- Home

- CIPS Certification

- L4M1 Exam

- CIPS.L4M1.v2026-01-09.q27 Practice Test

Question 1

Describe the main stages of the CIPS Procurement and Supply Cycle (25 points)

Correct Answer:

See the solution in Explanation part below.

Explanation:

How to respond to this question:

- Include as many of the stages as you can, but it's not vital to remember them all. You should aim to remember at least 8 of the 13 steps.

- The steps are; Define Business Need, Market Analysis + Make vs Buy, Develop Strategy and Plan, Pre- Procurement Market Testing, Develop Documents and Specification, Supplier Selection, Issue Tender, Bid Evaluation, Contract Award and Implementation, Warehouse Logistics, Contract performance and Improvement, Supplier Relationship Management and Asset Management Essay Plan:

Introduction - Explain what the CIPS Procurement and Supply Cycle is- a tool to be used by procurement professionals which tracks a procurement exercise from inception to close. It's helpful as it ensures procurement exercises are done correctly and steps are completed in the right order.

- Describe (briefly) what happens at each stage of the cycle, giving examples. You should put each stage into a separate paragraph. It's also a good idea to name the stages in chronological order. Some ideas of things you could mention include:

1) Define Business Need and Develop Specification - Identify what the need is, what type of purchase, put together a business case and outline the requirements

2) Market Analysis and Make vs Buy Decision - analyse the market using market segmentation (e.g. by buyer, product, geography etc) or use Porter's 5 Forces (buyer and supplier power, threat of new entrants, threat of substitutions, supplier rivalry). Looks at if what you want to procure is actually available.

3) Develop Strategy / Plan - you could use a STEEPLE and SWOT analysis. Consider if this is the right time to procure. Create timelines and budgets.

4) Pre-Procurement Market Testing - consider stakeholder engagement, supplier engagement, new / upcoming legislation, currency fluctuations, market, competitor actions. Is this the best time to procure? Will it be successful?

5) Develop Documentation / Creation of Contract terms- firm up the requirements and create the formal documents for the tender exercise. This may be a RFQ or ITT. Define the offer. Include KPIs.

6) Supplier Selection - May not be required for rebuys but an important step for new buys. May use a list of pre-approved suppliers or this may be going out to the open market. You can shortlist suppliers by sending out a pre-qualification questionnaire.

7) Issue Tender - Electronically, consider whether to use an open vs closed procurement exercise

8) Bid / Tender Evaluation - Very flexible for companies in the private sector but there are guiding principles for doing this for public procurement; transparency, equal treatment, proportionality. Often considers both price and quality.

9) Contract Award and Implementation- Organisations may have different processes for different values (e.g.

large purchases may need senior management approval, but under £500 just needs a manager's signature).

May require post-award negotiation. Contract is drafted and signed.

10) Warehouse Logistics and receipt - includes POs and Invoices. Battle of the Forms. Goods Inwards = receiving and inspecting goods- may use quality control.

11) Contract performance review - ensuring contract obligations are fulfilled includes P2P procedures, database management, budgeting / costs monitoring, reporting and dispute resolution.

12) Supplier Management - will depend on the relationship but includes; contact / meetings with the supplier, motivating / incentivising the supplier, working with them on performance issues, ensuring KPIs are met.

13) Asset Management / End of Life- considers TCO, ongoing maintenance and costs, insurance and warrantees and disposal of the item once it has reached the end of its life.

Conclusion - The CIPS Procurement Cycle is cycle rather than process as it is a continuous loop and needs constantly emerge. It never ends. New buys are more likely to follow all the stages of the cycle, rebuys may skip steps Tutor Notes:

- Often steps 11 and 12 are confused or merged together but they are different. It's possible to have great contract management and a poor supplier relationship i.e. the contract is working effectively and the supplier is delivering in line with the contract BUT the relationship may be fraught with tension and the buyer and supplier don't like each other.

- To get a high score I would include examples of all of the stages, but remember you only have 45 minutes to answer the question, so balance detail with timing so you don't overwrite

- The procurement cycle is on p. 70 or you can download it here: Procurement Supply Cycle | CIPS

Explanation:

How to respond to this question:

- Include as many of the stages as you can, but it's not vital to remember them all. You should aim to remember at least 8 of the 13 steps.

- The steps are; Define Business Need, Market Analysis + Make vs Buy, Develop Strategy and Plan, Pre- Procurement Market Testing, Develop Documents and Specification, Supplier Selection, Issue Tender, Bid Evaluation, Contract Award and Implementation, Warehouse Logistics, Contract performance and Improvement, Supplier Relationship Management and Asset Management Essay Plan:

Introduction - Explain what the CIPS Procurement and Supply Cycle is- a tool to be used by procurement professionals which tracks a procurement exercise from inception to close. It's helpful as it ensures procurement exercises are done correctly and steps are completed in the right order.

- Describe (briefly) what happens at each stage of the cycle, giving examples. You should put each stage into a separate paragraph. It's also a good idea to name the stages in chronological order. Some ideas of things you could mention include:

1) Define Business Need and Develop Specification - Identify what the need is, what type of purchase, put together a business case and outline the requirements

2) Market Analysis and Make vs Buy Decision - analyse the market using market segmentation (e.g. by buyer, product, geography etc) or use Porter's 5 Forces (buyer and supplier power, threat of new entrants, threat of substitutions, supplier rivalry). Looks at if what you want to procure is actually available.

3) Develop Strategy / Plan - you could use a STEEPLE and SWOT analysis. Consider if this is the right time to procure. Create timelines and budgets.

4) Pre-Procurement Market Testing - consider stakeholder engagement, supplier engagement, new / upcoming legislation, currency fluctuations, market, competitor actions. Is this the best time to procure? Will it be successful?

5) Develop Documentation / Creation of Contract terms- firm up the requirements and create the formal documents for the tender exercise. This may be a RFQ or ITT. Define the offer. Include KPIs.

6) Supplier Selection - May not be required for rebuys but an important step for new buys. May use a list of pre-approved suppliers or this may be going out to the open market. You can shortlist suppliers by sending out a pre-qualification questionnaire.

7) Issue Tender - Electronically, consider whether to use an open vs closed procurement exercise

8) Bid / Tender Evaluation - Very flexible for companies in the private sector but there are guiding principles for doing this for public procurement; transparency, equal treatment, proportionality. Often considers both price and quality.

9) Contract Award and Implementation- Organisations may have different processes for different values (e.g.

large purchases may need senior management approval, but under £500 just needs a manager's signature).

May require post-award negotiation. Contract is drafted and signed.

10) Warehouse Logistics and receipt - includes POs and Invoices. Battle of the Forms. Goods Inwards = receiving and inspecting goods- may use quality control.

11) Contract performance review - ensuring contract obligations are fulfilled includes P2P procedures, database management, budgeting / costs monitoring, reporting and dispute resolution.

12) Supplier Management - will depend on the relationship but includes; contact / meetings with the supplier, motivating / incentivising the supplier, working with them on performance issues, ensuring KPIs are met.

13) Asset Management / End of Life- considers TCO, ongoing maintenance and costs, insurance and warrantees and disposal of the item once it has reached the end of its life.

Conclusion - The CIPS Procurement Cycle is cycle rather than process as it is a continuous loop and needs constantly emerge. It never ends. New buys are more likely to follow all the stages of the cycle, rebuys may skip steps Tutor Notes:

- Often steps 11 and 12 are confused or merged together but they are different. It's possible to have great contract management and a poor supplier relationship i.e. the contract is working effectively and the supplier is delivering in line with the contract BUT the relationship may be fraught with tension and the buyer and supplier don't like each other.

- To get a high score I would include examples of all of the stages, but remember you only have 45 minutes to answer the question, so balance detail with timing so you don't overwrite

- The procurement cycle is on p. 70 or you can download it here: Procurement Supply Cycle | CIPS

Question 2

Explain 5 stages of the sourcing cycle that occur in the pre-contract stage (25 points)

Correct Answer:

See the solution in Explanation part below.

Explanation:

How to approach this question:

- The Sourcing Cycle is the first half of the CIPS Procurement Cycle and includes these steps:

1) Define Business Need

2) Market Analysis + Make vs Buy

3) Develop Strategy and Plan

4) Pre-Procurement Market Testing

5) Develop Documents and Specification

6) Supplier Selection

7) Issue Tender

8) Bid Evaluation

9) Contract Award and Implementation

Your response should detail 5 of these. It is a good idea to pick the ones you know most about and where there is more to write about. You won't get any extra points for naming more than 5 so focus on getting as much detail down about 5, rather than explaining more of them.

Essay Plan

Introduction - explain what the sourcing cycle is - the stages of the procurement cycle before a contract is signed. It describes the steps an organisation will take to source/ procures goods or services.

Paragraph 1 - Define the business need

How is the need identified? E.g. by end user, stores department, ERP system.

Procurement should challenge this - is it really necessary? Suggest alternatives - this could be a key source of added value

Put together business case / requisition / project initiation document

What type of purchase? Straight rebuy, modified rebuy, new purchase

Decide on what type of specification would be best - Conformance vs performance specification

This stage may include early supplier involvement

Paragraph 2 - Market Analysis and Make vs Buy Decision

Create an Analysis by segmenting the market by buyer, product, distribution channel, geography, customer market etc.

Make vs Buy - use Carter's Matrix to decide whether the organisation should make vs buy.

Also consider outsourcing at this stage

Paragraph 3 - Documents and Specification

Draft documents. These may include a RFQ or ITT, a specification and a proposed form of contract

Specification may be conformance or performance based

A contract sets out the roles, rights, responsibilities and obligations of the parties and shows intention to enter into 'legal relations'

This stage defines the 'offer' which becomes binding once other party accepts

Documentation may also include proposed KPIs and SLAs

Paragraph 4 - Supplier Selection

For a new purchase, supplier selection is very important - investigation should be proportionate to the value of the procurement. For rebuys or low-risk purchases you could use the same supplier or a list of pre- approved suppliers.

You can locate potential suppliers by; catalogues, websites, trade registers, market exchanges and review sites, trade or industry press, fairs and conferences, networking and recommendations/ referrals.

You can shortlist suppliers by sending out a pre-qualification questionnaire. This adds value by reducing wasted time / costs / risks to entering into a contract with the wrong supplier.

Other criteria for supplier selection include using Carter's 10 Cs (competency, consistency, capability, control, cost, cash, clean, communication, culture, commitment), thesupplier's financial standing (e.g.

liquidity and gearing), references and considering their CSR policy.

Paragraph 5 - Issue Tender

Competitive bidding should only be done when there's sufficient time and resources available, there's sufficient suppliers in the marketplace, they're keen to win business (ie that there's appetite for competition) and there is a strong specification

Best practice is to issue tenders electronically as it ensures equal treatment of suppliers and transparency

Consider open vs closed procurement processes

Use a cross-functional team - particularly when marking responses

Conclusion - you could mention here that different sourcing activities may require more or less effort at each of the stages e.g. procuring a new item may require more market analysis than a re-buy.

Tutor Notes:

- If you want to add in extra details, you could think about ways procurement can add value at each stage

- In the old syllabus, CIPS were a bit obsessed with Michael Porter. In the Market Analysis bit you could talk about using Porter's 5 forces (buyer and supplier power, threat of new entrants, threat of substitutions, supplier rivalry) and Porter's 3 generic strategies for competing (cost leadership, differentiation, niche segment). This has been removed from the study guide so it's not essential to know this for this module, but if you've seen it before it's a nice one to throw in.

- You could also mention that there are differences between the public and private sector procurement at the different stages. E.g. Public Sector requires open competitions for contracts of a certain value and must follow the rules set out in Public Contract Regulations - the private sector doesn't have such strict regulations so there is much more flexibility in how tenders are completed. Also in the public sector, the evaluation criteria needs to be agreed beforehand and presented in the ITT- not the same for the private sector.

- Study guide p.71

Explanation:

How to approach this question:

- The Sourcing Cycle is the first half of the CIPS Procurement Cycle and includes these steps:

1) Define Business Need

2) Market Analysis + Make vs Buy

3) Develop Strategy and Plan

4) Pre-Procurement Market Testing

5) Develop Documents and Specification

6) Supplier Selection

7) Issue Tender

8) Bid Evaluation

9) Contract Award and Implementation

Your response should detail 5 of these. It is a good idea to pick the ones you know most about and where there is more to write about. You won't get any extra points for naming more than 5 so focus on getting as much detail down about 5, rather than explaining more of them.

Essay Plan

Introduction - explain what the sourcing cycle is - the stages of the procurement cycle before a contract is signed. It describes the steps an organisation will take to source/ procures goods or services.

Paragraph 1 - Define the business need

How is the need identified? E.g. by end user, stores department, ERP system.

Procurement should challenge this - is it really necessary? Suggest alternatives - this could be a key source of added value

Put together business case / requisition / project initiation document

What type of purchase? Straight rebuy, modified rebuy, new purchase

Decide on what type of specification would be best - Conformance vs performance specification

This stage may include early supplier involvement

Paragraph 2 - Market Analysis and Make vs Buy Decision

Create an Analysis by segmenting the market by buyer, product, distribution channel, geography, customer market etc.

Make vs Buy - use Carter's Matrix to decide whether the organisation should make vs buy.

Also consider outsourcing at this stage

Paragraph 3 - Documents and Specification

Draft documents. These may include a RFQ or ITT, a specification and a proposed form of contract

Specification may be conformance or performance based

A contract sets out the roles, rights, responsibilities and obligations of the parties and shows intention to enter into 'legal relations'

This stage defines the 'offer' which becomes binding once other party accepts

Documentation may also include proposed KPIs and SLAs

Paragraph 4 - Supplier Selection

For a new purchase, supplier selection is very important - investigation should be proportionate to the value of the procurement. For rebuys or low-risk purchases you could use the same supplier or a list of pre- approved suppliers.

You can locate potential suppliers by; catalogues, websites, trade registers, market exchanges and review sites, trade or industry press, fairs and conferences, networking and recommendations/ referrals.

You can shortlist suppliers by sending out a pre-qualification questionnaire. This adds value by reducing wasted time / costs / risks to entering into a contract with the wrong supplier.

Other criteria for supplier selection include using Carter's 10 Cs (competency, consistency, capability, control, cost, cash, clean, communication, culture, commitment), thesupplier's financial standing (e.g.

liquidity and gearing), references and considering their CSR policy.

Paragraph 5 - Issue Tender

Competitive bidding should only be done when there's sufficient time and resources available, there's sufficient suppliers in the marketplace, they're keen to win business (ie that there's appetite for competition) and there is a strong specification

Best practice is to issue tenders electronically as it ensures equal treatment of suppliers and transparency

Consider open vs closed procurement processes

Use a cross-functional team - particularly when marking responses

Conclusion - you could mention here that different sourcing activities may require more or less effort at each of the stages e.g. procuring a new item may require more market analysis than a re-buy.

Tutor Notes:

- If you want to add in extra details, you could think about ways procurement can add value at each stage

- In the old syllabus, CIPS were a bit obsessed with Michael Porter. In the Market Analysis bit you could talk about using Porter's 5 forces (buyer and supplier power, threat of new entrants, threat of substitutions, supplier rivalry) and Porter's 3 generic strategies for competing (cost leadership, differentiation, niche segment). This has been removed from the study guide so it's not essential to know this for this module, but if you've seen it before it's a nice one to throw in.

- You could also mention that there are differences between the public and private sector procurement at the different stages. E.g. Public Sector requires open competitions for contracts of a certain value and must follow the rules set out in Public Contract Regulations - the private sector doesn't have such strict regulations so there is much more flexibility in how tenders are completed. Also in the public sector, the evaluation criteria needs to be agreed beforehand and presented in the ITT- not the same for the private sector.

- Study guide p.71

Question 3

Jan is a Contracts Manager at ABC Ltd and has recently awarded a contract to XYZ Ltd. Describe how she can manage the contract and supplier, detailing ways of monitoring performance and adding value for ABC Ltd (25 marks)

Correct Answer:

See the solution inExplanation partbelow.

Explanation:

How to approach this question:

- There are 4 sections to this essay, so before you start writing I'd make a couple of notes on each of the points. Then build those notes into separate paragraphs. Your notes may look like this:

How to manage the contract - ensuring contract is fit for purpose, holding XYZ to their responsibilities, ensuring ABC are also fulfilling their responsibilities, issuing contract variations if required, planning for contingencies.

- How to manage the supplier - ensure the right relationship is in place (transactional vs collaborative), communication - open and honest, ensure there is mutual trust and understanding of each other's goals/ objectives.

- Ways of monitoring performance - use KPIs / SLAs, Supplier Scorecard, Vendor Rating, feedback from customers

- How to add value for ABC - increasing efficiencies (e.g. less product defects), improved quality, assisting with Value Engineering exercises, reduction in time and costs (e.g. through improved processes such as ordering), the supplier delivers 'extras' for ABC such as training to staff at no additional cost.

- Ensure each paragraph refers to Jan, ABC and XYZ. The question doesn't state what the businesses are buying/ selling so you can use this as an opportunity to provide examples: 'if ABC are procuring raw materials from XYZ such as metal, an effective way to manage performance would include .... If they are procuring a service, it may be more beneficial to use .... methodology' Example Essay Jan, the Contracts Manager at ABC Ltd, plays a pivotal role in ensuring the success of the recently awarded contract with XYZ Ltd. Efficient contract and supplier management involves careful planning, communication, performance monitoring, and the continuous addition of value. Here's how Jan can navigate these aspects:

In terms of contract management, Jan must ensure that the terms and conditions of the contract are "fit for purpose," aligning with the specific needs and complexity of the procurement. For instance, a simple goods procurement may necessitate a concise document, while more intricate projects like engineering endeavors may require a detailed contract such as a JCT or NEC contract. Additionally, Jan should vigilantly manage the contract during its lifespan, addressing any potential 'scope creep' that might necessitate amendments. If the contract lacks provisions for such changes, Jan may need to initiate the creation of a new contract to accommodate evolving needs Clear delineation of responsibilities and contingencies is crucial in the contract to ensure accountability and preparedness for unforeseen circumstances. The inclusion of Key Performance Indicators (KPIs) and damage clauses, where appropriate, adds a layer of clarity and accountability to the contractual relationship. Planning for contingencies involves having backup strategies in place, especially considering potential challenges that may arise during the collaboration with XYZ Ltd. For example, having other suppliers she can call upon if XYZ fail to deliver on an order.

Turning to supplier management, Jan's role involves fostering a positive and productive relationship with XYZ Ltd. This includes regular meetings to discuss progress, achievements, and future plans. A mobilization meeting is particularly important to ensure a strong start to the contract. Subsequent monthly or quarterly meetings provide a platform to review performance retrospectively and plan for the future. Additionally, effective communication is paramount, with Jan ensuring that both organizations regularly communicate, particularly regarding urgent issues that may require immediate attention. This proactive communication can occur through various channels, such as email or phone calls, facilitating a swift resolution of any emerging concerns.

Trust and honesty form the bedrock of the relationship between ABC Ltd and XYZ Ltd. Jan should work towards fostering mutual trust through both formal and informal activities, recognizing the importance of a transparent and cooperative partnership In terms of performance monitoring, Jan can employ Key Performance Indicators (KPIs) and Service Level Agreements (SLAs) to track performance regularly. These metrics should not be viewed as one-off activities but rather as ongoing tools for assessing and ensuring that performance aligns with expectations. Clear communication regarding the consequences of failing to meet these targets, such as the implementation of a Performance Improvement Plan or potential contract cancellation, is essential for maintaining accountability.

Regular performance meetings between ABC Ltd and XYZ Ltd provide an opportunity to discuss achievements, setbacks, and any necessary adjustments. Beyond quantitative metrics, surveys and feedback from customers can provide qualitative insights into performance.

Finally, Jan can contribute to the partnership's success by focusing on adding value. This involves going above and beyond the contractual obligations, such as delivering products more efficiently at no additional cost or improving operational efficiencies. Encouraging XYZ Ltd to participate in Value Engineering exercises and engaging in Early Supplier Involvement to shape and define future requirements would be a good example of this. Additionally, providing 'add-ons' or 'extras' outside the contractual framework, such as training for ABC Ltd staff, further enhances the value derived from the partnership.

In conclusion, Jan's role as Contracts Manager extends beyond the initial awarding of a contract- rather her role involves strategic contract and supplier management throughoutthe lifetime of the professional relationship. By ensuring the contract is well-suited for its purpose, fostering a positive relationship with the supplier, monitoring performance effectively, and consistently adding value, Jan contributes to the success of the collaboration between ABC Ltd and XYZ Ltd. This comprehensive approach sets the stage for a mutually beneficial and enduring partnership.

Tutor Notes:

- A case study question like this in the real exam is likely to come with more details. They often come with lots and lots of details to be honest, talking about what XYZ supplies to ABC and the names of the people involved. The case study usually gives you some good clues as to what the examiner will be looking for you to include, so do read them carefully.

- You don't have to include much 'theory' on case study questions - the important thing is to reference Jan as much as possible. BUT you could throw in a cheeky mention of the Kraljic matrix. The approach to managing the contract and supplier would depend on the type of item supplied by XYZ - e.g. if it is a bottleneck item the supplier may need to be handled differently to if it is a routine item. You could also mention KPIs and objectives as being 'SMART' - Specific, Measurable, Attainable, Relevant, and Time-Bound

- study guide p.86-90 / p.94 / p.96 -98

Explanation:

How to approach this question:

- There are 4 sections to this essay, so before you start writing I'd make a couple of notes on each of the points. Then build those notes into separate paragraphs. Your notes may look like this:

How to manage the contract - ensuring contract is fit for purpose, holding XYZ to their responsibilities, ensuring ABC are also fulfilling their responsibilities, issuing contract variations if required, planning for contingencies.

- How to manage the supplier - ensure the right relationship is in place (transactional vs collaborative), communication - open and honest, ensure there is mutual trust and understanding of each other's goals/ objectives.

- Ways of monitoring performance - use KPIs / SLAs, Supplier Scorecard, Vendor Rating, feedback from customers

- How to add value for ABC - increasing efficiencies (e.g. less product defects), improved quality, assisting with Value Engineering exercises, reduction in time and costs (e.g. through improved processes such as ordering), the supplier delivers 'extras' for ABC such as training to staff at no additional cost.

- Ensure each paragraph refers to Jan, ABC and XYZ. The question doesn't state what the businesses are buying/ selling so you can use this as an opportunity to provide examples: 'if ABC are procuring raw materials from XYZ such as metal, an effective way to manage performance would include .... If they are procuring a service, it may be more beneficial to use .... methodology' Example Essay Jan, the Contracts Manager at ABC Ltd, plays a pivotal role in ensuring the success of the recently awarded contract with XYZ Ltd. Efficient contract and supplier management involves careful planning, communication, performance monitoring, and the continuous addition of value. Here's how Jan can navigate these aspects:

In terms of contract management, Jan must ensure that the terms and conditions of the contract are "fit for purpose," aligning with the specific needs and complexity of the procurement. For instance, a simple goods procurement may necessitate a concise document, while more intricate projects like engineering endeavors may require a detailed contract such as a JCT or NEC contract. Additionally, Jan should vigilantly manage the contract during its lifespan, addressing any potential 'scope creep' that might necessitate amendments. If the contract lacks provisions for such changes, Jan may need to initiate the creation of a new contract to accommodate evolving needs Clear delineation of responsibilities and contingencies is crucial in the contract to ensure accountability and preparedness for unforeseen circumstances. The inclusion of Key Performance Indicators (KPIs) and damage clauses, where appropriate, adds a layer of clarity and accountability to the contractual relationship. Planning for contingencies involves having backup strategies in place, especially considering potential challenges that may arise during the collaboration with XYZ Ltd. For example, having other suppliers she can call upon if XYZ fail to deliver on an order.

Turning to supplier management, Jan's role involves fostering a positive and productive relationship with XYZ Ltd. This includes regular meetings to discuss progress, achievements, and future plans. A mobilization meeting is particularly important to ensure a strong start to the contract. Subsequent monthly or quarterly meetings provide a platform to review performance retrospectively and plan for the future. Additionally, effective communication is paramount, with Jan ensuring that both organizations regularly communicate, particularly regarding urgent issues that may require immediate attention. This proactive communication can occur through various channels, such as email or phone calls, facilitating a swift resolution of any emerging concerns.

Trust and honesty form the bedrock of the relationship between ABC Ltd and XYZ Ltd. Jan should work towards fostering mutual trust through both formal and informal activities, recognizing the importance of a transparent and cooperative partnership In terms of performance monitoring, Jan can employ Key Performance Indicators (KPIs) and Service Level Agreements (SLAs) to track performance regularly. These metrics should not be viewed as one-off activities but rather as ongoing tools for assessing and ensuring that performance aligns with expectations. Clear communication regarding the consequences of failing to meet these targets, such as the implementation of a Performance Improvement Plan or potential contract cancellation, is essential for maintaining accountability.

Regular performance meetings between ABC Ltd and XYZ Ltd provide an opportunity to discuss achievements, setbacks, and any necessary adjustments. Beyond quantitative metrics, surveys and feedback from customers can provide qualitative insights into performance.

Finally, Jan can contribute to the partnership's success by focusing on adding value. This involves going above and beyond the contractual obligations, such as delivering products more efficiently at no additional cost or improving operational efficiencies. Encouraging XYZ Ltd to participate in Value Engineering exercises and engaging in Early Supplier Involvement to shape and define future requirements would be a good example of this. Additionally, providing 'add-ons' or 'extras' outside the contractual framework, such as training for ABC Ltd staff, further enhances the value derived from the partnership.

In conclusion, Jan's role as Contracts Manager extends beyond the initial awarding of a contract- rather her role involves strategic contract and supplier management throughoutthe lifetime of the professional relationship. By ensuring the contract is well-suited for its purpose, fostering a positive relationship with the supplier, monitoring performance effectively, and consistently adding value, Jan contributes to the success of the collaboration between ABC Ltd and XYZ Ltd. This comprehensive approach sets the stage for a mutually beneficial and enduring partnership.

Tutor Notes:

- A case study question like this in the real exam is likely to come with more details. They often come with lots and lots of details to be honest, talking about what XYZ supplies to ABC and the names of the people involved. The case study usually gives you some good clues as to what the examiner will be looking for you to include, so do read them carefully.

- You don't have to include much 'theory' on case study questions - the important thing is to reference Jan as much as possible. BUT you could throw in a cheeky mention of the Kraljic matrix. The approach to managing the contract and supplier would depend on the type of item supplied by XYZ - e.g. if it is a bottleneck item the supplier may need to be handled differently to if it is a routine item. You could also mention KPIs and objectives as being 'SMART' - Specific, Measurable, Attainable, Relevant, and Time-Bound

- study guide p.86-90 / p.94 / p.96 -98

Question 4

Explain the main differences between the Public Sector and the Private Sector (25 marks)

Correct Answer:

See the solution in Explanation part below.

Explanation:

Bottom of Form

Top of Form

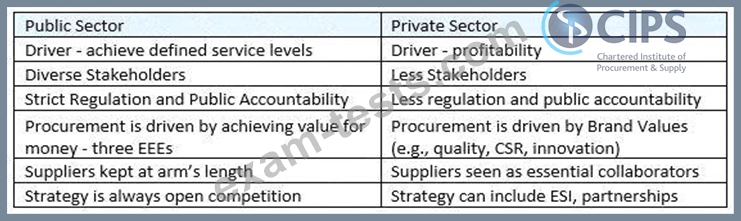

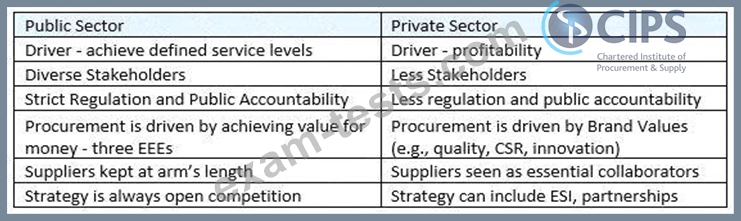

- This is an open question. You could really talk about anything. Here's some ideas of content:

Example Essay

The public and private sectors, while both essential to a nation's economy, operate under different paradigms, primarily due to their distinct drivers, stakeholders, regulations, procurement aims, and supplier relationships.

Drivers

The most fundamental difference lies in their drivers. Private sector organizations are primarily profit-driven; their existence hinges on their ability to generate profits. This profit influences their strategies, operations, and overall objectives. Conversely, public sector organizations are not driven by profit. Funded by taxpayer money, their primary objective is to deliver services effectively and efficiently to the public. Their success is measured not in financial terms, but in how well they meet the service levels required by the citizens who finance them through taxes.

Stakeholders

The range and influence of stakeholders in the two sectors also differ markedly. In the public sector, the stakeholder base is much broader, encompassing every member of society who interacts with or benefits from public services like healthcare, policing, and road maintenance. However, these stakeholders typically have less power to influence policy or practices. In contrast, stakeholders in the private sector, such as shareholders and customers, often have a more significant influence on company policies and practices. The private sector's narrower stakeholder base allows for more direct impact and influence from these groups.

Regulations

Regulations in the public sector are generally more stringent than in the private sector. Public sector entities, governed by regulations like PCR 2015, must demonstrate sound procurement practices and are accountable to society at large. This contrasts with the private sector, where companies have more latitude in choosing suppliers and are not obliged to justify their decisions publicly. The private sector faces fewer regulatory constraints, allowing for more flexibility in business decisions.

Procurement Aims

Procurement in the public sector is guided by the principles of efficiency, economy, and effectiveness, often summarized as the '3 Es'. The focus is on achieving value for money, considering both quality and price. In contrast, private sector procurement is more diverse in its aims, reflecting the organization's specific goals, which could range from profit maximization to innovation or sustainability. The private sector's procurement decisions are more closely aligned with the organization's unique values and objectives.

Supplier Relationships

Finally, the nature of supplier relationships differs significantly between the two sectors. The public sector is mandated to maintain a certain distance from its suppliers, ensuring equal treatment and open competition, as dictated by regulations like the PCR. This contrasts with the private sector, where companies are free to develop closer, more strategic relationships with preferred suppliers. The private sector can engage in practices like partnerships and Early Supplier Involvement, which are typically not permissible in the public sector due to the need for impartiality and fairness.

In summary, while both sectors aim to deliver services or products effectively, the public sector's focus on service delivery for the public good, stringent regulations, broad stakeholder base, and specific procurement principles, sets it apart from the private sector's profit-driven, flexible, and more narrowly focused approach.

Tutor Notes

- At Level 4 the questions are usually explain or describe, so don't worry too much about doing an in depth

'compare and contrast' style of answer. They don't expect that level of detail here. Simply saying Public Sector does X and Private Sector does Y is all you need.

- I have mentioned PCR 2015 - if you're taking this exam in 2025 you may need to update this reference with the new regulations.

- LO 4.3 p.220 / p. 226

Explanation:

Bottom of Form

Top of Form

- This is an open question. You could really talk about anything. Here's some ideas of content:

Example Essay

The public and private sectors, while both essential to a nation's economy, operate under different paradigms, primarily due to their distinct drivers, stakeholders, regulations, procurement aims, and supplier relationships.

Drivers

The most fundamental difference lies in their drivers. Private sector organizations are primarily profit-driven; their existence hinges on their ability to generate profits. This profit influences their strategies, operations, and overall objectives. Conversely, public sector organizations are not driven by profit. Funded by taxpayer money, their primary objective is to deliver services effectively and efficiently to the public. Their success is measured not in financial terms, but in how well they meet the service levels required by the citizens who finance them through taxes.

Stakeholders

The range and influence of stakeholders in the two sectors also differ markedly. In the public sector, the stakeholder base is much broader, encompassing every member of society who interacts with or benefits from public services like healthcare, policing, and road maintenance. However, these stakeholders typically have less power to influence policy or practices. In contrast, stakeholders in the private sector, such as shareholders and customers, often have a more significant influence on company policies and practices. The private sector's narrower stakeholder base allows for more direct impact and influence from these groups.

Regulations

Regulations in the public sector are generally more stringent than in the private sector. Public sector entities, governed by regulations like PCR 2015, must demonstrate sound procurement practices and are accountable to society at large. This contrasts with the private sector, where companies have more latitude in choosing suppliers and are not obliged to justify their decisions publicly. The private sector faces fewer regulatory constraints, allowing for more flexibility in business decisions.

Procurement Aims

Procurement in the public sector is guided by the principles of efficiency, economy, and effectiveness, often summarized as the '3 Es'. The focus is on achieving value for money, considering both quality and price. In contrast, private sector procurement is more diverse in its aims, reflecting the organization's specific goals, which could range from profit maximization to innovation or sustainability. The private sector's procurement decisions are more closely aligned with the organization's unique values and objectives.

Supplier Relationships

Finally, the nature of supplier relationships differs significantly between the two sectors. The public sector is mandated to maintain a certain distance from its suppliers, ensuring equal treatment and open competition, as dictated by regulations like the PCR. This contrasts with the private sector, where companies are free to develop closer, more strategic relationships with preferred suppliers. The private sector can engage in practices like partnerships and Early Supplier Involvement, which are typically not permissible in the public sector due to the need for impartiality and fairness.

In summary, while both sectors aim to deliver services or products effectively, the public sector's focus on service delivery for the public good, stringent regulations, broad stakeholder base, and specific procurement principles, sets it apart from the private sector's profit-driven, flexible, and more narrowly focused approach.

Tutor Notes

- At Level 4 the questions are usually explain or describe, so don't worry too much about doing an in depth

'compare and contrast' style of answer. They don't expect that level of detail here. Simply saying Public Sector does X and Private Sector does Y is all you need.

- I have mentioned PCR 2015 - if you're taking this exam in 2025 you may need to update this reference with the new regulations.

- LO 4.3 p.220 / p. 226

Question 5

Provide a definition of a stakeholder (5 points) and describe 3 categories of stakeholders (20 points).

Correct Answer:

See the solution inExplanation partbelow.

Explanation:

Essay Plan:

Definition of Stakeholder- someone who has a 'stake' or interest in the company. A person or organisation who influences and can be influenced by the company.

Categories of stakeholders:

1) Internal Stakeholders- these people work inside the company e.g. employees, managers etc

2) Connected- these people work with the company e.g. suppliers, mortgage lenders

3) External Stakeholders - these people are outside of the company e.g. the government, professional bodies, the local community.

Example Essay:

A stakeholder is an individual, group, or entity that has a vested interest or concern in the activities, decisions, or outcomes of an organization or project. Stakeholders are those who can be affected by or can affect the organization, and they play a crucial role in influencing its success, sustainability, and reputation.

Understanding and managing stakeholder relationships is a fundamental aspect of effective organizational governance and decision-making and there are several different types of stakeholders.

Firstly, internal stakeholders are those individuals or groups directly connected to the daily operations and management of the organization. Internal stakeholders are key to success and are arguably more vested in the company succeeding. They may depend on the company for their income / livelihood. Anyone who contributes to the company's internal functions can be considered an internal stakeholder for example:

This category includes

1) Employees: With a direct influence on the organization's success, employees are critical internal stakeholders. Their engagement, satisfaction, and productivity impact the overall performance.

2) Management and Executives: The leadership team has a significant influence on the organization's strategic direction and decision-making. Their decisions can shape the company's future.

Secondly, connected stakeholders are those individuals or groups whose interests are tied to the organization but may not be directly involved in its day-to-day operations. Connected stakeholders work alongside the organisation and often have a contractual relationship with the organisation. For example, banks, mortgage lenders, and suppliers. These stakeholders have an interest in the business succeeding, but not as much as internal stakeholders. It is important to keep these stakeholders satisfied as the organisation does depend on them to some extent. For example, it is important that the organisation has a good relationship with their bank / mortgage provider/ supplier as failing to pay what they owe may result in the stakeholders taking legal action against the organisation.

This category includes:

1) Shareholders/Investors: Holding financial stakes in the organization, shareholders seek a return on their investment and have a vested interest in the company's financial performance.

2) Suppliers and Partners: External entities providing goods, services, or collaboration. Their relationship with the organization impacts the quality and efficiency of its operations.

Lastly external stakeholders are entities outside the organization that can influence or be influenced by its actions. This category includes anyone who is affected by the company but who does not contribute to internal operations. They have less power to influence decisions than internal and connected stakeholders. External stakeholders include the government, professional bodies, pressure groups and the local community. They have quite diverse objectives and have varying ability to influence the organisation. For example, the government may be able to influence the organisation by passing legislation that regulates the industry but they do not have the power to get involved in the day-to-day affairs of the company. Pressure groups may have varying degrees of success in influencing the organisation depending on the subject matter. This category includes:

1) Customers: With a direct impact on the organization's revenue, customers are vital external stakeholders.

Their satisfaction and loyalty are crucial for the company's success.

2) Government and Regulatory Bodies: External entities overseeing industry regulations. Compliance with these regulations is crucial for the organization's reputation and legal standing.

In conclusion, stakeholders are diverse entities with a vested interest in an organization's activities. The three categories-internal, connected and external -encompass various groups that significantly influence and are influenced by the organization. Recognizing and addressing the needs and concerns of stakeholders are vital for sustainable and responsible business practices.

Tutor Notes

- The above essay is pretty short and to the point and would pass. If you want to beef out the essay you can include some of the following information for a higher score:

- Stakeholders can be harmed by, or benefit from the organisation (can affect and be affected by the organisation). For example a stakeholder can be harmed if the organisation becomes involved in illegal or immoral practices- e.g. the local community can suffer if the organisation begins to pollute the local rivers.

The local community can also benefit from the organisation through increased employment levels.

- CSR argues organisations should respect the rights of stakeholder groups

- Stakeholders are important because they may have direct or indirect influence on decisions

- The public sector has a wider and more complex range of stakeholders as they're managed on behalf of society as a whole. They're more likely to take a rage of stakeholder views into account when making decisions. However, these stakeholders are less powerful - i.e. they can't threaten market sanctions, to withdraw funding, or to quit the business etc.

- The essay doesn't specifically ask you to Map Stakeholders, but you could throw in a cheeky mention of Mendelow's Stakeholder Matrix, perhaps in the conclusion. Don't spend time describing it though- you won't get more than 1 point for mentioning it. You'd be better off spending your time giving lots and lots of examples of different types of stakeholders.

- Study guide p. 58

Explanation:

Essay Plan:

Definition of Stakeholder- someone who has a 'stake' or interest in the company. A person or organisation who influences and can be influenced by the company.

Categories of stakeholders:

1) Internal Stakeholders- these people work inside the company e.g. employees, managers etc

2) Connected- these people work with the company e.g. suppliers, mortgage lenders

3) External Stakeholders - these people are outside of the company e.g. the government, professional bodies, the local community.

Example Essay:

A stakeholder is an individual, group, or entity that has a vested interest or concern in the activities, decisions, or outcomes of an organization or project. Stakeholders are those who can be affected by or can affect the organization, and they play a crucial role in influencing its success, sustainability, and reputation.

Understanding and managing stakeholder relationships is a fundamental aspect of effective organizational governance and decision-making and there are several different types of stakeholders.

Firstly, internal stakeholders are those individuals or groups directly connected to the daily operations and management of the organization. Internal stakeholders are key to success and are arguably more vested in the company succeeding. They may depend on the company for their income / livelihood. Anyone who contributes to the company's internal functions can be considered an internal stakeholder for example:

This category includes

1) Employees: With a direct influence on the organization's success, employees are critical internal stakeholders. Their engagement, satisfaction, and productivity impact the overall performance.

2) Management and Executives: The leadership team has a significant influence on the organization's strategic direction and decision-making. Their decisions can shape the company's future.

Secondly, connected stakeholders are those individuals or groups whose interests are tied to the organization but may not be directly involved in its day-to-day operations. Connected stakeholders work alongside the organisation and often have a contractual relationship with the organisation. For example, banks, mortgage lenders, and suppliers. These stakeholders have an interest in the business succeeding, but not as much as internal stakeholders. It is important to keep these stakeholders satisfied as the organisation does depend on them to some extent. For example, it is important that the organisation has a good relationship with their bank / mortgage provider/ supplier as failing to pay what they owe may result in the stakeholders taking legal action against the organisation.

This category includes:

1) Shareholders/Investors: Holding financial stakes in the organization, shareholders seek a return on their investment and have a vested interest in the company's financial performance.

2) Suppliers and Partners: External entities providing goods, services, or collaboration. Their relationship with the organization impacts the quality and efficiency of its operations.

Lastly external stakeholders are entities outside the organization that can influence or be influenced by its actions. This category includes anyone who is affected by the company but who does not contribute to internal operations. They have less power to influence decisions than internal and connected stakeholders. External stakeholders include the government, professional bodies, pressure groups and the local community. They have quite diverse objectives and have varying ability to influence the organisation. For example, the government may be able to influence the organisation by passing legislation that regulates the industry but they do not have the power to get involved in the day-to-day affairs of the company. Pressure groups may have varying degrees of success in influencing the organisation depending on the subject matter. This category includes:

1) Customers: With a direct impact on the organization's revenue, customers are vital external stakeholders.

Their satisfaction and loyalty are crucial for the company's success.

2) Government and Regulatory Bodies: External entities overseeing industry regulations. Compliance with these regulations is crucial for the organization's reputation and legal standing.

In conclusion, stakeholders are diverse entities with a vested interest in an organization's activities. The three categories-internal, connected and external -encompass various groups that significantly influence and are influenced by the organization. Recognizing and addressing the needs and concerns of stakeholders are vital for sustainable and responsible business practices.

Tutor Notes

- The above essay is pretty short and to the point and would pass. If you want to beef out the essay you can include some of the following information for a higher score:

- Stakeholders can be harmed by, or benefit from the organisation (can affect and be affected by the organisation). For example a stakeholder can be harmed if the organisation becomes involved in illegal or immoral practices- e.g. the local community can suffer if the organisation begins to pollute the local rivers.

The local community can also benefit from the organisation through increased employment levels.

- CSR argues organisations should respect the rights of stakeholder groups

- Stakeholders are important because they may have direct or indirect influence on decisions

- The public sector has a wider and more complex range of stakeholders as they're managed on behalf of society as a whole. They're more likely to take a rage of stakeholder views into account when making decisions. However, these stakeholders are less powerful - i.e. they can't threaten market sanctions, to withdraw funding, or to quit the business etc.

- The essay doesn't specifically ask you to Map Stakeholders, but you could throw in a cheeky mention of Mendelow's Stakeholder Matrix, perhaps in the conclusion. Don't spend time describing it though- you won't get more than 1 point for mentioning it. You'd be better off spending your time giving lots and lots of examples of different types of stakeholders.

- Study guide p. 58

- Latest Upload

- 123SAP.C-LCNC-2406.v2026-01-09.q21

- 139Salesforce.CRT-550.v2026-01-09.q122

- 118Salesforce.Marketing-Cloud-Intelligence.v2026-01-09.q41

- 119CIPS.L4M1.v2026-01-09.q27

- 106ISTQB.ATM.v2026-01-09.q49

- 108SAP.C_BCBAI_2502.v2026-01-08.q38

- 110Oracle.1Z0-1056-24.v2026-01-08.q53

- 145Huawei.H13-831_V2.0.v2026-01-07.q101

- 169Salesforce.Salesforce-Slack-Administrator.v2026-01-06.q103

- 148CIPS.L5M15.v2026-01-06.q31