Question 36

MDS is facing a temporary shortage of Material H which is used to produce all three of its products.

In order to maximise its profitability, which product should be manufactured first?

In order to maximise its profitability, which product should be manufactured first?

Question 37

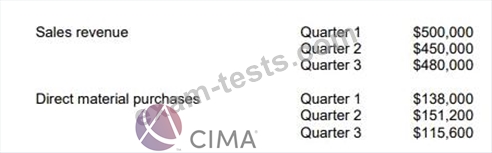

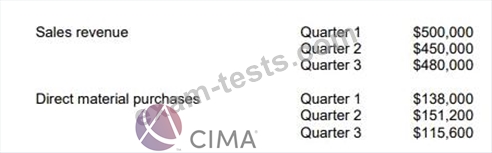

JL is preparing its cash budget for the next three quarters. The following data have been extracted from the operational budgets:

Additional information is available as follows:

* JL sells 20% of its goods for cash. Of the remaining sales value, 70% is received within the same quarter as sale and 30% is received in the following quarter. It is estimated that trade receivables will be

$125,000 at the beginning of Quarter 1. No bad debts are anticipated.

* 50% of payments for direct material purchases are made in the quarter of purchase, with the remaining 50% in the quarter following purchase. It is estimated that the amount owing for direct material purchases will be $60,000 at the beginning of Quarter 1.

* JL pays labour and overhead costs when they are incurred. It has been estimated that labour and overhead costs in total will be $303,600 per quarter. This figure includes depreciation of $19,600.

* JL expects to repay a loan of $100,000 in Quarter 3.

* The cash balance at the beginning of Quarter 1 is estimated to be $49,400 positive.

Required:

Prepare a cash budget for each of the THREE quarters.

What will the closing balance of cash flows in quarter THREE be?

Additional information is available as follows:

* JL sells 20% of its goods for cash. Of the remaining sales value, 70% is received within the same quarter as sale and 30% is received in the following quarter. It is estimated that trade receivables will be

$125,000 at the beginning of Quarter 1. No bad debts are anticipated.

* 50% of payments for direct material purchases are made in the quarter of purchase, with the remaining 50% in the quarter following purchase. It is estimated that the amount owing for direct material purchases will be $60,000 at the beginning of Quarter 1.

* JL pays labour and overhead costs when they are incurred. It has been estimated that labour and overhead costs in total will be $303,600 per quarter. This figure includes depreciation of $19,600.

* JL expects to repay a loan of $100,000 in Quarter 3.

* The cash balance at the beginning of Quarter 1 is estimated to be $49,400 positive.

Required:

Prepare a cash budget for each of the THREE quarters.

What will the closing balance of cash flows in quarter THREE be?

Question 38

A company manufactures two products and has two production constraints.

When the graphical approach to linear programming is used, the axes of the graph will show:

When the graphical approach to linear programming is used, the axes of the graph will show:

Question 39

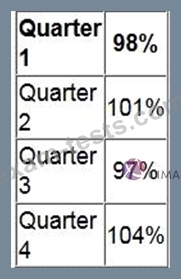

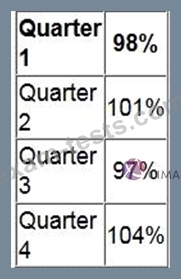

An analysis of past sales data shows that the underlying trend in a company's sales volume can be represented by:

Y = 50X + 625

Where Y is the trend sales units for a quarter and X is the quarterly period number.

The seasonal variation index values have been identified as follows:

The forecast sales volume in units for quarter 4 next year, which is period 14, is:

Y = 50X + 625

Where Y is the trend sales units for a quarter and X is the quarterly period number.

The seasonal variation index values have been identified as follows:

The forecast sales volume in units for quarter 4 next year, which is period 14, is:

Question 40

XY can choose from four mutually exclusive projects. The projects will each last for one year and their net cash inflows will be determined by market conditions. The forecast net cash inflows for each of the possible outcomes are shown below.

If the company applies the maximax criterion the project chosen would be:

If the company applies the maximax criterion the project chosen would be: