Question 16

Company A has just announced a takeover bid for Company B. The two companies are large companies in the same industry_ The bid is considered to be hostile.

Company B's Board of Directors intends to try to prevent the takeover as they do not consider it to be in the best interests of shareholders

Which THREE of the following are considered to be legitimate post-offer defences?

Company B's Board of Directors intends to try to prevent the takeover as they do not consider it to be in the best interests of shareholders

Which THREE of the following are considered to be legitimate post-offer defences?

Question 17

A manufacturing company based in Country R. where the currency is the R$, has an objective of maintaining an operating profit margin of at least 10% each year

Relevant data:

* The company makes sales to Country S whose currency is the SS It also makes sales to Country T whose currency is the T$ " All purchases are from Country U whose currency is the US.

* The settlement of an transactions is in the currency of the customer or supplier

Which of the following changes would be most likely to help the company achieve its objective?

Relevant data:

* The company makes sales to Country S whose currency is the SS It also makes sales to Country T whose currency is the T$ " All purchases are from Country U whose currency is the US.

* The settlement of an transactions is in the currency of the customer or supplier

Which of the following changes would be most likely to help the company achieve its objective?

Question 18

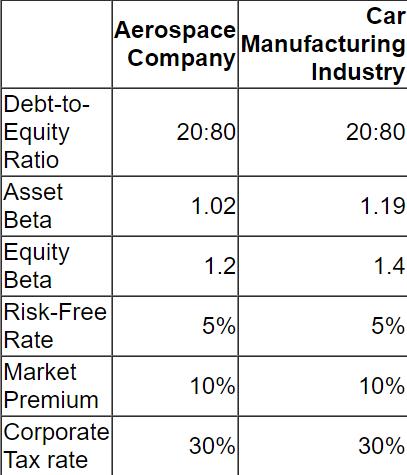

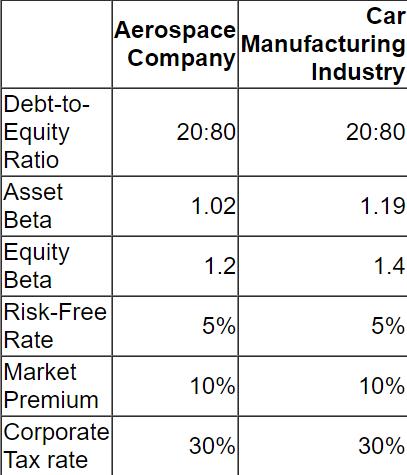

An aerospace company is planning to diversify into car manufacturing.

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

Question 19

A company currently has a 5.25% fixed rate loan but it wishes to change the interest style of the loan to variable by using an interest rate swap directly with the bank.

The bank has quoted the following swap rate:

* 4.50% - 455% in exchange for Libor

Libor is currently 4%.

If the company enters into the swap and Libor remains at 4%. what will the company's interest cost be?

The bank has quoted the following swap rate:

* 4.50% - 455% in exchange for Libor

Libor is currently 4%.

If the company enters into the swap and Libor remains at 4%. what will the company's interest cost be?

Question 20

Under traditional theory, an increase in a company's WACC would cause the value of the company to: