Question 16

U+ Bank, a retail bank, follows all engagement policy best practices to present credit card offers on their website. The bank has introduced a new credit card offer, the Rewards card. Anna, an existing customer, currently holds a higher value card. Premier Rewards, and does not see the new Rewards card offer.

What condition possibly prevents Anna from seeing the new Rewards card offer?

What condition possibly prevents Anna from seeing the new Rewards card offer?

Question 17

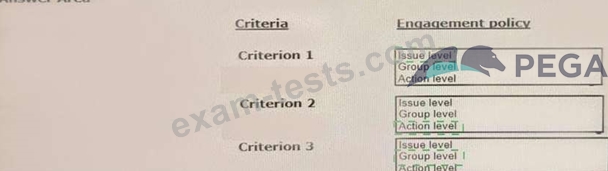

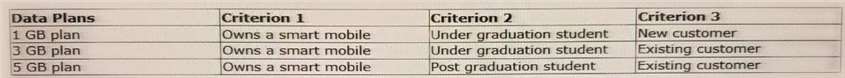

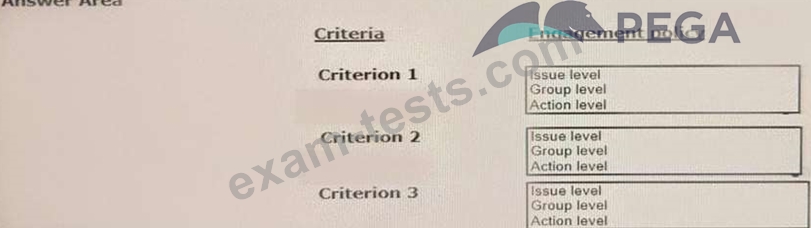

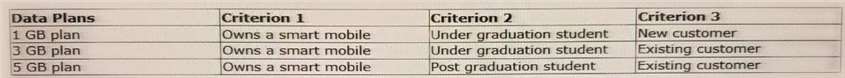

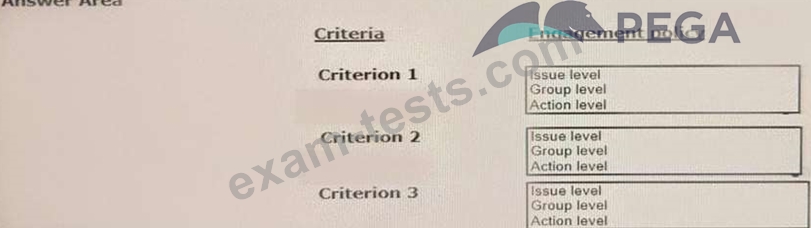

Myco, a telecom company, has come up with a new data plan group to suit its customers' needs. The below table lists the three data plan actions and the criteria a customer should satisfy to qualify for the offer.

How do you configure the engagement policies to implement this requirement?

How do you configure the engagement policies to implement this requirement?

Question 18

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?

Which option allows you to implement the business requirement?

Question 19

U+ Bank uses Pega Customer Decision Hubtm to display an offer to its customers on the U+ Bank website.

The bank wants to ensure that Silver credit cards are not offered to customers under 27 years of age. They also want to ensure that Platinum cards are offered only to customers who had a positive balance in the last year.

What do you configure in the Next-Best-Action Designer to achieve this outcome?

The bank wants to ensure that Silver credit cards are not offered to customers under 27 years of age. They also want to ensure that Platinum cards are offered only to customers who had a positive balance in the last year.

What do you configure in the Next-Best-Action Designer to achieve this outcome?

Question 20

U+ Bank has recently introduced a few mortgage offers that are presented to qualified customers on its website- The business now wants to prevent offer overexposure, as overexposure negatively impacts the customer experience.

Select the correct suppression rule for the requirement: If a customer has clicked on any of the mortgage offers a total of three times in the last 7 days, do not show any mortgage offers to that customer for the next 10 days.

Select the correct suppression rule for the requirement: If a customer has clicked on any of the mortgage offers a total of three times in the last 7 days, do not show any mortgage offers to that customer for the next 10 days.