Question 21

Company P is a large unlisted food-processing company.

Its current profit before interest and taxation is $4 million, which it expects to be maintainable in the future.

It has a $10 million long-term loan on which it pays interest of 10%.

Corporate tax is paid at the rate of 20%.

The following information on P/E multiples is available:

Which of the following is the best indication of the equity value of Company P?

Its current profit before interest and taxation is $4 million, which it expects to be maintainable in the future.

It has a $10 million long-term loan on which it pays interest of 10%.

Corporate tax is paid at the rate of 20%.

The following information on P/E multiples is available:

Which of the following is the best indication of the equity value of Company P?

Question 22

A company currently has a 6.25% fixed rate loan but it wishes to change the interest style of the loan to variable by using an interest rate swap directly with the bank.

The bank has quoted the following swap rate:

* 5.50% - 5.55% in exchange for LIBOR

LIBOR is currently 5%.

If the company enters into the swap and LIBOR remains at 5%, what will the company's interest cost be?

The bank has quoted the following swap rate:

* 5.50% - 5.55% in exchange for LIBOR

LIBOR is currently 5%.

If the company enters into the swap and LIBOR remains at 5%, what will the company's interest cost be?

Question 23

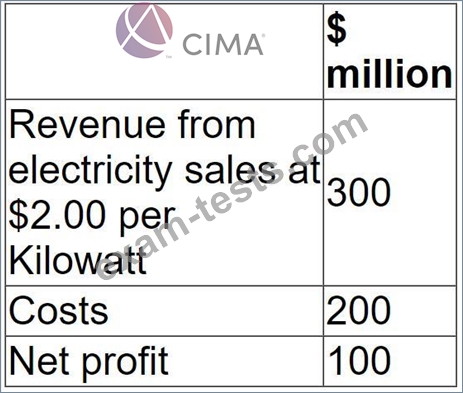

A company generates and distributes electricity and gas to households and businesses.

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $1.50 per Kilowatt.

The company expects this to cause consumption to rise by 10% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $1.50 per Kilowatt.

The company expects this to cause consumption to rise by 10% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Question 24

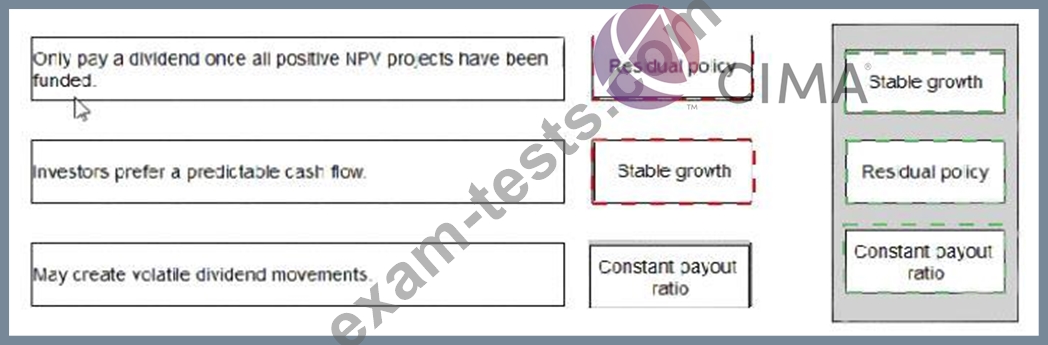

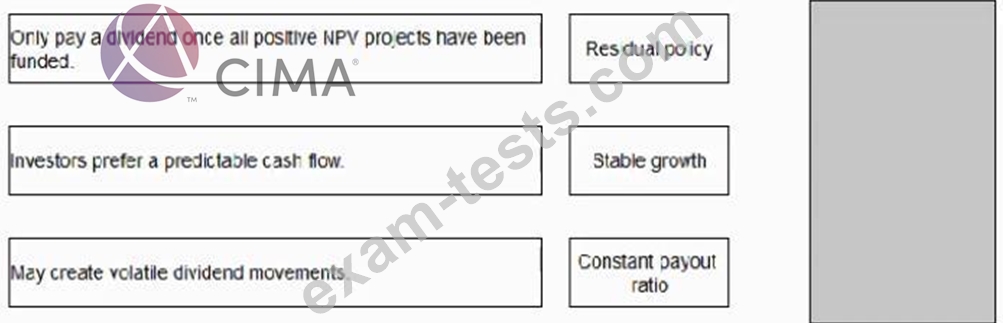

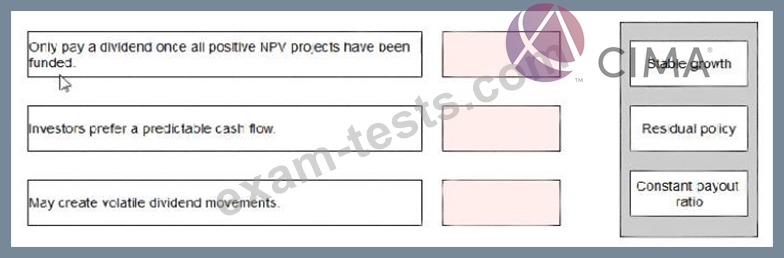

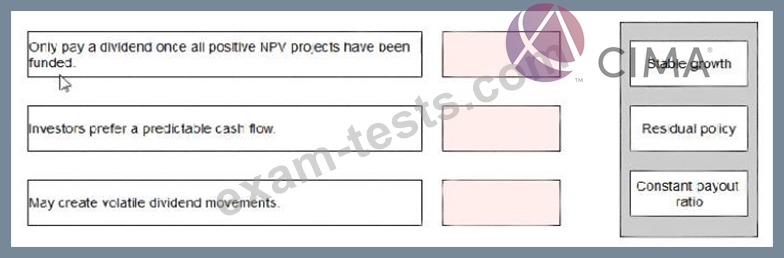

Select the most appropriate divided for each of the following statements:

Question 25

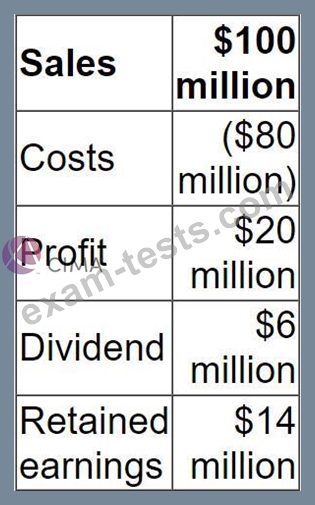

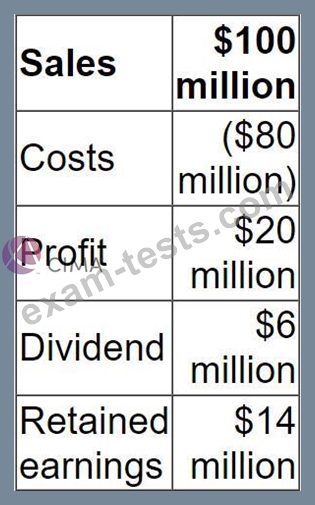

A company's main objective is to achieve an average growth in dividends of 10% a year.

In the most recent financial year:

Sales are expected to grow at 8% a year over the next 5 years.

Costs are expected to grow at 5% a year over the next 5 years.

What is the minimum dividend payout ratio in 5 years' time that would allow the company to achieve its objective?

In the most recent financial year:

Sales are expected to grow at 8% a year over the next 5 years.

Costs are expected to grow at 5% a year over the next 5 years.

What is the minimum dividend payout ratio in 5 years' time that would allow the company to achieve its objective?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: