Question 11

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

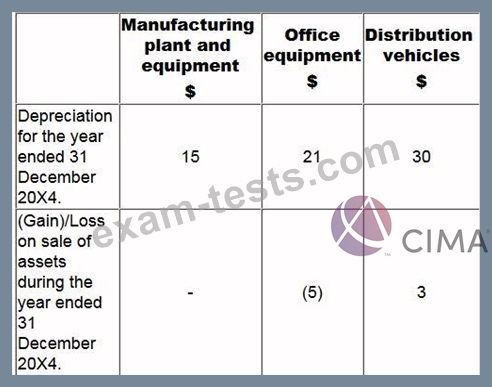

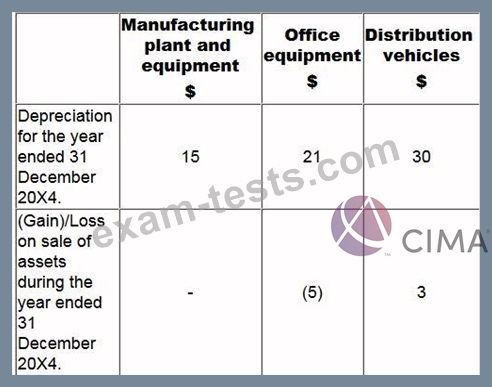

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered in the Statement of Profit or Loss for the year ended 31 December 20X4 in relation to Administration and Distribution costs?

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered in the Statement of Profit or Loss for the year ended 31 December 20X4 in relation to Administration and Distribution costs?

Question 12

YZ has $40,000 of plant and machinery which was acquired on 1 June 20X1.Tax depreciation rates on plant and machinery are 25% reducing balance. All plant and machinery was sold for $24,000 on 1 June

20X3.

Calculate the tax balancing allowance or charge on disposal for the year ended 31 May 20X3 and state the effect on the taxable profit.

20X3.

Calculate the tax balancing allowance or charge on disposal for the year ended 31 May 20X3 and state the effect on the taxable profit.

Question 13

The development of an international financial reporting standard generally goes through a number of stages.

Which of the following is NOT a stage of development?

Which of the following is NOT a stage of development?

Question 14

The Code of Ethics lists five fundamental principles. One of these is.

Question 15

RST operates in Country X where the tax rules state entertaining costs and accounting depreciation are disallowable for tax purposes.

In year ending 31 May 20X4, XYZ made an accounting profit of $480,000.

Profit included $16,300 of entertaining costs and $15,150 of income exempt from taxation.

XYZ has plant and machinery with accounting depreciation amounting to $24,200 and tax depreciation amounting to $45,200.

Calculate the tax charge for the year ended 31 May 20X4 assuming all profits are taxed at 25%.

In year ending 31 May 20X4, XYZ made an accounting profit of $480,000.

Profit included $16,300 of entertaining costs and $15,150 of income exempt from taxation.

XYZ has plant and machinery with accounting depreciation amounting to $24,200 and tax depreciation amounting to $45,200.

Calculate the tax charge for the year ended 31 May 20X4 assuming all profits are taxed at 25%.