotiated a credit facility with the following terms:

-$5,000,000 line of credit -$3,000,000 average borrowing -30 basis point commitment fee on unused portion of line -Interest rate on advances is 1-month LIBOR plus 4% -1-month LIBOR is currently 2% -Compensating balance requirement of 20% on the outstanding borrowings

What is the effective annual borrowing rate for the line of credit?

-$5,000,000 line of credit -$3,000,000 average borrowing -30 basis point commitment fee on unused portion of line -Interest rate on advances is 1-month LIBOR plus 4% -1-month LIBOR is currently 2% -Compensating balance requirement of 20% on the outstanding borrowings

What is the effective annual borrowing rate for the line of credit?

Question 230

Which of the following is NOT one of the three goals of a disbursement system?