Question 11

Company A, a listed company, plans to acquire Company T, which is also listed.

Additional information is:

* Company A has 100 million shares in issue, with market price currently at $8.00 per share.

* Company T has 90 million shares in issue,. with market price currently at $5.00 each share.

* Synergies valued at $60 million are expected to arise from the acquisition.

* The terms of the offer will be 2 shares in A for 3 shares in B.

Assuming the offer is accepted and the synergies are realised, what should the post-acquisition price of each of Company A's shares be?

Give your answer to two decimal places.

$ ? .

Additional information is:

* Company A has 100 million shares in issue, with market price currently at $8.00 per share.

* Company T has 90 million shares in issue,. with market price currently at $5.00 each share.

* Synergies valued at $60 million are expected to arise from the acquisition.

* The terms of the offer will be 2 shares in A for 3 shares in B.

Assuming the offer is accepted and the synergies are realised, what should the post-acquisition price of each of Company A's shares be?

Give your answer to two decimal places.

$ ? .

Question 12

Which THREE of the following remain unchanged over the life of a 10 year fixed rate bond?

Question 13

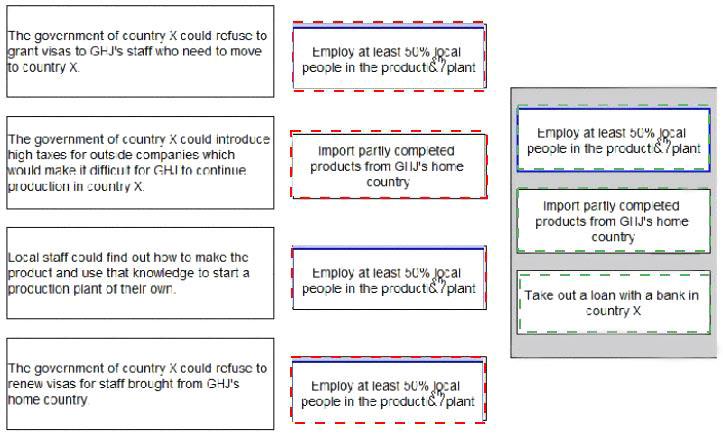

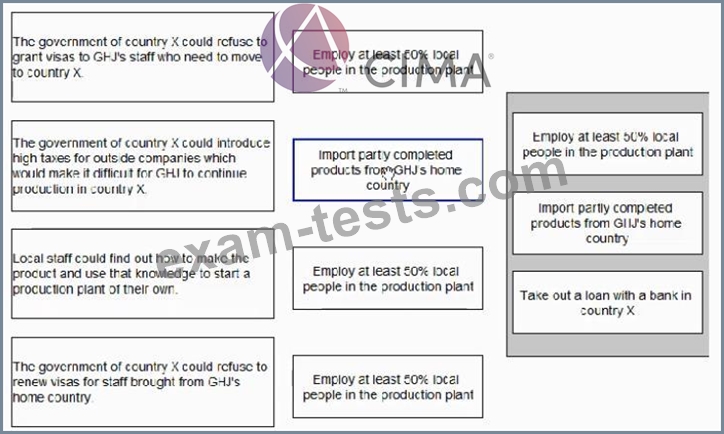

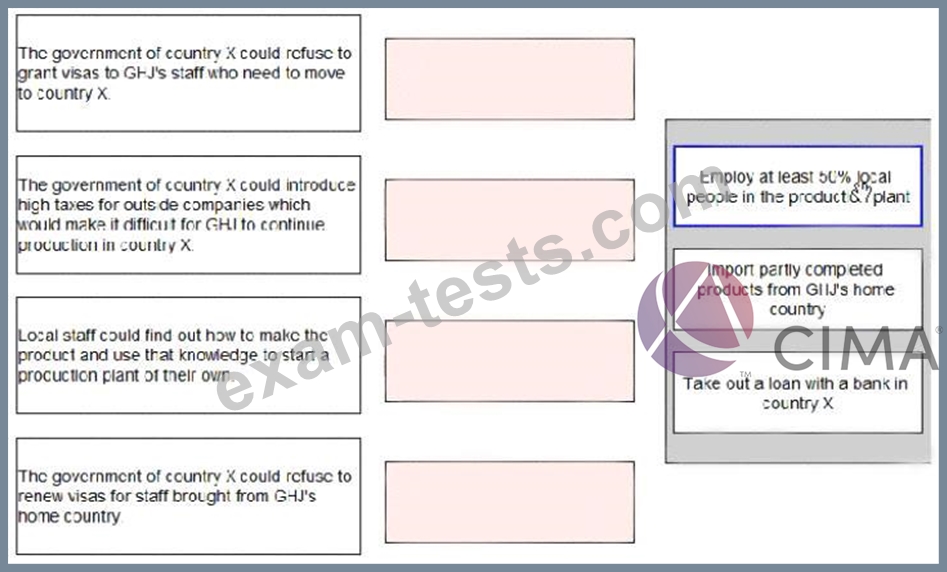

CI IJ has decided to move its production plant to overseas country X.

This would make the product cheaper to produce. The technology used to make the product is very advanced and some of the skilled staff would have to move to country X.

The Production Director has identified that there are some political risks in moving to county X.

For each of the political risks of moving to country X shown below, select the correct method for reducing the risk.

This would make the product cheaper to produce. The technology used to make the product is very advanced and some of the skilled staff would have to move to country X.

The Production Director has identified that there are some political risks in moving to county X.

For each of the political risks of moving to country X shown below, select the correct method for reducing the risk.

Question 14

Company A is a listed company that produces pottery goods which it sells throughout Europe. The pottery is then delivered to a network of self employed artists who are contracted to paint the pottery in their own homes. Finished goods are distributed by network of sales agents.The directors of Company A are now considering acquiring one or more smaller companies by means of vertical integration to improve profit margins.

Advise the Board of Company A which of the following acquisitions is most likely to achieve the stated aim of vertical integration?

Advise the Board of Company A which of the following acquisitions is most likely to achieve the stated aim of vertical integration?

Question 15

An unlisted company:

* Is owned by the original founder and member of their families.

* Is growing more rapidly than other companies in the same industry.

* Pays a fixed annual divided

Which of the following methods would be the most appropriate to value this company's equity?

* Is owned by the original founder and member of their families.

* Is growing more rapidly than other companies in the same industry.

* Pays a fixed annual divided

Which of the following methods would be the most appropriate to value this company's equity?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: