Question 76

XY manufactures a range of products and uses an activity based costing system.

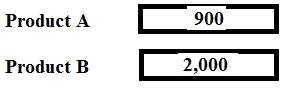

Budgeted production of Product B is 7,500 units.

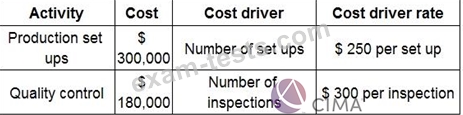

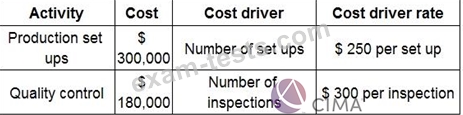

Overheads have been identified by activity and related to appropriate cost drivers.

Product B is produced in batches of 250 units. Machines have to be reset after every batch and quality inspections are carried out on every third batch.

What is the total overhead cost per unit of Product B?

Give your answer to two decimal places.

Budgeted production of Product B is 7,500 units.

Overheads have been identified by activity and related to appropriate cost drivers.

Product B is produced in batches of 250 units. Machines have to be reset after every batch and quality inspections are carried out on every third batch.

What is the total overhead cost per unit of Product B?

Give your answer to two decimal places.

Question 77

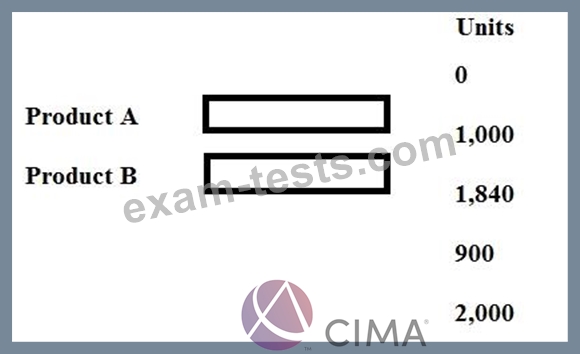

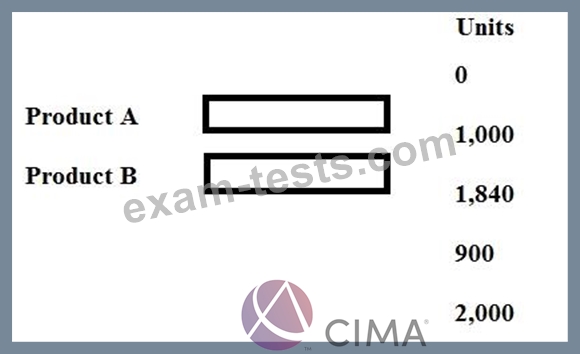

Demand for two products, A and B is 1,000 units and 2,000 units respectively. Each unit of Product A requires 8 kg of material and each unit of Product B requires 5 kg of material. The maximum availability of material is 17,200 kg. Contribution per unit of A is $10 and per unit of B is $9.

Place the production volumes of Product A and Product B, that will maximize contribution, in the table.

Place the production volumes of Product A and Product B, that will maximize contribution, in the table.

Question 78

A company accountant is trying to determine the optimum production plan for the period using linear programming.

The accountant has correctly formulated the linear programming problem as follows:

Variables (products): x and y

Objective function: Maximise contribution, C = 10x + 15y

Material constraint: 4x + 6y ≤ 500 (kg)

Labour constraint: x + 2y ≤ 350 (hours)

Machine constraint: 10x + 4y ≤ 1,500 (hours)

x constraint: 50 ≤ x ≤ 200

y constraint: y ≥ 0

Which of the following statements is true?

The accountant has correctly formulated the linear programming problem as follows:

Variables (products): x and y

Objective function: Maximise contribution, C = 10x + 15y

Material constraint: 4x + 6y ≤ 500 (kg)

Labour constraint: x + 2y ≤ 350 (hours)

Machine constraint: 10x + 4y ≤ 1,500 (hours)

x constraint: 50 ≤ x ≤ 200

y constraint: y ≥ 0

Which of the following statements is true?

Question 79

For the past year a manufacturing company has recorded the number of units produced (x) each week and the total production cost (y) for that week. The company intends to use this data to predict future costs.

For the circumstance described above, linear regression is more useful and accurate than the high-low method because:

1. It uses all the sets of data observed to calculate the line of best fit.

2. The coefficient of variation can estimate what percentage of x is due to a change in y.

3. Forecasts remain valid for values for x outside of the observed range.

Which of the above statements are true?

For the circumstance described above, linear regression is more useful and accurate than the high-low method because:

1. It uses all the sets of data observed to calculate the line of best fit.

2. The coefficient of variation can estimate what percentage of x is due to a change in y.

3. Forecasts remain valid for values for x outside of the observed range.

Which of the above statements are true?

Question 80

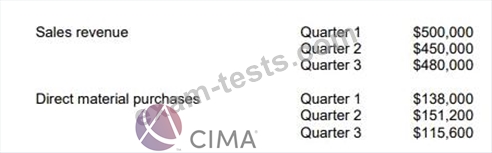

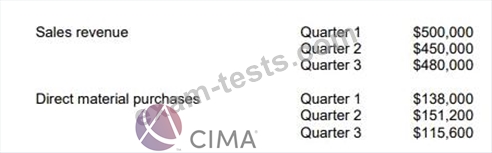

JL is preparing its cash budget for the next three quarters. The following data have been extracted from the operational budgets:

Additional information is available as follows:

* JL sells 20% of its goods for cash. Of the remaining sales value, 70% is received within the same quarter as sale and 30% is received in the following quarter. It is estimated that trade receivables will be

$125,000 at the beginning of Quarter 1. No bad debts are anticipated.

* 50% of payments for direct material purchases are made in the quarter of purchase, with the remaining 50% in the quarter following purchase. It is estimated that the amount owing for direct material purchases will be $60,000 at the beginning of Quarter 1.

* JL pays labour and overhead costs when they are incurred. It has been estimated that labour and overhead costs in total will be $303,600 per quarter. This figure includes depreciation of $19,600.

* JL expects to repay a loan of $100,000 in Quarter 3.

* The cash balance at the beginning of Quarter 1 is estimated to be $49,400 positive.

Required:

Prepare a cash budget for each of the THREE quarters.

What will the closing balance of cash flows in quarter THREE be?

Additional information is available as follows:

* JL sells 20% of its goods for cash. Of the remaining sales value, 70% is received within the same quarter as sale and 30% is received in the following quarter. It is estimated that trade receivables will be

$125,000 at the beginning of Quarter 1. No bad debts are anticipated.

* 50% of payments for direct material purchases are made in the quarter of purchase, with the remaining 50% in the quarter following purchase. It is estimated that the amount owing for direct material purchases will be $60,000 at the beginning of Quarter 1.

* JL pays labour and overhead costs when they are incurred. It has been estimated that labour and overhead costs in total will be $303,600 per quarter. This figure includes depreciation of $19,600.

* JL expects to repay a loan of $100,000 in Quarter 3.

* The cash balance at the beginning of Quarter 1 is estimated to be $49,400 positive.

Required:

Prepare a cash budget for each of the THREE quarters.

What will the closing balance of cash flows in quarter THREE be?