Question 16

A company has announced a rights issue of 1 new share for every 4 existing shares.

Relevant data:

* The current market price per share is $10.00.

* Rights are to be issued at a 20% discount to the current price.

* The rate of return on the new funds raised is expected to be 10%.

* The rate of return on existing funds is 5%.

What is the yield-adjusted theoretical ex-rights price?

Give your answer to two decimal places.

Relevant data:

* The current market price per share is $10.00.

* Rights are to be issued at a 20% discount to the current price.

* The rate of return on the new funds raised is expected to be 10%.

* The rate of return on existing funds is 5%.

What is the yield-adjusted theoretical ex-rights price?

Give your answer to two decimal places.

Question 17

A company proposes to value itself based on the net present value of estimated future cash flows.

Relevant data:

* The cash flow for the next three years is expected to be £100 million each year

* The cash flow after year 3 will grow at 2% to perpetuity

* The cost of capital is 12%

The value of the company to the nearest $ million is:

Relevant data:

* The cash flow for the next three years is expected to be £100 million each year

* The cash flow after year 3 will grow at 2% to perpetuity

* The cost of capital is 12%

The value of the company to the nearest $ million is:

Question 18

Assume today is 31 December 20X1.

A listed mobile phone company has just launched a new phone which is proving to be a great success.

As a direct result of the product's success, earnings are forecast to increase by:

* 5% a year in each of years 20X2 - 20X6

* 3% from 20X7 onwards

Market analysts were very excited to hear the news of the success of the product and future growth forecasts.

Assuming a semi-efficient market applies, which of the following company valuation methods is likely to give the best estimate of the company's equity value today?

A listed mobile phone company has just launched a new phone which is proving to be a great success.

As a direct result of the product's success, earnings are forecast to increase by:

* 5% a year in each of years 20X2 - 20X6

* 3% from 20X7 onwards

Market analysts were very excited to hear the news of the success of the product and future growth forecasts.

Assuming a semi-efficient market applies, which of the following company valuation methods is likely to give the best estimate of the company's equity value today?

Question 19

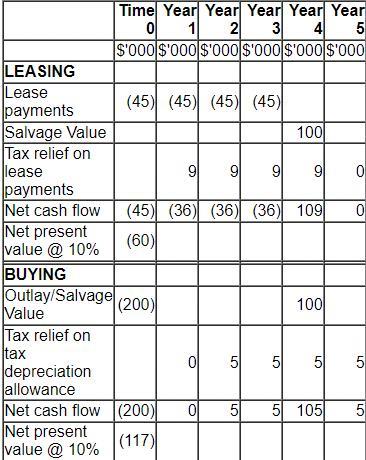

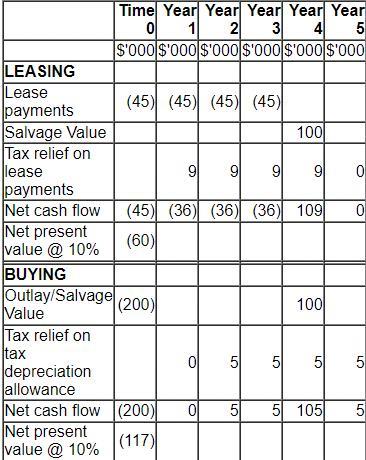

A company plans a four-year project which will be financed by either an operating lease or a bank loan.

Lease details:

* Four year lease contract.

* Annual lease rentals of $45,000, paid in advance on the 1st day of the year.

Other information:

* The interest rate payable on the bank borrowing is 10%.

* The capital cost of the project is $200,000 which would have to be paid at the beginning of the first year.

* A salvage or residual value of $100,000 is estimated at the end of the project's life.

* Purchased assets attract straight line tax depreciation allowances.

* Corporate income tax is 20% and is payable at the end of the year following the year to which it relates.

A lease-or-buy appraisal is shown below:

Which THREE of the following items are errors within the appraisal?

Lease details:

* Four year lease contract.

* Annual lease rentals of $45,000, paid in advance on the 1st day of the year.

Other information:

* The interest rate payable on the bank borrowing is 10%.

* The capital cost of the project is $200,000 which would have to be paid at the beginning of the first year.

* A salvage or residual value of $100,000 is estimated at the end of the project's life.

* Purchased assets attract straight line tax depreciation allowances.

* Corporate income tax is 20% and is payable at the end of the year following the year to which it relates.

A lease-or-buy appraisal is shown below:

Which THREE of the following items are errors within the appraisal?

Question 20

Holding cash in excess of business requirements rather than returning the cash to shareholders is most likely to result in lower: