Question 91

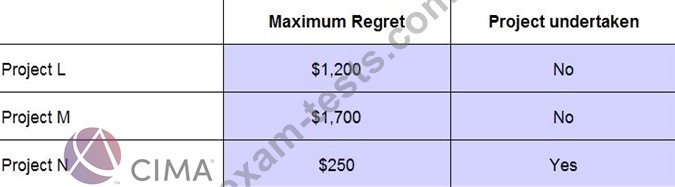

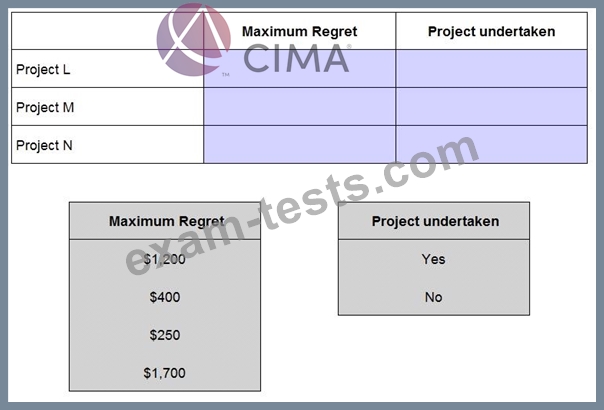

A company is choosing between three projects, Project L, Project M and Project N using minimax regret.

The outcome from each project is dependent on competitor reaction. If this is passive returns will be L

$4,000, M $3,500 and N $5,200. If it is aggressive returns will be L $3,200, M $2,800 and N $2,950.

Place the tokens into the table to show the maximum regret for each project and whether the project would be undertaken using minimax regret.

The outcome from each project is dependent on competitor reaction. If this is passive returns will be L

$4,000, M $3,500 and N $5,200. If it is aggressive returns will be L $3,200, M $2,800 and N $2,950.

Place the tokens into the table to show the maximum regret for each project and whether the project would be undertaken using minimax regret.

Question 92

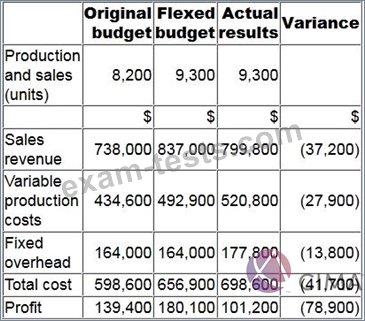

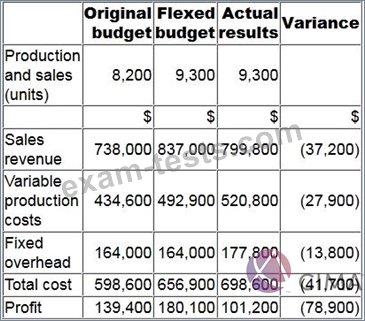

The budgetary control report of XYZ for the latest period is shown below. Variances in brackets are adverse.

What is the sales volume profit variance?

What is the sales volume profit variance?

Question 93

Which THREE of the following are functional budgets?