Question 41

Modigliani and Miller are the main proponents of the view that the dividend policy is irrelevant to the value of a company's shares.

They argue that a company that continually reinvests its entire earnings would generate the same shareholder wealth if it engaged in a policy of high dividends and financed its expansion with funds obtained from rights issues.

Which THREE of the following statements are assumptions that are required in order to support this proposition?

They argue that a company that continually reinvests its entire earnings would generate the same shareholder wealth if it engaged in a policy of high dividends and financed its expansion with funds obtained from rights issues.

Which THREE of the following statements are assumptions that are required in order to support this proposition?

Question 42

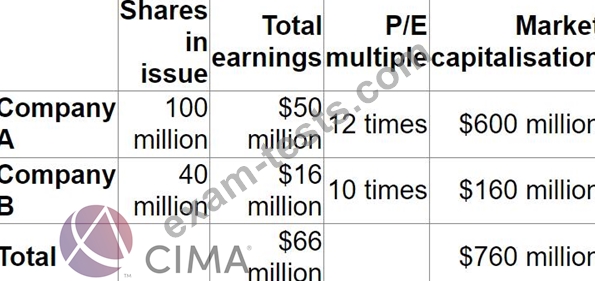

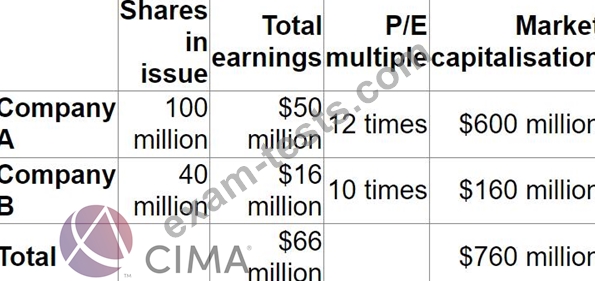

Company A plans to acquire Company B in a 1-for-1 share exchange.

Pre-acquisition information is as follows:

Post-acquisition information is as follows:

Annual earnings are expected to increase by $4 million.

The P/E multiple of the combined company is expected to be 12 times.

If the acquisition proceeds, what is the expected percentage increase in the post acquisition share price of Company A?

Pre-acquisition information is as follows:

Post-acquisition information is as follows:

Annual earnings are expected to increase by $4 million.

The P/E multiple of the combined company is expected to be 12 times.

If the acquisition proceeds, what is the expected percentage increase in the post acquisition share price of Company A?

Question 43

Which THREE of the following statements are correct?

Question 44

Which of the following statements are true with regard to interest rate swaps?

Select ALL that apply.

Select ALL that apply.

Question 45

Company A is a listed company that produces pottery goods which it sells throughout Europe. The pottery is then delivered to a network of self employed artists who are contracted to paint the pottery in their own homes. Finished goods are distributed by network of sales agents.The directors of Company A are now considering acquiring one or more smaller companies by means of vertical integration to improve profit margins.

Advise the Board of Company A which of the following acquisitions is most likely to achieve the stated aim of vertical integration?

Advise the Board of Company A which of the following acquisitions is most likely to achieve the stated aim of vertical integration?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: