Question 36

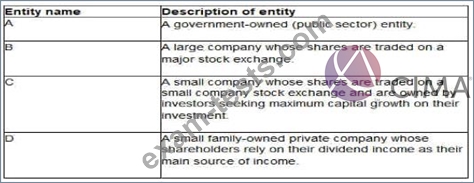

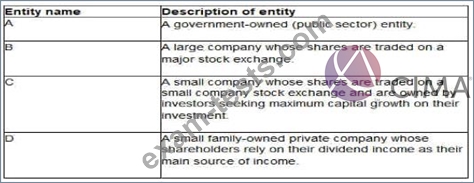

The directors of the following four entities have been discussing dividend policy:

Which of these four entities is most likely to have a residual dividend policy?

Which of these four entities is most likely to have a residual dividend policy?

Question 37

Company Y plans to diversify into an activity where Company X has an equity beta of 1.6, a debt beta of zero and gearing of 50% (debt/debt plus equity).

The risk-free rate of return is 5% and the market portfolio is expected to return 10%.

The rate of corporate income tax is 30%.

What would be the risk-adjusted cost of equity if Company Y has 60% equity and 40% debt?

The risk-free rate of return is 5% and the market portfolio is expected to return 10%.

The rate of corporate income tax is 30%.

What would be the risk-adjusted cost of equity if Company Y has 60% equity and 40% debt?

Question 38

A company is considering a divestment via either a management buyout (MBO) or sale to a private equity purchaser. Which of the following is an argument in favour of the MBO from the viewpoint of the original company?

Question 39

Company R is a well-established, unlisted, road freight company.

In recent years R has come under pressure to improve its customer service and has had some cusses in doing this However, the cost of improved service levels has resulted In it marketing small losses in its latest financial year. This is the forest time R has not been profitable.

R uses a' residual divided policy ad has paid dividends twice in the last 10 years.

Which of the following methods would be most appropriate for valuating R?

In recent years R has come under pressure to improve its customer service and has had some cusses in doing this However, the cost of improved service levels has resulted In it marketing small losses in its latest financial year. This is the forest time R has not been profitable.

R uses a' residual divided policy ad has paid dividends twice in the last 10 years.

Which of the following methods would be most appropriate for valuating R?

Question 40

A company plans to cut its dividend but is concerned that the share price will fall. This demonstrates the _____________ effect