Question 11

U+ Bank recently introduced a new credit card offer, Platinum Plus, for its premium customers. As the bank has some financial targets to meet, the business has decided to boost the Platinum plus card.

As a decisioning consultant, how can you ensure that the Platinum Plus offer is prioritized over other offers?

As a decisioning consultant, how can you ensure that the Platinum Plus offer is prioritized over other offers?

Question 12

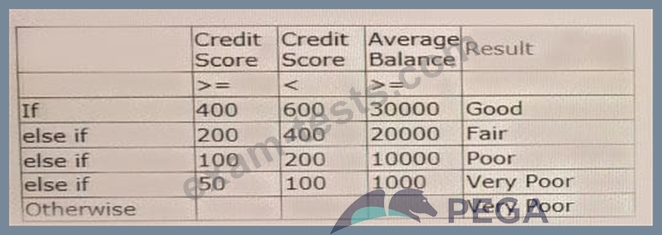

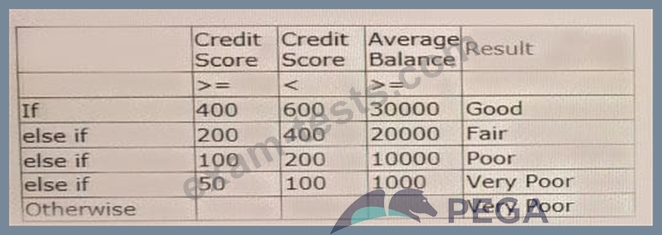

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hubtm.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hubtm.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

Question 13

When a customer is offered an action that they already accepted, this is because_________.

Question 14

U+ Bank, a retail bank, uses the always-on outbound approach to send outbound messages on different channels such as email, SMS, and push notifications. There are a variety of action flow patterns in use to meet various business and channel integrations requirements.

Due to technical reasons, the bank wants to temporarily suspend sending outbound messages and instead write the selected customers and action details to a database table for later offline processing.

What is the most efficient way to meet this requirement?

Due to technical reasons, the bank wants to temporarily suspend sending outbound messages and instead write the selected customers and action details to a database table for later offline processing.

What is the most efficient way to meet this requirement?

Question 15

U+ Bank, a retail bank, presents various credit card offers to its customers on its website. The bank uses artificial intelligence (AI) to prioritize the offers based on customer behavior. Since introducing the Gold credit card offer, the offer click through rate propensity has increased to 0.83.

What does the increase in the propensity value most likely indicate?

What does the increase in the propensity value most likely indicate?