Question 41

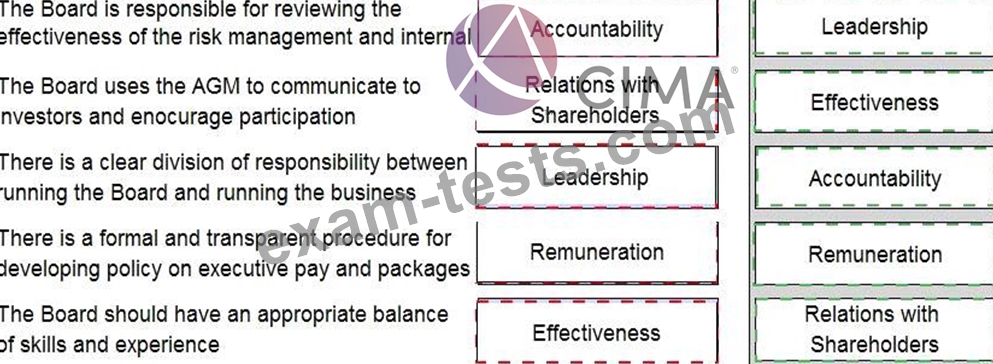

Place the correct label against each of the descriptors for the main principles of the UK Corporate Governance Code.

Question 42

CCC is a small business which manufactures and sells bicycles. Its most popular product is the standard road bike, brand named the 'Easy Rider'. CCC offers customers a limited degree of choice in terms of product specification for the Easy Rider bicycle. CCC manufactures and sells 1,000 Easy Rider bicycles each year. The average retail price of an Easy Rider bicycle is $500.

As a result of the recent rise in popularity of cycling in its home country, last year CCC launched a new bicycle, brand named the 'Pro Rider'. This bicycle is aimed at the more serious cyclists who take part in competitions and road races. CCC offers Pro Rider customers a wide choice of specifications and accessories and uses the highest quality of materials in its manufacturing process. A Pro Rider bicycle retails for an average price of $6,000. In its first year, CCC sold 150 Pro Rider bicycles.

CCC's business is generated mainly from word of mouth recommendations, repeat business and from customer visits to its small chain of shops. It aims to increase its market share for both brands within the next 5 years.

Competition is high, with a number of large national bicycle manufacturers in the market.

Which TWO of the following are critical success factors (CSF's) for CCC?

As a result of the recent rise in popularity of cycling in its home country, last year CCC launched a new bicycle, brand named the 'Pro Rider'. This bicycle is aimed at the more serious cyclists who take part in competitions and road races. CCC offers Pro Rider customers a wide choice of specifications and accessories and uses the highest quality of materials in its manufacturing process. A Pro Rider bicycle retails for an average price of $6,000. In its first year, CCC sold 150 Pro Rider bicycles.

CCC's business is generated mainly from word of mouth recommendations, repeat business and from customer visits to its small chain of shops. It aims to increase its market share for both brands within the next 5 years.

Competition is high, with a number of large national bicycle manufacturers in the market.

Which TWO of the following are critical success factors (CSF's) for CCC?

Question 43

EF manufactures and sells cars in Country X. Which of the following would improve its profitability?

Question 44

Which TWO of the following are advantages to an organization of using non-financial performance measures, rather than financial performance measures? (Choose two.)

Question 45

Information regarding two potential investments, that do not provide initial, valuable positive NPV opportunities, is outlined below:

* Y is a telecoms company, considering paying a premium for a Chinese telecoms company which has exclusive rights to service a large segment of the Chinese market, currently worth $123 billion in total The exclusive rights cover 25% of the market

* Z is a developed market retailer, considering paying a premium for an Indian retail company in the belief that the market is going to continue to be lucrative and grow by 8% per annum for the foreseeable future The current market is worth $600 billion and the company currently has 12% of the total market.

Which of the following statements regarding sustainable excess returns for the above real options is true1?

* Y is a telecoms company, considering paying a premium for a Chinese telecoms company which has exclusive rights to service a large segment of the Chinese market, currently worth $123 billion in total The exclusive rights cover 25% of the market

* Z is a developed market retailer, considering paying a premium for an Indian retail company in the belief that the market is going to continue to be lucrative and grow by 8% per annum for the foreseeable future The current market is worth $600 billion and the company currently has 12% of the total market.

Which of the following statements regarding sustainable excess returns for the above real options is true1?

Premium Bundle

Newest E3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing E3 Exam! BraindumpsPass.com now offer the updated E3 exam dumps, the BraindumpsPass.com E3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com E3 pdf dumps with Exam Engine here: