Question 51

KL sells luxury leather handbags and has 3 stores in exclusive shopping areas. Following years of static revenues and margins, in August 20X6 KL opened a fourth store at a busy airport terminal which is proving to be successful.

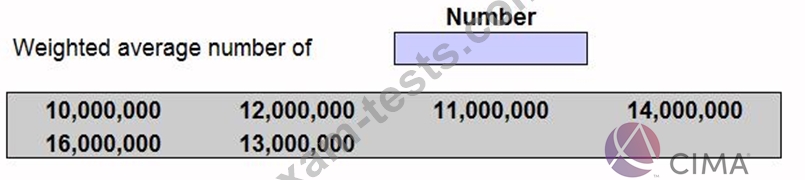

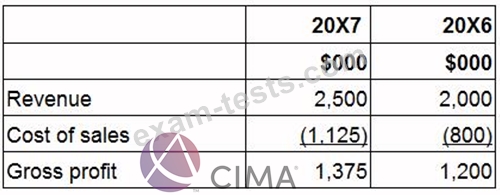

The revenue and gross profit of KL for the years ended 31 March 20X7 and 20X6 are as follows:

Which of the following would be a contributing factor to the movement in the gross profit margin of KL?

The revenue and gross profit of KL for the years ended 31 March 20X7 and 20X6 are as follows:

Which of the following would be a contributing factor to the movement in the gross profit margin of KL?

Question 52

AB owned 80% of the equity share capital of FG at 1 January 20X6. AB disposed of 10% of FG's equity share capital on 31 December 20X6 for $400,000. The non controlling interest was measured at

$700,000 immediately prior to the disposal.

Which of the following represents the adjustment that AB made to non controlling interest in respect of the disposal when it prepared its consolidated financial statements at 31 December 20X6?

$700,000 immediately prior to the disposal.

Which of the following represents the adjustment that AB made to non controlling interest in respect of the disposal when it prepared its consolidated financial statements at 31 December 20X6?

Question 53

Mr D, a CIMA qualified accountant, is working on the preparation of a long term profit forecast required by the local stock market prior to a new share issue of equity shares. At the most recent board meeting the directors requested that the forecast be inflated. In Mr D's view this would grossly overestimate the forecast profit. The board intends to publish the revised inflated forecast.

Which THREE of the following are the ethical options available to Mr D in this situation?

Which THREE of the following are the ethical options available to Mr D in this situation?

Question 54

Following the impairment review of the investment in BC, what would be the carrying value of this associate in KL's consolidated statement of financial position at 31 December 20X9?

Question 55

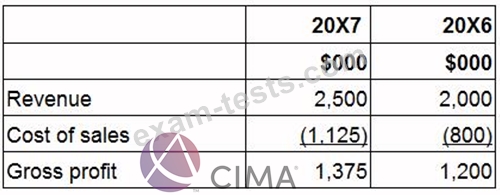

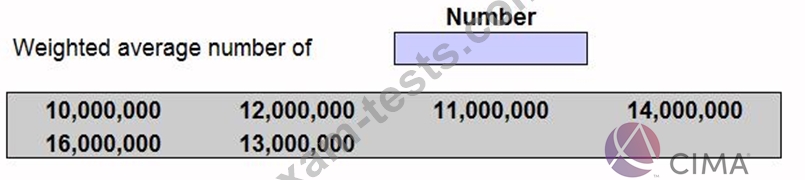

On 1 January 20X8 XY, a listed entity, had 10,000,000 ordinary shares in issue each with a par value of 50 cents. On 1 July 20X8 XY raised $6,000,000 by issuing ordinary shares at a price of £1.50 each which was the full market price.

Place the correct figure into the box below to show the number that XY will use as its weighted average number of ordinary shares in the calculation of earnings per share for the year to 31 December 20X8.

Place the correct figure into the box below to show the number that XY will use as its weighted average number of ordinary shares in the calculation of earnings per share for the year to 31 December 20X8.