Question 16

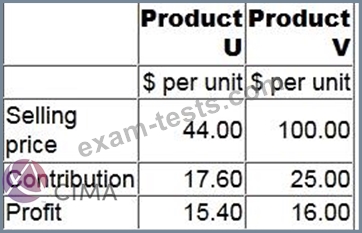

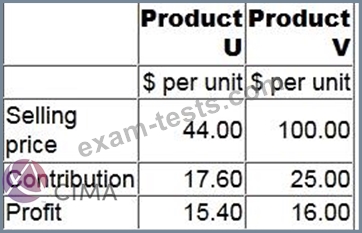

Information about a company's only two products is as follows:

The revenue from the products must be in the constant mix of 2U:3V. Budgeted monthly sales revenue is $110,000.

Fixed costs are $23,095 each month.

To the nearest $10, what is the budgeted monthly margin of safety in terms of sales revenue?

The revenue from the products must be in the constant mix of 2U:3V. Budgeted monthly sales revenue is $110,000.

Fixed costs are $23,095 each month.

To the nearest $10, what is the budgeted monthly margin of safety in terms of sales revenue?

Question 17

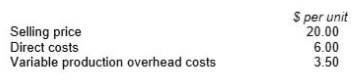

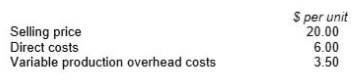

A company has budgeted to produce 5,000 units of Product B per month. The opening and closing inventories of Product B for next month are budgeted to be 400 units and 900 units respectively. The budgeted selling price and variable production costs per unit for Product B are as follows:

Total budgeted fixed production overheads are $29,500 per month.

The company absorbs fixed production overheads on the basis of the budgeted number of units produced. The budgeted profit for Product B for next month, using absorption costing, is $20,700.

Prepare a marginal costing statement which shows the budgeted profit for Product B for next month.

What was the marginal costing profit for the next month?

Total budgeted fixed production overheads are $29,500 per month.

The company absorbs fixed production overheads on the basis of the budgeted number of units produced. The budgeted profit for Product B for next month, using absorption costing, is $20,700.

Prepare a marginal costing statement which shows the budgeted profit for Product B for next month.

What was the marginal costing profit for the next month?

Question 18

A company develops computer software programs to meet each client's specific requirements. The management accountant is considering introducing a standard costing system.

Which THREE of the following are reasons that support the case for the company's introduction of a standard costing system?

Which THREE of the following are reasons that support the case for the company's introduction of a standard costing system?

Question 19

PQR has recently introduced an activity-based costing system.

It manufactures three products, details of which are given below.

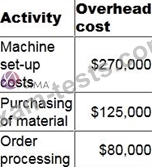

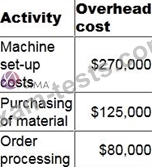

The budgeted production overhead costs for the year are shown in table below:

What is budgeted machine set-up cost per unit of Product J?

Give your answer to the nearest cent.

It manufactures three products, details of which are given below.

The budgeted production overhead costs for the year are shown in table below:

What is budgeted machine set-up cost per unit of Product J?

Give your answer to the nearest cent.

Question 20

Which THREE of the following are advantages of activity-based costing (ABC), in a multi-product environment, when compared with traditional absorption costing?