Question 31

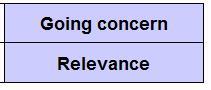

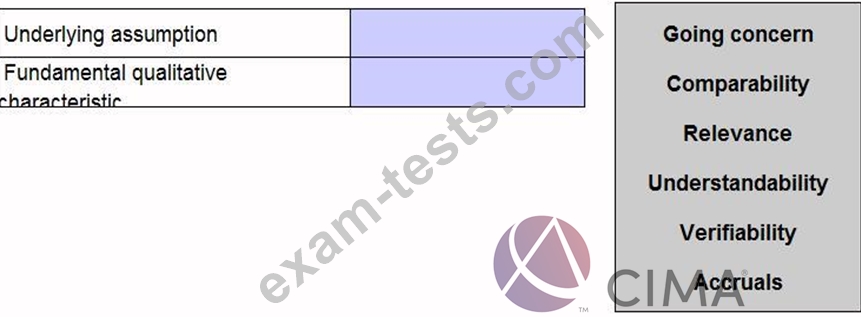

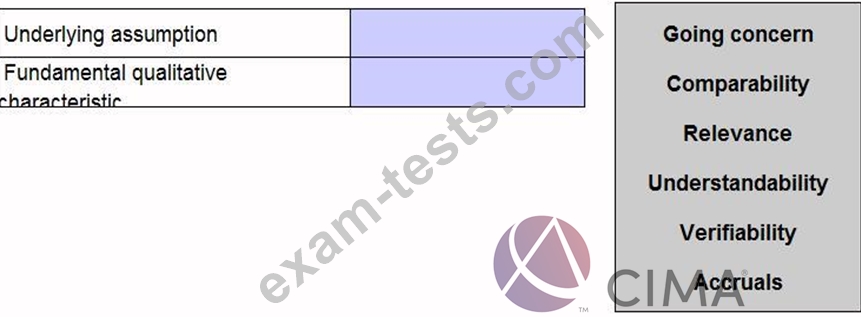

The Conceptual Framework for Financial Reporting issued by the International Accounting Standards Board (known as the IASB's conceptual framework) includes one underlying assumption about the preparation of financial statements and two fundamental qualitative characteristics for financial information.

Identify the underlying assumption and one of the fundamental characteristics by placing one of the options in each of the boxes below.

Identify the underlying assumption and one of the fundamental characteristics by placing one of the options in each of the boxes below.

Question 32

Which of the following would be found under the heading "other comprehensive income" in the statement of total comprehensive income?

Question 33

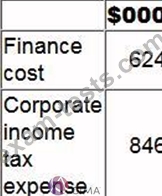

The following information is extracted from QQ's statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March

20X1.

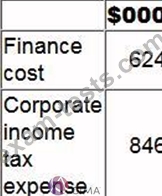

The following information if included within QQ's statement of profit or loss for the year ended 31 March 20X2.

Included within finance cost is $124,000 which relates to interest paid on a finance lease. QQ includes finance lease interest within financing activities on its statement of cash flows.

QQ is preparing its statement of cash flows for the year ended 31 March 20X2.

What cash outflow figure should be included for corporate income tax paid within the cash flow from operating activities section of the statement?

Give your answer to the nearest $000.

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March

20X1.

The following information if included within QQ's statement of profit or loss for the year ended 31 March 20X2.

Included within finance cost is $124,000 which relates to interest paid on a finance lease. QQ includes finance lease interest within financing activities on its statement of cash flows.

QQ is preparing its statement of cash flows for the year ended 31 March 20X2.

What cash outflow figure should be included for corporate income tax paid within the cash flow from operating activities section of the statement?

Give your answer to the nearest $000.

Question 34

Which THREE of the following would be included in a cash budget?

Question 35

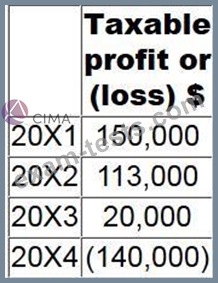

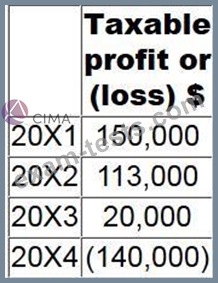

In 20X4, DEF closed its business having made a trading loss of $160,000. In DEF's country of residence, trading losses may be carried back three years on a LIFO basis.

The profits for the last four years of trading were:

What are the taxable profits or losses for years 20X1 and 20X2?

The profits for the last four years of trading were:

What are the taxable profits or losses for years 20X1 and 20X2?