Question 26

Which THREE of the following are likely to be strategic reasons for a horizontal acquisition?

Question 27

Which THREE of the following are the most likely exit routes that apply to a venture capitalist?

Question 28

A company has just received a hostile bid. Which of the following response strategies could be considered?

Question 29

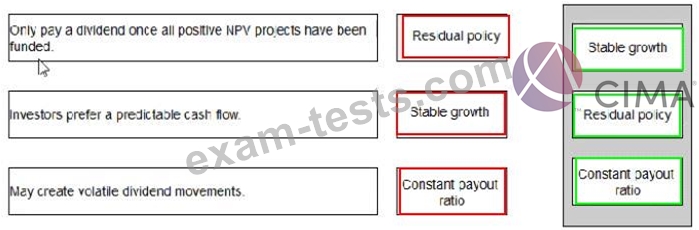

Select the most appropriate divided for each of the following statements:

Question 30

A company has a financial objective of maintaining a gearing ratio of between 30% and 40%, where gearing is defined as debt/equity at market values.

The company has been affected by a recent economic downturn leading to a shortage of liquidity and a fall in the share price during 20X1.

On 31 December 20X1 the company was funded by:

* Share capital of 4 million $1 shares trading at $4.0 per share.

* Debt of $7 million floating rate borrowings.

The directors plan to raise $2 million additional borrowings in order to improve liquidity.

They expect this to reassure investors about the company's liquidity position and result in a rise in the share price to $4.2 per share.

Is the planned increase in borrowings expected to help the company meet its gearing objective?

The company has been affected by a recent economic downturn leading to a shortage of liquidity and a fall in the share price during 20X1.

On 31 December 20X1 the company was funded by:

* Share capital of 4 million $1 shares trading at $4.0 per share.

* Debt of $7 million floating rate borrowings.

The directors plan to raise $2 million additional borrowings in order to improve liquidity.

They expect this to reassure investors about the company's liquidity position and result in a rise in the share price to $4.2 per share.

Is the planned increase in borrowings expected to help the company meet its gearing objective?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: