Question 41

LM operates a parcel delivery service. Last year its employees delivered 15,120 parcels and travelled

120,960 kilometers. Total costs were $194,400.

LM has estimated that 70% of its total costs are variable with activity and that 60% of these costs vary with the number of parcels and the remainder vary with the distance travelled.

LM is preparing its budget for the forthcoming year using an incremental budgeting approach and has produced the following estimates:

* All costs will be 3% higher than the previous year due to inflation

* Efficiency will remain unchanged

* A total of 18,360 parcels will be delivered and 128,800 kilometers will be travelled.

Calculate the following costs to be included in the forthcoming year's budget:

(i) the total variable costs related to the number of parcels delivered.

(ii) the total variable costs related to the distance travelled.

120,960 kilometers. Total costs were $194,400.

LM has estimated that 70% of its total costs are variable with activity and that 60% of these costs vary with the number of parcels and the remainder vary with the distance travelled.

LM is preparing its budget for the forthcoming year using an incremental budgeting approach and has produced the following estimates:

* All costs will be 3% higher than the previous year due to inflation

* Efficiency will remain unchanged

* A total of 18,360 parcels will be delivered and 128,800 kilometers will be travelled.

Calculate the following costs to be included in the forthcoming year's budget:

(i) the total variable costs related to the number of parcels delivered.

(ii) the total variable costs related to the distance travelled.

Question 42

Which of the following statements about expected value is NOT correct?

Question 43

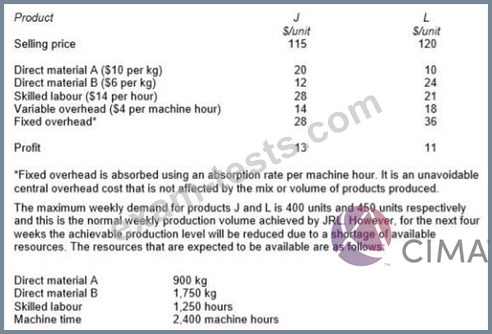

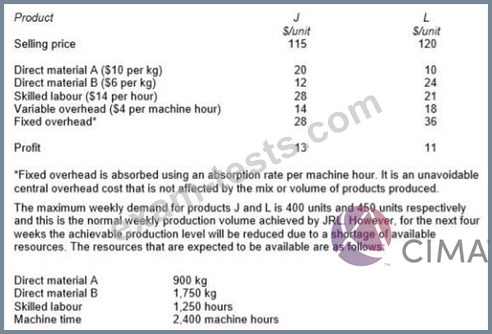

JRL manufactures two products from different combinations of the same resources. Unit selling prices and unit cost details for each product are as follows:

The optimal solution in the previous question shows that the shadow prices of skilled labour and direct material A are as follows:

Skilled labour $ Nil

Direct material A $11.70

Explain the relevance of these values to the management of JRL.

What is the additional contribution that can be earned?

The optimal solution in the previous question shows that the shadow prices of skilled labour and direct material A are as follows:

Skilled labour $ Nil

Direct material A $11.70

Explain the relevance of these values to the management of JRL.

What is the additional contribution that can be earned?

Question 44

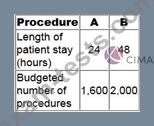

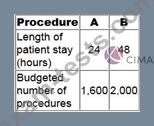

A clinic offers two types of procedure, A and B.

The clinic uses activity-based costing. The general facility overhead cost for next year is budgeted to be

$8,601,600. The cost driver is the length of patient stay.

Additional data:

What is the general facility overhead cost for each Procedure B?

The clinic uses activity-based costing. The general facility overhead cost for next year is budgeted to be

$8,601,600. The cost driver is the length of patient stay.

Additional data:

What is the general facility overhead cost for each Procedure B?

Question 45

The budgeted production of product G for the period was 300 units. At the end of the period it was discovered that the standard hourly rate for labour should have been higher than that originally planned. Actual production was 450 units.

The labour rate planning variance would be calculated as:

The labour rate planning variance would be calculated as: