- Home

- CIPS Certification

- L4M1 Exam

- CIPS.L4M1.v2026-01-09.q27 Practice Test

Question 21

Describe the main differences between the three economic sectors: public, private and third. Your answer may make reference to the following: funding, ownership, shares, objectives and administration (25 marks)

Correct Answer:

See the solution in Explanation part below.

Explanation:

How to approach this question

- Sometimes CIPS give you a steer on how to answer the question. My advice is to follow it. The question says you MAY make reference to the following, but I'd use those hints as a guide for content- a paragraph on each and you're done!

- When you've got a 'may make reference to' hint - this means you can completely ignore it and do your own thing and bring in your own ideas. May means it's optional, so you wouldn't be penalised for this. However, you have to consider the examiner's mark scheme- it will detail options of stuff you can write for funding, ownership etc. Then there will be a line at the bottom saying something like 'accept other options such as x and y'. This leaves it up to the examiner to decide whether what you've said is relevant. I'd personally not leave it up to chance you get a lenient examiner. If you write what's definitely going to be on their mark scheme, you're more likely to get more points.

Example Essay

The modern economy is a complex tapestry of various sectors, each with its own distinct characteristics and functions. The three prominent sectors are the public sector, the private sector, and the third sector. These sectors differ significantly in terms of their funding mechanisms, ownership structures, objectives, the concept of shares, and their administration.

Firstly, the public sector is predominantly funded by the government through taxation, grants, and other forms of public revenue. Its very existence hinges on the provision of essential services and the fulfilment of societal needs. These organizations are owned by the government, be it at the federal, state, or local level. Unlike the private sector, the concept of shares doesn't apply in the public sector. Instead, the government allocates budgets to various departments and agencies for public services and projects. The primary objectives of the public sector revolve around the welfare of the citizens, including the provision of education, healthcare, defence, and infrastructure. It is characterized by bureaucratic administration, with decision-making processes subject to governmental regulations and oversight. A prime example is public schools and healthcare systems, which are funded and operated by the government with the primary objective of ensuring universal access to education and healthcare services.

In contrast, the private sector operates on a starkly different paradigm. It is primarily funded by private capital, investment, and profit-seeking activities. Private individuals and corporations own these entities, with ownership shares often represented by stocks. Shareholders invest capital in exchange for ownership stakes and the potential for dividends. The central objective in the private sector is profit maximization, driven by competition in the market. Companies in the private sector are administered by management teams and boards of directors, with decisions guided by market forces. Apple and ExxonMobil are examples of private sector entities, privately owned and publicly traded, with profit motives at their core. Shareholders invest in these companies with the expectation of financial returns.

Lastly, the third sector, often referred to as the nonprofit or voluntary sector, represents a unique economic sphere. It relies on a combination of funding sources, including donations, grants, and earned income, but not taxation. Third sector organizations are not owned by individuals or shareholders; instead, they are governed by boards of directors or trustees. Unlike the private sectors, shares are not applicable in the third sector.

These organizations do not seek to distribute profits to owners. The primary objective of the third sector is to serve a social or community purpose, such as addressing societal issues, promoting social change, and providing services that benefit the public. Administration in this sector is overseen by non-profit boards, and it heavily relies on volunteers, philanthropy, and community engagement. For example, the Red Cross operates with the objective of providing humanitarian aid and disaster relief, relying on donations and volunteers to fulfil its mission. Any profits that are made are reinvested into the organisation to further its mission.

In conclusion, the public, private, and third sectors represent diverse economic domains, each with its own funding mechanisms, ownership structures, objectives, and administrative models. These sectors play essential and complementary roles in society, contributing to economic development, public welfare, and social progress. Together, they form the foundation of a balanced and dynamic economic landscape.

Tutor Notes

- I've structured this essay with a paragraph on each sector, but you could have done a paragraph on each theme, thus having 5 paragraphs instead of 3. Either approach works.

- You've got 5 things and 3 sectors, that equals 15 marks. If you give an example of each and a strong intro and conclusion, that's full marks.

- See LO 4.1 p. 203 - there's a cute table with this information on.

Explanation:

How to approach this question

- Sometimes CIPS give you a steer on how to answer the question. My advice is to follow it. The question says you MAY make reference to the following, but I'd use those hints as a guide for content- a paragraph on each and you're done!

- When you've got a 'may make reference to' hint - this means you can completely ignore it and do your own thing and bring in your own ideas. May means it's optional, so you wouldn't be penalised for this. However, you have to consider the examiner's mark scheme- it will detail options of stuff you can write for funding, ownership etc. Then there will be a line at the bottom saying something like 'accept other options such as x and y'. This leaves it up to the examiner to decide whether what you've said is relevant. I'd personally not leave it up to chance you get a lenient examiner. If you write what's definitely going to be on their mark scheme, you're more likely to get more points.

Example Essay

The modern economy is a complex tapestry of various sectors, each with its own distinct characteristics and functions. The three prominent sectors are the public sector, the private sector, and the third sector. These sectors differ significantly in terms of their funding mechanisms, ownership structures, objectives, the concept of shares, and their administration.

Firstly, the public sector is predominantly funded by the government through taxation, grants, and other forms of public revenue. Its very existence hinges on the provision of essential services and the fulfilment of societal needs. These organizations are owned by the government, be it at the federal, state, or local level. Unlike the private sector, the concept of shares doesn't apply in the public sector. Instead, the government allocates budgets to various departments and agencies for public services and projects. The primary objectives of the public sector revolve around the welfare of the citizens, including the provision of education, healthcare, defence, and infrastructure. It is characterized by bureaucratic administration, with decision-making processes subject to governmental regulations and oversight. A prime example is public schools and healthcare systems, which are funded and operated by the government with the primary objective of ensuring universal access to education and healthcare services.

In contrast, the private sector operates on a starkly different paradigm. It is primarily funded by private capital, investment, and profit-seeking activities. Private individuals and corporations own these entities, with ownership shares often represented by stocks. Shareholders invest capital in exchange for ownership stakes and the potential for dividends. The central objective in the private sector is profit maximization, driven by competition in the market. Companies in the private sector are administered by management teams and boards of directors, with decisions guided by market forces. Apple and ExxonMobil are examples of private sector entities, privately owned and publicly traded, with profit motives at their core. Shareholders invest in these companies with the expectation of financial returns.

Lastly, the third sector, often referred to as the nonprofit or voluntary sector, represents a unique economic sphere. It relies on a combination of funding sources, including donations, grants, and earned income, but not taxation. Third sector organizations are not owned by individuals or shareholders; instead, they are governed by boards of directors or trustees. Unlike the private sectors, shares are not applicable in the third sector.

These organizations do not seek to distribute profits to owners. The primary objective of the third sector is to serve a social or community purpose, such as addressing societal issues, promoting social change, and providing services that benefit the public. Administration in this sector is overseen by non-profit boards, and it heavily relies on volunteers, philanthropy, and community engagement. For example, the Red Cross operates with the objective of providing humanitarian aid and disaster relief, relying on donations and volunteers to fulfil its mission. Any profits that are made are reinvested into the organisation to further its mission.

In conclusion, the public, private, and third sectors represent diverse economic domains, each with its own funding mechanisms, ownership structures, objectives, and administrative models. These sectors play essential and complementary roles in society, contributing to economic development, public welfare, and social progress. Together, they form the foundation of a balanced and dynamic economic landscape.

Tutor Notes

- I've structured this essay with a paragraph on each sector, but you could have done a paragraph on each theme, thus having 5 paragraphs instead of 3. Either approach works.

- You've got 5 things and 3 sectors, that equals 15 marks. If you give an example of each and a strong intro and conclusion, that's full marks.

- See LO 4.1 p. 203 - there's a cute table with this information on.

Question 22

Explain what is meant by Corporate Governance and why having Corporate Governance structures is important. Discuss 2 obstacles which may impede an organisation achieving high levels of Corporate Governance. (25 points)

Correct Answer:

See the solution inExplanation partbelow.

Explanation:

- Firstly start with a definition of Corporate Governance - this means the rules, policies, processes and organisational structures that ensure an organisation adheres to accepted ethical standards, good practices, the law and regulations. It's the systems put in place which directs and controls organisations to do 'the right thing'.

- Then move on to discuss why having this is important - I'd maybe think of 3-4 examples here such as:

protects the interest of shareholders, reduces risk, moral obligations, legal obligations

- The last part of your essay should talk about the 2 obstacles - describe two from the following list: lack of executive support, poor stakeholder co-operation, lack of clarity and / or resources, having poor IT systems, lack of co-ordination of procurement responsibilities. Because you're only talking about 2 here, you'll need to go into detail about them. So pick 2 you know well. Don't be tempted to talk about more than 2. You won't get extra marks.

Example Essay:

Corporate governance refers to the system of rules, practices, processes, and structures by which a company is directed and controlled. It encompasses the relationships among a company's management, its board of directors, shareholders, and other stakeholders. The primary objective of corporate governance is to ensure that the company operates in an ethical, transparent, and accountable manner, safeguarding the interests of shareholders and promoting long-term value creation. Corporate governance can be defined internally (by shareholders/ managers) or externally (by governments and international standard-setting bodies such as ISO) and is important for all organisations Corporate governance is needed because you can't assume everyone will act ethically- rules and procedures need to be written down and the organisation needs to have recourse for dealing with behaviour that falls outside of what is accepted. Procurement's role in Corporate Governance includes control over finance and expenditure, ensuring the supply chain is 'clean' (i.e. not involved in unethical business practices such as child labour) and risk management.

Why having a corporate governance structure is important:

1) The procurement department has a 'stewardship' role - it controls large sums of organisation's funds. There are many opportunities to commit fraud, make unethical or biased decisions so it's important that there are corporate governance structures in place to prevent this. It protects the organisation from individuals with bad intent, scandal, and legal repercussions.

2) Strong Corporate Governance is required to successfully manage a supply chain. It's important to ensure good relationships- suppliers need to see you as a 'good customer'. If your organisation is seen to be unethical or underhand, suppliers may not want to work with you.

3) Financial impact - where corporate governance isn't implemented, there may be financial costs for the organisation. For example, in the Public Sector if a supplier successfully challenges a tender award, the buyer may have to award the value of the tender - so there's financial impact on a company if corporate governance isn't followed.

Obstacle 1 - lack of senior management support

Unless there is buy-in from the senior leadership team it will not be possible for departments such as Procurement to implement sound Corporate Governance procedures. Corporate Governance needs to be directed from the top of an organisation to ensure all departments and staff give importance to this. If Senior Leadership are seen not to care about implementing or following Corporate Governance, other staff won't care either. They need to lead by example to ensure the whole organisation 'buys into' the processes.

Obstacle 2 - Poor IT infrastructure.

For Corporate Governance to be effective, an effective IT system must be implemented. For example, to avoid fraud it's not just necessary to have a written anti-fraud policy, there must be ways of checking that fraud isn't being committed. The way to do this is to have an effective IT system which can flag anomaly payments and procurement activities outside of what is considered 'normal'. Therefore, having a poor IT infrastructure is a barrier to effective Corporate Governance.

In conclusion, corporate governance is essential for building trust among stakeholders and contributing to the overall success and sustainability of a company. Effective governance structures and practices instil confidence in investors, enhance the company's reputation, and foster a culture of responsibility and accountability throughout the organization. Good corporate governance is a cornerstone of sound business management and contributes to the long-term prosperity of the company.

Tutor Notes

- Corporate Governance became a big thing in the 70s and 80s following high profile scandals and the collapse of several companies. Investors were concerned about what companies were doing which led to increased control on the powers of directors and greater transparency of corporate actions.

- Examples of Corporate Governance. Enron is a good real life example you could use: Impact of Bad Corporate Governance - Corporate Fraud and Corruption: A Holistic Approach to Preventing Financial Crises (ebrary.net)

- This is a really good real-life example of Public Sector procurement gone wrong: Flawed nuclear tender sees

£100m payout to firms - BBC News

- Adding in some real life examples will take your essay from a Merit result (50-70%) to a Distinction (70% +)

- Another way this topic can come up as a question is describing the elements of corporate governance, or asking what a procurement manager should do when corporate governance is broken/ not followed.

- LO 3.1 p.117

Explanation:

- Firstly start with a definition of Corporate Governance - this means the rules, policies, processes and organisational structures that ensure an organisation adheres to accepted ethical standards, good practices, the law and regulations. It's the systems put in place which directs and controls organisations to do 'the right thing'.

- Then move on to discuss why having this is important - I'd maybe think of 3-4 examples here such as:

protects the interest of shareholders, reduces risk, moral obligations, legal obligations

- The last part of your essay should talk about the 2 obstacles - describe two from the following list: lack of executive support, poor stakeholder co-operation, lack of clarity and / or resources, having poor IT systems, lack of co-ordination of procurement responsibilities. Because you're only talking about 2 here, you'll need to go into detail about them. So pick 2 you know well. Don't be tempted to talk about more than 2. You won't get extra marks.

Example Essay:

Corporate governance refers to the system of rules, practices, processes, and structures by which a company is directed and controlled. It encompasses the relationships among a company's management, its board of directors, shareholders, and other stakeholders. The primary objective of corporate governance is to ensure that the company operates in an ethical, transparent, and accountable manner, safeguarding the interests of shareholders and promoting long-term value creation. Corporate governance can be defined internally (by shareholders/ managers) or externally (by governments and international standard-setting bodies such as ISO) and is important for all organisations Corporate governance is needed because you can't assume everyone will act ethically- rules and procedures need to be written down and the organisation needs to have recourse for dealing with behaviour that falls outside of what is accepted. Procurement's role in Corporate Governance includes control over finance and expenditure, ensuring the supply chain is 'clean' (i.e. not involved in unethical business practices such as child labour) and risk management.

Why having a corporate governance structure is important:

1) The procurement department has a 'stewardship' role - it controls large sums of organisation's funds. There are many opportunities to commit fraud, make unethical or biased decisions so it's important that there are corporate governance structures in place to prevent this. It protects the organisation from individuals with bad intent, scandal, and legal repercussions.

2) Strong Corporate Governance is required to successfully manage a supply chain. It's important to ensure good relationships- suppliers need to see you as a 'good customer'. If your organisation is seen to be unethical or underhand, suppliers may not want to work with you.

3) Financial impact - where corporate governance isn't implemented, there may be financial costs for the organisation. For example, in the Public Sector if a supplier successfully challenges a tender award, the buyer may have to award the value of the tender - so there's financial impact on a company if corporate governance isn't followed.

Obstacle 1 - lack of senior management support

Unless there is buy-in from the senior leadership team it will not be possible for departments such as Procurement to implement sound Corporate Governance procedures. Corporate Governance needs to be directed from the top of an organisation to ensure all departments and staff give importance to this. If Senior Leadership are seen not to care about implementing or following Corporate Governance, other staff won't care either. They need to lead by example to ensure the whole organisation 'buys into' the processes.

Obstacle 2 - Poor IT infrastructure.

For Corporate Governance to be effective, an effective IT system must be implemented. For example, to avoid fraud it's not just necessary to have a written anti-fraud policy, there must be ways of checking that fraud isn't being committed. The way to do this is to have an effective IT system which can flag anomaly payments and procurement activities outside of what is considered 'normal'. Therefore, having a poor IT infrastructure is a barrier to effective Corporate Governance.

In conclusion, corporate governance is essential for building trust among stakeholders and contributing to the overall success and sustainability of a company. Effective governance structures and practices instil confidence in investors, enhance the company's reputation, and foster a culture of responsibility and accountability throughout the organization. Good corporate governance is a cornerstone of sound business management and contributes to the long-term prosperity of the company.

Tutor Notes

- Corporate Governance became a big thing in the 70s and 80s following high profile scandals and the collapse of several companies. Investors were concerned about what companies were doing which led to increased control on the powers of directors and greater transparency of corporate actions.

- Examples of Corporate Governance. Enron is a good real life example you could use: Impact of Bad Corporate Governance - Corporate Fraud and Corruption: A Holistic Approach to Preventing Financial Crises (ebrary.net)

- This is a really good real-life example of Public Sector procurement gone wrong: Flawed nuclear tender sees

£100m payout to firms - BBC News

- Adding in some real life examples will take your essay from a Merit result (50-70%) to a Distinction (70% +)

- Another way this topic can come up as a question is describing the elements of corporate governance, or asking what a procurement manager should do when corporate governance is broken/ not followed.

- LO 3.1 p.117

Question 23

Sarah has recently been hired as the new Head of Procurement at Alpha Ltd, a manufacturer of small electronics such as hairdryers and alarm clocks. Alpha Ltd has a large factory based in Birmingham where many of the products are manufactured. One of the large pieces of machinery in the factory has recently broken and Sarah has been charged with replacing it as quickly as possible. Sarah is considering using the Whole Life Costing approach to this procurement. What is meant by Whole Life Costing? (5 points). Discuss

5 factors that Sarah should consider when buying new machinery (20 points).

5 factors that Sarah should consider when buying new machinery (20 points).

Correct Answer:

See the solution inExplanation partbelow.

Explanation:

How to approach this question

- I'd use clear headings with numbers for this one. It asks you for a definition and 5 factors. Number them.

Makes it easy for you to write and easy for the examiner to mark.

- Don't go over 5 - you won't get any extra points for this. So spend your time giving examples and explaining the 5 well, rather than naming more than 5.

Example Essay

As the new Head of Procurement at Alpha Ltd, Sarah faces the urgent task of replacing a critical piece of machinery in the company's Birmingham factory. Recognizing the complexity of the decision, Sarah contemplates utilizing the Whole Life Costing approach to ensure a comprehensive evaluation that goes beyond initial expenses. This essay explores the concept of Whole Life Costing and delves into five essential factors Sarah should consider when procuring new machinery.

Definition:

Whole Life Costing (WLC) is a procurement approach that considers the total cost associated with an asset throughout its entire lifecycle. Unlike traditional procurement methods that focus primarily on the initial purchase price, WLC evaluates all costs incurred from acquisition to disposal. This includes operational, maintenance, and disposal costs, providing a holistic perspective on the true financial impact of an asset over time.

Factors to Consider in Machinery Procurement

1) Initial Purchase Price:

While WLC looks beyond the initial cost, the purchase price remains a critical factor. Sarah should balance the upfront expense with the long-term costs to ensure the initial investment aligns with the overall financial strategy.

2) Operational Costs:

Sarah needs to analyze the ongoing operational costs associated with the new machinery. This includes energy consumption, routine maintenance, and potential repair expenses. Opting for energy-efficient and reliable equipment can contribute to substantial operational savings over the machine's lifespan, even though this may result in a higher up-front purchase price

3) Training and Integration:

The cost of training employees to operate and maintain the new machinery is a significant consideration. Sarah should assess how easily the equipment integrates into existing workflows and whether additional training programs are required, impacting both immediate and long-term costs.

4) Downtime and Productivity:

Evaluating the potential downtime and its impact on productivity is crucial. Sarah should assess the reliability and historical performance of the machinery to gauge its potential contribution to sustained production levels and minimized disruptions, impacting the overall operational efficiency.

5) Technology Upgrades and Adaptability:

Sarah should consider the machinery's adaptability to technological advancements and potential upgrades.

Investing in equipment that allows for seamless integration with future technologies ensures that Alpha Ltd remains competitive and resilient in a rapidly evolving industry landscape.

In conclusion, adopting a Whole Life Costing approach empowers Sarah to make informed decisions that align with Alpha Ltd's strategic goals. By considering factors beyond the initial purchase price, such as operational costs, training, downtime, and technology adaptability, Sarah ensures that the replacement machinery not only meets immediate production needs but proves to be a cost-effective and efficient asset throughout its entire lifecycle. The WLC approach safeguards against unforeseen financial burdens, fostering sustainable and informed procurement practices in the dynamic manufacturing environment.

Tutor Notes

- Whole Life Costing is on p.28

- Total Life Cycle Costs, Total Cost of Ownership and Life Cycle Costs are all practically the same thing. The book says they're slightly different, but don't get yourself bogged down in trying to remember the differences.

Honestly, in the real world, people use this language interchangeably.

- Other factors you could have chosen to talk about include commissioning costs and disposal costs

- Don't worry if you feel CIPS breezed through this as a topic, they did. It's explained much better in L4M7.

You can read more about it here: Whole Life Costing - What is Whole Life Costing | CIPS and here Whole-Life Cost: What it Means, How it Works (investopedia.com)

Explanation:

How to approach this question

- I'd use clear headings with numbers for this one. It asks you for a definition and 5 factors. Number them.

Makes it easy for you to write and easy for the examiner to mark.

- Don't go over 5 - you won't get any extra points for this. So spend your time giving examples and explaining the 5 well, rather than naming more than 5.

Example Essay

As the new Head of Procurement at Alpha Ltd, Sarah faces the urgent task of replacing a critical piece of machinery in the company's Birmingham factory. Recognizing the complexity of the decision, Sarah contemplates utilizing the Whole Life Costing approach to ensure a comprehensive evaluation that goes beyond initial expenses. This essay explores the concept of Whole Life Costing and delves into five essential factors Sarah should consider when procuring new machinery.

Definition:

Whole Life Costing (WLC) is a procurement approach that considers the total cost associated with an asset throughout its entire lifecycle. Unlike traditional procurement methods that focus primarily on the initial purchase price, WLC evaluates all costs incurred from acquisition to disposal. This includes operational, maintenance, and disposal costs, providing a holistic perspective on the true financial impact of an asset over time.

Factors to Consider in Machinery Procurement

1) Initial Purchase Price:

While WLC looks beyond the initial cost, the purchase price remains a critical factor. Sarah should balance the upfront expense with the long-term costs to ensure the initial investment aligns with the overall financial strategy.

2) Operational Costs:

Sarah needs to analyze the ongoing operational costs associated with the new machinery. This includes energy consumption, routine maintenance, and potential repair expenses. Opting for energy-efficient and reliable equipment can contribute to substantial operational savings over the machine's lifespan, even though this may result in a higher up-front purchase price

3) Training and Integration:

The cost of training employees to operate and maintain the new machinery is a significant consideration. Sarah should assess how easily the equipment integrates into existing workflows and whether additional training programs are required, impacting both immediate and long-term costs.

4) Downtime and Productivity:

Evaluating the potential downtime and its impact on productivity is crucial. Sarah should assess the reliability and historical performance of the machinery to gauge its potential contribution to sustained production levels and minimized disruptions, impacting the overall operational efficiency.

5) Technology Upgrades and Adaptability:

Sarah should consider the machinery's adaptability to technological advancements and potential upgrades.

Investing in equipment that allows for seamless integration with future technologies ensures that Alpha Ltd remains competitive and resilient in a rapidly evolving industry landscape.

In conclusion, adopting a Whole Life Costing approach empowers Sarah to make informed decisions that align with Alpha Ltd's strategic goals. By considering factors beyond the initial purchase price, such as operational costs, training, downtime, and technology adaptability, Sarah ensures that the replacement machinery not only meets immediate production needs but proves to be a cost-effective and efficient asset throughout its entire lifecycle. The WLC approach safeguards against unforeseen financial burdens, fostering sustainable and informed procurement practices in the dynamic manufacturing environment.

Tutor Notes

- Whole Life Costing is on p.28

- Total Life Cycle Costs, Total Cost of Ownership and Life Cycle Costs are all practically the same thing. The book says they're slightly different, but don't get yourself bogged down in trying to remember the differences.

Honestly, in the real world, people use this language interchangeably.

- Other factors you could have chosen to talk about include commissioning costs and disposal costs

- Don't worry if you feel CIPS breezed through this as a topic, they did. It's explained much better in L4M7.

You can read more about it here: Whole Life Costing - What is Whole Life Costing | CIPS and here Whole-Life Cost: What it Means, How it Works (investopedia.com)

Question 24

Explain, with examples, the three different ways one can categorise procurement spend: direct vs indirect, capital expenditure vs operational expenditure and stock vs non-stock items. (25 points)

Correct Answer:

See the solution in Explanation part below.

Explanation:

The knowledge to remember:

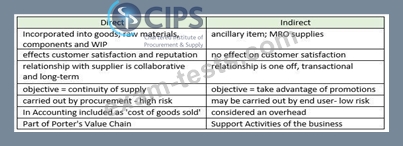

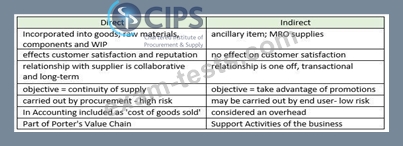

A table with text on it Description automatically generated

Essay Plan :

Remember to include examples for each of the six categories of spend. This is specifically asked for in the question so it's important to include as many examples as you can. To do this you could take an example organisation such as a cake manufacturer and explain which of their purchases would fall into each category and why.

Introduction - explain why procurement categorises spend

- Direct - these are items that are incorporated into the final goods (the cakes) so would include raw materials such as flour, eggs, sugar etc

- Indirect - these are items that the company needs, but don't go into the end product. For example, cleaning products and MRO supplies for the machines

- Capital Expenditure- these are large one-off purchases, such as buying a new piece of equipment such as a giant oven to cook the cakes.

- Operational Expenditure - these are purchases that are required to ensure the business can function day-to- day. They may include PPE for the workers in the factory and cleaning equipment

- Stock items - these are items procured in advance and held in inventory until they are needed. In a cake manufacturing factory this could be PPE for staff such as hairnets and gloves. The organisation will buy these in bulk and keep them in a stock cupboard, using these as and when they are required

- Non- stock items - items that are not stored and used right away. An example would be eggs- these will need to be put directly into the cakes as they would go off if bought in advance.

Conclusion - the categories are not mutually exclusive - an item can be direct and operational, or indirect and stock. Different companies may use different systems to classify items of spend.

Example Introduction and Conclusion

Introduction

Procurement categorizes spend to efficiently manage resources and make strategic decisions. Three primary ways of categorizing procurement spend include distinguishing between direct and indirect spend, classifying expenditures as capital or operational, and categorizing items as stock or non-stock. These distinctions aid organizations in optimizing their procurement strategies for better resource allocation.

Conclusion:

In conclusion, categorizing procurement spend into direct vs. indirect, capital vs. operational, and stock vs.

non-stock items is essential for strategic resource management. While these categories provide a structured framework, they are not mutually exclusive, as an item can fall into multiple categories. For example, an item may be both direct and operational or indirect and stock. The flexibility of these categories allows organizations to tailor their procurement strategies based on their specific needs, ensuring efficient resource allocation and effective supply chain management. Different companies may adopt varying categorization approaches depending on their industry, size, and operational requirements.

Tutor notes:

- Because you've got 6 categories of spend to talk about you're only going to need 3-4 sentences for each.

Providing you've said the category, explained what it is and given one example, you'll absolutely fly through this type of question

- You could also mention that it is useful to use categories of spend as this helps with budgeting. Different categories may also have different processes to follow for procuring the item (this could form part of your introduction or conclusion).

- This subject is LO 1.3.2 it's quite spread out in the text book but the main info is on p.49

- Note- different companies/ industries classify items of spend differently. Particularly packaging and salaries.

Some say they're direct costs and some say they're indirect costs. Honestly, it's a hotly debated subject and I don't think there is a right or wrong. I'd just avoid those two examples if you can and stick to ones that aren't as contentious like eggs and PPE.

Explanation:

The knowledge to remember:

A table with text on it Description automatically generated

Essay Plan :

Remember to include examples for each of the six categories of spend. This is specifically asked for in the question so it's important to include as many examples as you can. To do this you could take an example organisation such as a cake manufacturer and explain which of their purchases would fall into each category and why.

Introduction - explain why procurement categorises spend

- Direct - these are items that are incorporated into the final goods (the cakes) so would include raw materials such as flour, eggs, sugar etc

- Indirect - these are items that the company needs, but don't go into the end product. For example, cleaning products and MRO supplies for the machines

- Capital Expenditure- these are large one-off purchases, such as buying a new piece of equipment such as a giant oven to cook the cakes.

- Operational Expenditure - these are purchases that are required to ensure the business can function day-to- day. They may include PPE for the workers in the factory and cleaning equipment

- Stock items - these are items procured in advance and held in inventory until they are needed. In a cake manufacturing factory this could be PPE for staff such as hairnets and gloves. The organisation will buy these in bulk and keep them in a stock cupboard, using these as and when they are required

- Non- stock items - items that are not stored and used right away. An example would be eggs- these will need to be put directly into the cakes as they would go off if bought in advance.

Conclusion - the categories are not mutually exclusive - an item can be direct and operational, or indirect and stock. Different companies may use different systems to classify items of spend.

Example Introduction and Conclusion

Introduction

Procurement categorizes spend to efficiently manage resources and make strategic decisions. Three primary ways of categorizing procurement spend include distinguishing between direct and indirect spend, classifying expenditures as capital or operational, and categorizing items as stock or non-stock. These distinctions aid organizations in optimizing their procurement strategies for better resource allocation.

Conclusion:

In conclusion, categorizing procurement spend into direct vs. indirect, capital vs. operational, and stock vs.

non-stock items is essential for strategic resource management. While these categories provide a structured framework, they are not mutually exclusive, as an item can fall into multiple categories. For example, an item may be both direct and operational or indirect and stock. The flexibility of these categories allows organizations to tailor their procurement strategies based on their specific needs, ensuring efficient resource allocation and effective supply chain management. Different companies may adopt varying categorization approaches depending on their industry, size, and operational requirements.

Tutor notes:

- Because you've got 6 categories of spend to talk about you're only going to need 3-4 sentences for each.

Providing you've said the category, explained what it is and given one example, you'll absolutely fly through this type of question

- You could also mention that it is useful to use categories of spend as this helps with budgeting. Different categories may also have different processes to follow for procuring the item (this could form part of your introduction or conclusion).

- This subject is LO 1.3.2 it's quite spread out in the text book but the main info is on p.49

- Note- different companies/ industries classify items of spend differently. Particularly packaging and salaries.

Some say they're direct costs and some say they're indirect costs. Honestly, it's a hotly debated subject and I don't think there is a right or wrong. I'd just avoid those two examples if you can and stick to ones that aren't as contentious like eggs and PPE.

Question 25

Bob is a procurement manager at ABC Ltd. He has been asked to ensure all future purchases achieve

'value for money' for the organisation. What is meant by 'value for money'? (5 points). Describe 4 techniques that Bob could use to achieve this (20 points)

'value for money' for the organisation. What is meant by 'value for money'? (5 points). Describe 4 techniques that Bob could use to achieve this (20 points)

Correct Answer:

See the solution in Explanation part below.

Explanation:

1) A definition of Value for Money: ensuring a purchase is cost effective. This may be that the purchase achieves the 5 Rights of Procurement or that the purchase achieves the 4Es: Economy, Efficiency, Effectiveness and Equity. - this is only worth 5 points, so don't spend too long on this

2) 4 techniques Bob can use to achieve VFM: this is the bulk of your essay. Each of the 4 will be worth 5 points, so remember to give a thorough Explanation: and example. Pick 4 from the list below: complete a value analysis to eliminate non-essential features, minimise variety/ consolidate demand, avoid over specification, pro-active sourcing, whole life costing methodologies, eliminate / reduce inventory, use electronic systems, international sourcing, sustainability / environmental policies, currency/ exchange rate considerations, negotiating good payment terms, packaging, warrantees.

Example Essay:

"Value for money" (VFM) is a concept that refers to obtaining the best possible return on investment or benefits relative to the cost incurred. It involves assessing whether the goods, services, or activities provided offer an optimal balance between their cost and the quality, benefits, or outcomes they deliver.

Value for money is not solely about choosing the cheapest option; instead, it considers the overall efficiency, effectiveness, and long-term value derived from an expenditure. For Bob, the Procurement Manager at ABC Ltd there are four key ways that he can achieve this for all future purchases.

Value Engineering

This is looking at the components of a product and evaluating the value of each component individually. You can then eliminate any components that do not add value to the end product. To do this Bob would choose a product to review and determine whether any parts of this can be omitted (thus saving the company money) or could be replaced by components that are of a higher quality at the same price (thus providing added value to the customer). For example, Bob could complete a Value Engineering exercise on the new mobile phone prototype ABC plan to release next year. His findings may discover a way to provide a higher quality camera at no additional cost or that some components don't add value and can be eliminated.

Consolidate demand

Bob can achieve value for money by consolidating demand at ABC ltd. This would mean rather than each individual person/ department ordering what they want when they need it, Bob creates a centralised process for ordering items in bulk for the departments to share. For example, if each department require stationary to be ordered, Bob can consolidate this demand and create one big order each quarter. This will likely result in cost savings for ABC as suppliers often offer discounts for large orders. Moreover, consolidating demand will allow for saving in time (one person does the task once, rather than lots of people doing the same task and duplicating work).

International sourcing

Bob may find there is value for money in changing suppliers and looking at international sourcing.

Often other countries outside of the UK can offer the same products at a lower cost. An example of this is manufactured goods from China. By looking at international supply chains, Bob may be able to make cost-savings for ABC. He should be sure that when using this technique there is no compromise on quality.

Whole Life Costing methodology

This is a technique Bob can use for procuring capital expenditure items for ABC. This involves looking at the costs of the item throughout its lifecycle and not just the initial purchase price. For example, if Bob needs to buy a new delivery truck he should consider not only the price of the truck, but also the costs of insurance for the truck, how expensive it is to buy replacement parts such as tyres and the cost of disposing of the truck once it reaches the end of its life. By considering these factors Bob will ensure that he buys the truck that represents the best value for money long term.

In conclusion Bob should ensure he uses these four techniques for all items he and his team procures in the future. This will ensure ABC Ltd are always achieving value for money, and thus remain competitive in the marketplace.

Tutor Notes

- This case study is really short, and the ones you'll receive in the exam are often longer and give you more guidance on what they're expecting you to write. With case study questions, you have to make your entire answer about Bob. So don't bring in examples from your own experience, rather, focus on giving examples for Bob.

- A good rule of thumb for case study questions is make sure you reference the case study once per paragraph.

- Value for Money is a really broad topic and you can pretty much argue anything that procurement does is helping to achieve value for money. There's a large table of stuff that's considered VFM on p.38 but that table isn't exhaustive. So feel free to come up with your own ideas for this type of essay.

Some additional tidbits of information on VFM:

- The 'academic' definition of Value for Money is 'the optimum combination of whole life cost and the quality necessary to meet the customer's requirement'

- Value for Money is an important strategic objective for most organisations but particularly in the public sector. This is because the public sector is financed by public money (taxes), so they must demonstrate that the organisation is using this money wisely. This might be an interesting fact to put into an essay on VFM.

- Value can often be hard to quantify, particularly in the service industry. E.g. in customer service it can be difficult to quantify the value of having knowledgeable and polite employees delivering the service.

Explanation:

1) A definition of Value for Money: ensuring a purchase is cost effective. This may be that the purchase achieves the 5 Rights of Procurement or that the purchase achieves the 4Es: Economy, Efficiency, Effectiveness and Equity. - this is only worth 5 points, so don't spend too long on this

2) 4 techniques Bob can use to achieve VFM: this is the bulk of your essay. Each of the 4 will be worth 5 points, so remember to give a thorough Explanation: and example. Pick 4 from the list below: complete a value analysis to eliminate non-essential features, minimise variety/ consolidate demand, avoid over specification, pro-active sourcing, whole life costing methodologies, eliminate / reduce inventory, use electronic systems, international sourcing, sustainability / environmental policies, currency/ exchange rate considerations, negotiating good payment terms, packaging, warrantees.

Example Essay:

"Value for money" (VFM) is a concept that refers to obtaining the best possible return on investment or benefits relative to the cost incurred. It involves assessing whether the goods, services, or activities provided offer an optimal balance between their cost and the quality, benefits, or outcomes they deliver.

Value for money is not solely about choosing the cheapest option; instead, it considers the overall efficiency, effectiveness, and long-term value derived from an expenditure. For Bob, the Procurement Manager at ABC Ltd there are four key ways that he can achieve this for all future purchases.

Value Engineering

This is looking at the components of a product and evaluating the value of each component individually. You can then eliminate any components that do not add value to the end product. To do this Bob would choose a product to review and determine whether any parts of this can be omitted (thus saving the company money) or could be replaced by components that are of a higher quality at the same price (thus providing added value to the customer). For example, Bob could complete a Value Engineering exercise on the new mobile phone prototype ABC plan to release next year. His findings may discover a way to provide a higher quality camera at no additional cost or that some components don't add value and can be eliminated.

Consolidate demand

Bob can achieve value for money by consolidating demand at ABC ltd. This would mean rather than each individual person/ department ordering what they want when they need it, Bob creates a centralised process for ordering items in bulk for the departments to share. For example, if each department require stationary to be ordered, Bob can consolidate this demand and create one big order each quarter. This will likely result in cost savings for ABC as suppliers often offer discounts for large orders. Moreover, consolidating demand will allow for saving in time (one person does the task once, rather than lots of people doing the same task and duplicating work).

International sourcing

Bob may find there is value for money in changing suppliers and looking at international sourcing.

Often other countries outside of the UK can offer the same products at a lower cost. An example of this is manufactured goods from China. By looking at international supply chains, Bob may be able to make cost-savings for ABC. He should be sure that when using this technique there is no compromise on quality.

Whole Life Costing methodology

This is a technique Bob can use for procuring capital expenditure items for ABC. This involves looking at the costs of the item throughout its lifecycle and not just the initial purchase price. For example, if Bob needs to buy a new delivery truck he should consider not only the price of the truck, but also the costs of insurance for the truck, how expensive it is to buy replacement parts such as tyres and the cost of disposing of the truck once it reaches the end of its life. By considering these factors Bob will ensure that he buys the truck that represents the best value for money long term.

In conclusion Bob should ensure he uses these four techniques for all items he and his team procures in the future. This will ensure ABC Ltd are always achieving value for money, and thus remain competitive in the marketplace.

Tutor Notes

- This case study is really short, and the ones you'll receive in the exam are often longer and give you more guidance on what they're expecting you to write. With case study questions, you have to make your entire answer about Bob. So don't bring in examples from your own experience, rather, focus on giving examples for Bob.

- A good rule of thumb for case study questions is make sure you reference the case study once per paragraph.

- Value for Money is a really broad topic and you can pretty much argue anything that procurement does is helping to achieve value for money. There's a large table of stuff that's considered VFM on p.38 but that table isn't exhaustive. So feel free to come up with your own ideas for this type of essay.

Some additional tidbits of information on VFM:

- The 'academic' definition of Value for Money is 'the optimum combination of whole life cost and the quality necessary to meet the customer's requirement'

- Value for Money is an important strategic objective for most organisations but particularly in the public sector. This is because the public sector is financed by public money (taxes), so they must demonstrate that the organisation is using this money wisely. This might be an interesting fact to put into an essay on VFM.

- Value can often be hard to quantify, particularly in the service industry. E.g. in customer service it can be difficult to quantify the value of having knowledgeable and polite employees delivering the service.

- Latest Upload

- 126SAP.C-LCNC-2406.v2026-01-09.q21

- 144Salesforce.CRT-550.v2026-01-09.q122

- 119Salesforce.Marketing-Cloud-Intelligence.v2026-01-09.q41

- 124CIPS.L4M1.v2026-01-09.q27

- 107ISTQB.ATM.v2026-01-09.q49

- 117SAP.C_BCBAI_2502.v2026-01-08.q38

- 111Oracle.1Z0-1056-24.v2026-01-08.q53

- 156Huawei.H13-831_V2.0.v2026-01-07.q101

- 176Salesforce.Salesforce-Slack-Administrator.v2026-01-06.q103

- 150CIPS.L5M15.v2026-01-06.q31