Question 36

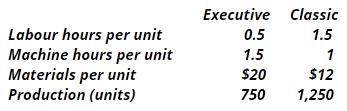

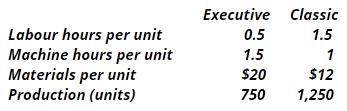

D3 makes 2 types of toilets - the Executive (Ex) and the Classic (CI). Direct labour costs $6 per hr and overheads are absorbed on a machine hour basis. The overhead absorption rate for the period is $28 per machine hour. What is the traditional cost per unit for (Ex) and (CI)?

Question 37

Which of the following are examples of feedforward control?

Select ALL that apply.

Select ALL that apply.

Question 38

You are a trainee management accountant working for a prestigious manufacturing firm. One day you go to a business meeting a business meeting and the managing director is there. They stand up and say that the company is losing too much money through wastage and losses and so they have decided to implement a total quality management system. They go on to say this system will:

1:Allow the company to improve on a consistent and continual basis

2:Allow the company to identify and allocate quality accountability to certain departments

3:Help the company detect error and fraud

Are ALL of these statements correct?

1:Allow the company to improve on a consistent and continual basis

2:Allow the company to identify and allocate quality accountability to certain departments

3:Help the company detect error and fraud

Are ALL of these statements correct?

Question 39

What type of budget is prepared on an annual basis taking current year operating results and adjusting them for expected growth and inflation?

Question 40

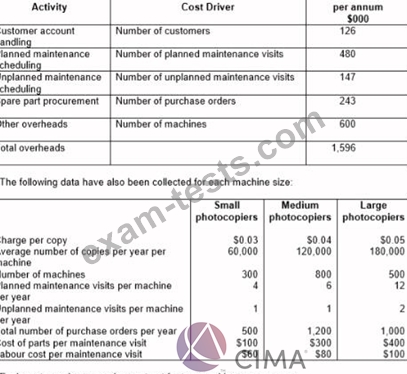

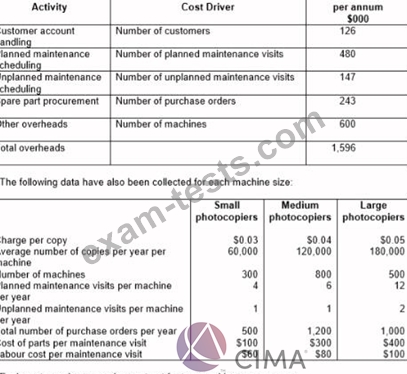

A company sells and services photocopying machines. Its sales department sells the machines and consumables, including ink and paper, and its service department provides an after sales service to its customers. The after sales service includes planned maintenance of the machine and repairs in the event of a machine breakdown. Service department customers are charged an amount per copy that differs depending on the size of the machine.

The company's existing costing system uses a single overhead rate, based on total sales revenue from copy charges, to charge the cost of the Service Department's support activities to each size of machine.

The Service Manager has suggested that the copy charge should more accurately reflect the costs involved. The company's accountant has decided to implement an activity-based costing system and has obtained the following information about the support activities of the service department:

Calculate the annual profit per machine for each of the three sizes of machine using activity-based costing.

The company's existing costing system uses a single overhead rate, based on total sales revenue from copy charges, to charge the cost of the Service Department's support activities to each size of machine.

The Service Manager has suggested that the copy charge should more accurately reflect the costs involved. The company's accountant has decided to implement an activity-based costing system and has obtained the following information about the support activities of the service department:

Calculate the annual profit per machine for each of the three sizes of machine using activity-based costing.