Question 56

A medium-sized manufacturing company, which operates in the electronics industry, has employed a firm of consultants to carry out a review of the company's planning and control systems. The company presently uses a traditional incremental budgeting system and the inventory management system is based on economic order quantities (EOQ) and reorder levels. The company's normal production patterns have changed significantly over the previous few years as a result of increasing demand for customized products. This has resulted in shorter production runs and difficulties with production and resource planning. The consultants have recommended the implementation of activity based budgeting and a manufacturing resource planning system to improve planning and resource management.

What are the benefits for the company that could occur following the introduction of an activity based budgeting system?

Select ALL the correct answers.

What are the benefits for the company that could occur following the introduction of an activity based budgeting system?

Select ALL the correct answers.

Question 57

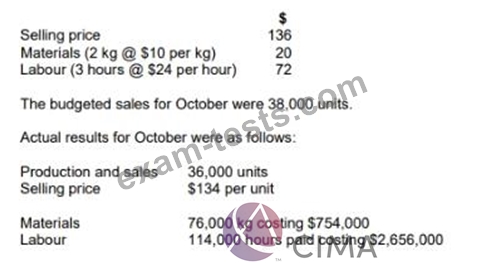

GH manufactures a product using skilled labour and high quality materials. The company operates a standard costing system and a just-in-time (JIT) purchasing and production system. The standard selling price and variable costs for one unit of the product are as follows:

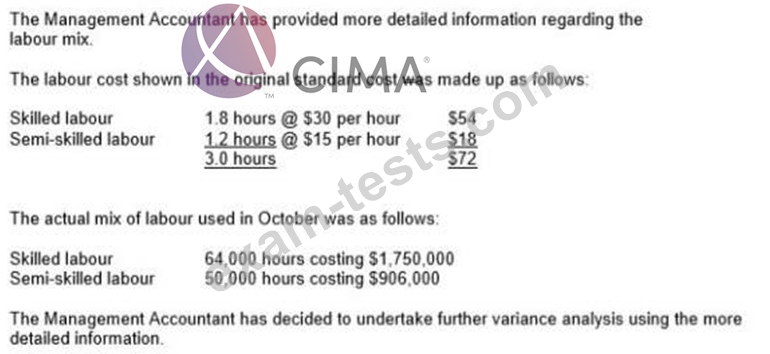

Calculate the following variances for October, taking account of the more detailed information regarding the labour mix:

(i) The total labour efficiency variance

(ii) The total labour mix variance

(iii) The total labour yield variance

Select the correct statements.

Calculate the following variances for October, taking account of the more detailed information regarding the labour mix:

(i) The total labour efficiency variance

(ii) The total labour mix variance

(iii) The total labour yield variance

Select the correct statements.

Question 58

Select the benefits to a company of using sensitivity analysis in investment appraisal.

(Select all the true statements.)

Question 59

A company is bidding to win a special contract.

Which of the following is NOT a relevant cost to the company of undertaking the contract?

Which of the following is NOT a relevant cost to the company of undertaking the contract?

Question 60

A small manufacturing company makes a single product. Direct labour costs and factory rent account for

80% and 15% of total cost respectively. Activity levels have not varied by more than 5% for a number of years and there is no evidence of operational inefficiency.

Which of the following is the most appropriate approach to budgeting for this company?

80% and 15% of total cost respectively. Activity levels have not varied by more than 5% for a number of years and there is no evidence of operational inefficiency.

Which of the following is the most appropriate approach to budgeting for this company?