Question 71

A company produces and sells more than one product.

All products are manufactured using the same facilities and incur common fixed costs.

Which of the following is used to calculate the break-even sales revenue for the business?

All products are manufactured using the same facilities and incur common fixed costs.

Which of the following is used to calculate the break-even sales revenue for the business?

Question 72

A company has budgeted to produce 5,000 units of Product B per month. The opening and closing inventories of Product B for next month are budgeted to be 400 units and 900 units respectively. The budgeted selling price and variable production costs per unit for Product B are as follows:

Total budgeted fixed production overheads are $29,500 per month. The company absorbs fixed production overheads on the basis of the budgeted number of units produced. The budgeted profit for Product B for next month, using absorption costing, is $20,700.

Prepare a marginal costing statement which shows the budgeted profit for Product B for next month.

What was the difference between the profit calculation using marginal costing and the profit calculation using absorption costing?

Total budgeted fixed production overheads are $29,500 per month. The company absorbs fixed production overheads on the basis of the budgeted number of units produced. The budgeted profit for Product B for next month, using absorption costing, is $20,700.

Prepare a marginal costing statement which shows the budgeted profit for Product B for next month.

What was the difference between the profit calculation using marginal costing and the profit calculation using absorption costing?

Question 73

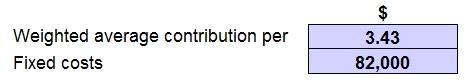

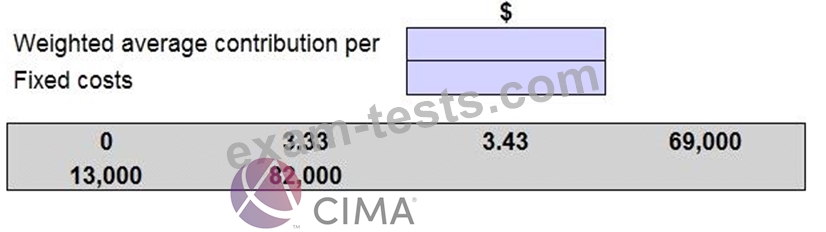

A company sells three products A, B and C in a ratio of 2:2:3.

Each unit of A,B and C earns a contribution of $4.00, $2.00 and $4.00 respectively. Production fixed costs are $69,000 each month and selling fixed costs are $13,000 each month.

The company holds no inventory. The management accountant wants to know the total number of units needed to break-even. However, he is unsure about how to calculate the weighted average contribution per unit or what category of fixed cost to use.

Place the amounts given to complete the table in order to calculate the total number of units to break even.

Each unit of A,B and C earns a contribution of $4.00, $2.00 and $4.00 respectively. Production fixed costs are $69,000 each month and selling fixed costs are $13,000 each month.

The company holds no inventory. The management accountant wants to know the total number of units needed to break-even. However, he is unsure about how to calculate the weighted average contribution per unit or what category of fixed cost to use.

Place the amounts given to complete the table in order to calculate the total number of units to break even.

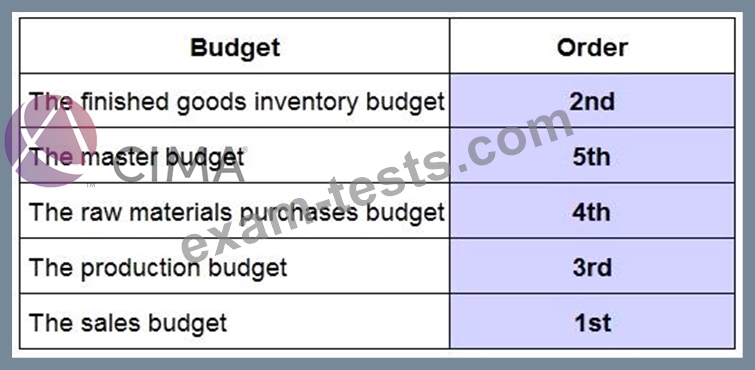

Question 74

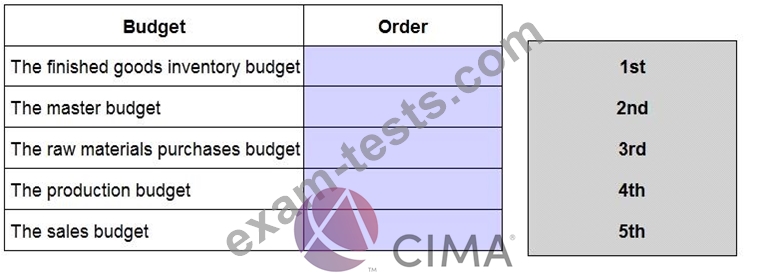

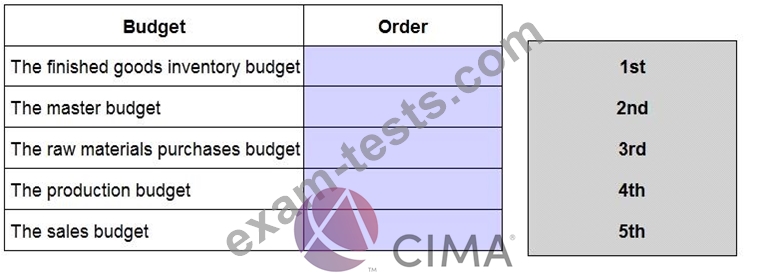

Rank the budgets listed below to show the order in which they should normally be prepared:

Question 75

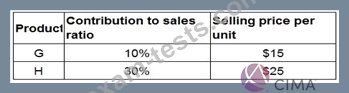

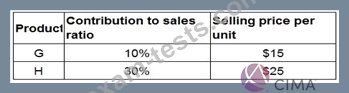

Information about a company's two products is as follows:

The products are currently sold in equal quantities.

Monthly fixed costs are $360,000.

What is the monthly breakeven sales revenue assuming a sales quantity mix of 50/50?

Give your answer to the nearest $.

The products are currently sold in equal quantities.

Monthly fixed costs are $360,000.

What is the monthly breakeven sales revenue assuming a sales quantity mix of 50/50?

Give your answer to the nearest $.