Question 56

An entity has declared a dividend of $0.12 a share. The cum dividend market price of one equity share is

$1.40.

Assuming a dividend growth rate of 7% a year, what is the entity's cost of equity?

$1.40.

Assuming a dividend growth rate of 7% a year, what is the entity's cost of equity?

Question 57

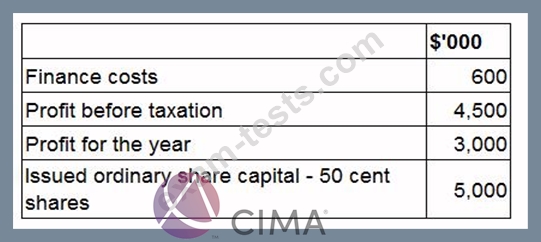

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

Question 58

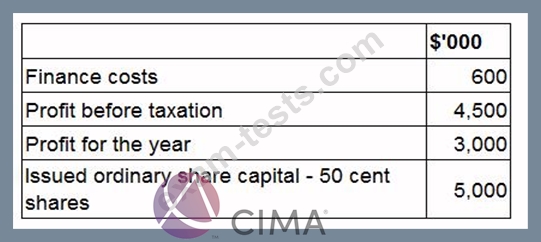

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

Question 59

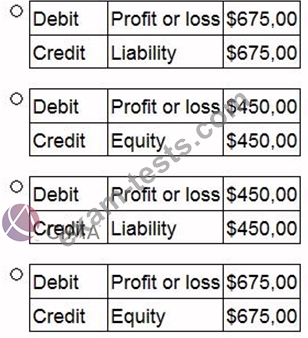

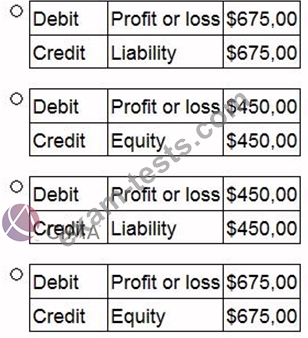

On 1 January 20X4 EF grants each of its 125 employees 500 share options on the condition that they remain in employment for 3 years. During the year to 31 December 20X4 10 employees left and It is expected that a further 25 will leave before the end of the vesting period.

The fair value of each share option is $30 on 1 January 20X4 and $45 on 31 December 20X4.

What is the journal entry in respect of these share options in EF's financial statements for the year ended 31 December 20X4?

The fair value of each share option is $30 on 1 January 20X4 and $45 on 31 December 20X4.

What is the journal entry in respect of these share options in EF's financial statements for the year ended 31 December 20X4?

Question 60

Which of the following actions should XY's management take in order to reduce its investment in working capital?