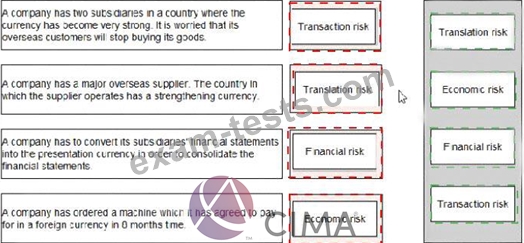

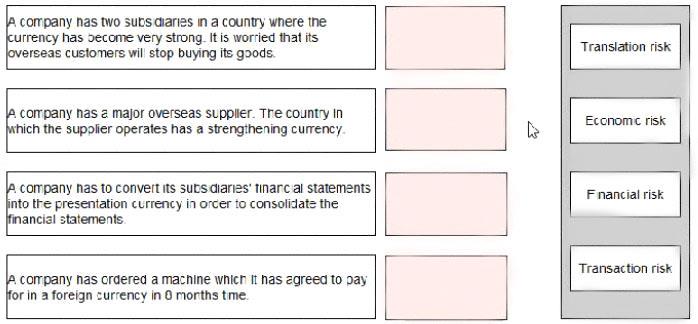

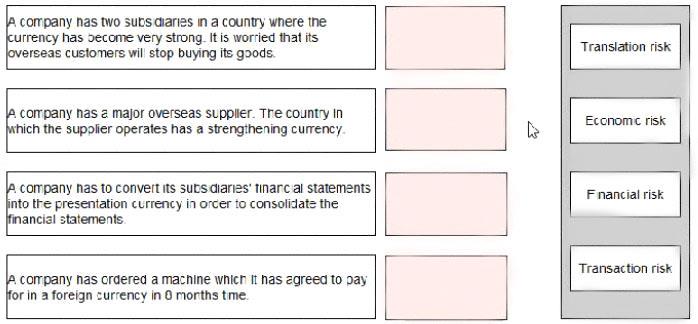

Question 6

Select the category of risk for each of the descriptions below:

Question 7

Companies A, B, C and D:

* are based in a country that uses the K$ as its currency.

* have an objective to grow operating profit year on year.

* have the same total levels of revenue and cost.

* trade with companies or individuals in the eurozone. All import and export trade with companies or individuals in the eurozone is priced in EUR.

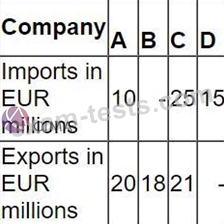

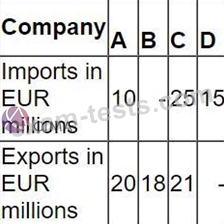

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the EUR/K$ exchange rate?

* are based in a country that uses the K$ as its currency.

* have an objective to grow operating profit year on year.

* have the same total levels of revenue and cost.

* trade with companies or individuals in the eurozone. All import and export trade with companies or individuals in the eurozone is priced in EUR.

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the EUR/K$ exchange rate?

Question 8

An unlisted company is attempting to value its equity using the dividend valuation model.

Relevant information is as follows:

* A dividend of $500,000 has just been paid.

* Dividend growth of 8% is expected for the foreseeable future.

* Earnings growth of 6% is expected for the foreseeable future.

* The cost of equity of a proxy listed company is 15%.

* The risk premium required due to the company being unlisted is 3%.

The calculation that has been performed is as follows:

Equity value = $540,000 / (0.18 - 0.08) = $5,400,000

What is the fault with the calculation that has been performed?

Relevant information is as follows:

* A dividend of $500,000 has just been paid.

* Dividend growth of 8% is expected for the foreseeable future.

* Earnings growth of 6% is expected for the foreseeable future.

* The cost of equity of a proxy listed company is 15%.

* The risk premium required due to the company being unlisted is 3%.

The calculation that has been performed is as follows:

Equity value = $540,000 / (0.18 - 0.08) = $5,400,000

What is the fault with the calculation that has been performed?

Question 9

A company is valuing its equity prior to an initial public offering (IPO).

Relevant data:

* Earnings per share $1.00

* WACC is 8% and the cost of equity is 12%

* Dividend payout ratio 40%

* Dividend growth rate 2% in perpetuity

The current share price using the Dividend Valuation Model is closest to:

Relevant data:

* Earnings per share $1.00

* WACC is 8% and the cost of equity is 12%

* Dividend payout ratio 40%

* Dividend growth rate 2% in perpetuity

The current share price using the Dividend Valuation Model is closest to:

Question 10

A company is currently all-equity financed with a cost of equity of 8%.

It plans to raise debt with a pre-tax cost of 4% in order to buy back equity shares.

After the buy-back, the debt-to-equity ratio at market values will be 1 to 2.

The corporate income tax rate is 30%.

Which of the following represents the company's cost of equity after the buy-back according to Modigliani and Miller's Theory of Capital Structure with taxes?

It plans to raise debt with a pre-tax cost of 4% in order to buy back equity shares.

After the buy-back, the debt-to-equity ratio at market values will be 1 to 2.

The corporate income tax rate is 30%.

Which of the following represents the company's cost of equity after the buy-back according to Modigliani and Miller's Theory of Capital Structure with taxes?