Question 66

Your company operates using TQM. As the accountant you have been tasked with producing a quality report so that management can understand how well their new range of products is being received and how the quality of the products has improved. In order to produce the report you have requested information from different departments, but you soon realise not all the information is relevant. You have information regarding the following:

Cost of downtime Training costs Environmental costs Customer returns and refunds Number of defects per unit Which pieces of information are relevant to your report? Select ALL that apply.

Cost of downtime Training costs Environmental costs Customer returns and refunds Number of defects per unit Which pieces of information are relevant to your report? Select ALL that apply.

Question 67

A company's budget for the next period shows that it would breakeven at sales revenue of $800,000 and fixed costs of $320,000.

The sales revenue needed to achieve a profit of $200,000 in the next period would be:

The sales revenue needed to achieve a profit of $200,000 in the next period would be:

Question 68

Which of the following distinguishes risk from uncertainty?

Question 69

Which THREE of the following statements relating to fixed overhead variances are correct?

Question 70

FGH used to manufacture components that required raw material Q.

Currently there are 80 kg of material Q in inventory.

The company has no use for the material in the foreseeable future and intends to sell it for scrap.

A potential new customer has asked for a price for a large order.

This order would require 100 kg of material Q.

The company management has decided to quote a price for this work on a relevant cost basis.

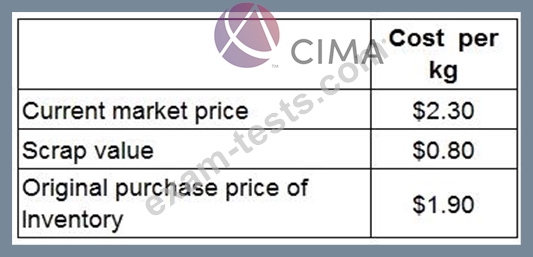

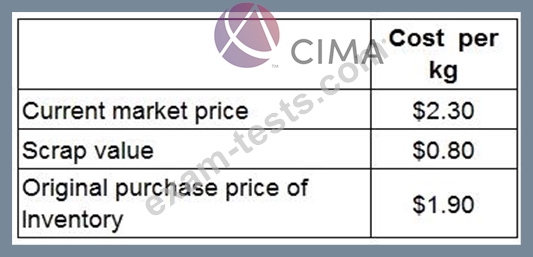

Details of costs for material Q are as follows:

What would be the relevant cost of Material Q to use in this order?

Currently there are 80 kg of material Q in inventory.

The company has no use for the material in the foreseeable future and intends to sell it for scrap.

A potential new customer has asked for a price for a large order.

This order would require 100 kg of material Q.

The company management has decided to quote a price for this work on a relevant cost basis.

Details of costs for material Q are as follows:

What would be the relevant cost of Material Q to use in this order?