Question 51

XY acquired 75% of the equity shares of CD on 1 January 20X2 for $230,000.

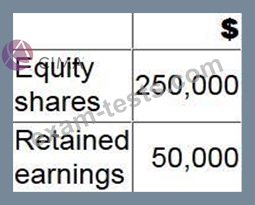

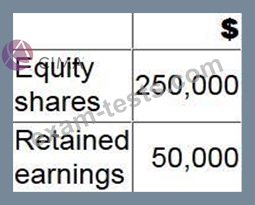

On 1 January 20X2 CD had the following balances:

XY uses the proportionate share of net assets method to value non controlling interest at acquisition.

Calculate the goodwill arising on the acquisition of CD.

Give your answer to nearest whole number.

On 1 January 20X2 CD had the following balances:

XY uses the proportionate share of net assets method to value non controlling interest at acquisition.

Calculate the goodwill arising on the acquisition of CD.

Give your answer to nearest whole number.

Question 52

Country X levies a duty on alcoholic drinks. Where the alcohol content is above 40% by volume the duty levied is $5 per 1 litre bottle.

What type of tax is this duty?

What type of tax is this duty?

Question 53

The external auditors have completed their audit and have discovered a material but not pervasive error in the financial statements of JK.

The directors of JK have refused to change the financial statements.

What type of modified audit report should be issued?

The directors of JK have refused to change the financial statements.

What type of modified audit report should be issued?

Question 54

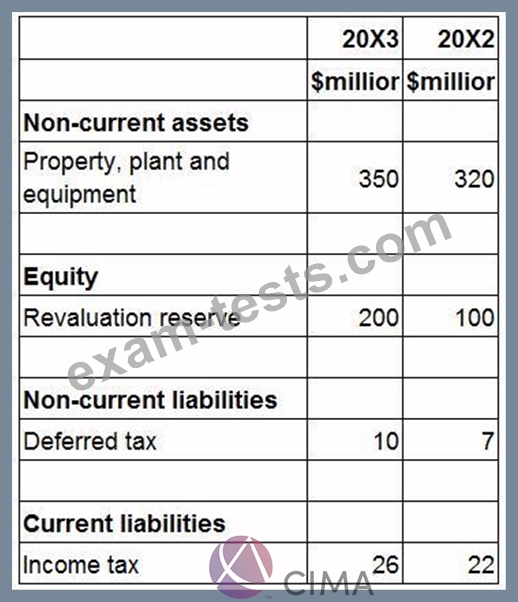

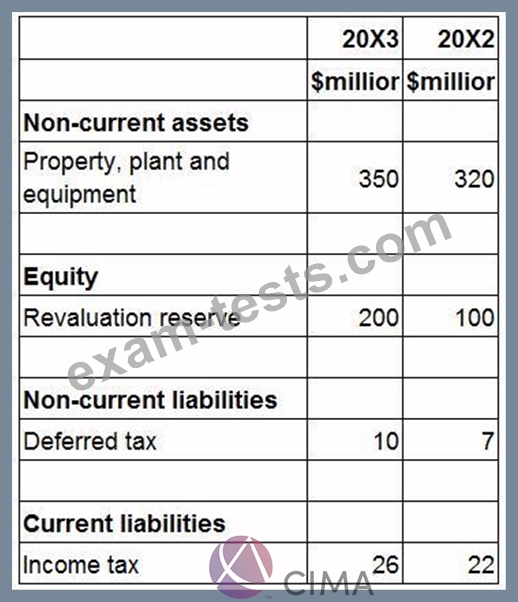

The following information is extracted from the statement of financial position for ZZ at 31 March 20X3:

Included within cost of sales in the statement of profit or loss for the year ended 31 March 20X3 is $20 million relating to the loss on the sale of plant and equipment which had cost $100 million in June 20X1.

Depreciation is charged on all plant and equipment at 25% on a straight line basis with a full year's depreciation charged in the year of acquisition and none in the year of sale.

The revaluation reserve relates to the revaluation of ZZ's property.

The total depreciation charge for property, plant and equipment in ZZ's statement of profit of loss for the year ended 31 March 20X3 is $80 million.

The corporate income tax expense in ZZ's statement of profit or loss for year ended 31 March 20X3 is

$28 million.

ZZ is preparing its statement of cash flows for the year ended 31 March 20X3.

What figure should be included for corporate income tax paid in order to arrive at the net cash flow from operating activities?

Give your answer to the nearest $ million.

Included within cost of sales in the statement of profit or loss for the year ended 31 March 20X3 is $20 million relating to the loss on the sale of plant and equipment which had cost $100 million in June 20X1.

Depreciation is charged on all plant and equipment at 25% on a straight line basis with a full year's depreciation charged in the year of acquisition and none in the year of sale.

The revaluation reserve relates to the revaluation of ZZ's property.

The total depreciation charge for property, plant and equipment in ZZ's statement of profit of loss for the year ended 31 March 20X3 is $80 million.

The corporate income tax expense in ZZ's statement of profit or loss for year ended 31 March 20X3 is

$28 million.

ZZ is preparing its statement of cash flows for the year ended 31 March 20X3.

What figure should be included for corporate income tax paid in order to arrive at the net cash flow from operating activities?

Give your answer to the nearest $ million.

Question 55

On 1 January 20X2 an entity began work on constructing a factory. It purchased the land for $14 million, built the factory buildings for $11 million and installed plant and equipment for $7 million. The project was completed on 31 December 20X3 when the factory was deemed ready to use, however, the factory did not start operations until 1 June 20X4.

To fund the project the entity borrowed $25 million on 1 January 20X2, with interest at 10% per year.

The loan was repaid in full on 31 December 20X4.

Calculate the total amount to be added to the cost of property, plant and equipment in respect of the above development.

Give your answer to the nearest $ million.

To fund the project the entity borrowed $25 million on 1 January 20X2, with interest at 10% per year.

The loan was repaid in full on 31 December 20X4.

Calculate the total amount to be added to the cost of property, plant and equipment in respect of the above development.

Give your answer to the nearest $ million.