Question 1

A company operates a divisional structure. The manager of division D receives a bonus based on the division's annual return on capital employed (ROCE).

A minimum ROCE of 20% must be achieved to receive any bonus and thereafter the bonus increases in line with increases in ROCE.

This year division D achieved a ROCE of 24% and the divisional manager received a large bonus.

The manager is considering an investment in a new machine for next year. The incremental ROCE earned by the machine is expected to be 19% although the ROCE for the division as a whole with the machine is expected to be 22%. Without the machine, ROCE is likely to be stable at 24%.

The cost of capital for the company as a whole is 18% per year.

Which of the following statements is correct?

A minimum ROCE of 20% must be achieved to receive any bonus and thereafter the bonus increases in line with increases in ROCE.

This year division D achieved a ROCE of 24% and the divisional manager received a large bonus.

The manager is considering an investment in a new machine for next year. The incremental ROCE earned by the machine is expected to be 19% although the ROCE for the division as a whole with the machine is expected to be 22%. Without the machine, ROCE is likely to be stable at 24%.

The cost of capital for the company as a whole is 18% per year.

Which of the following statements is correct?

Question 2

Which of the following would change if the cost of capital of a proposed project was increased?

Question 3

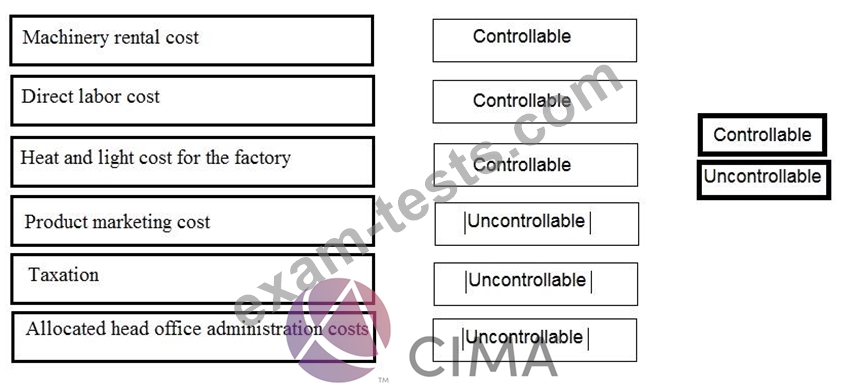

A company classifies its main factory as an investment centre. Categorise each of the following costs as either controllable or uncontrollable by the investment centre manager.

Question 4

Kaizen costing is being used by an organization to gradually reduce the unit cost of one of its products in order to achieve a 20% mark up on the product's cost.

The selling price of the product must be $72 per unit and this selling price has been maintained for two years.

Two years ago the product's cost was $3 per unit more than its selling price. Kaizen costing has achieved an 8% reduction from the previous period's unit cost in each of the past two years. The organization expects to continue to achieve the same rate of cost reduction next year.

Which of the following statements provides an accurate analysis of the extent to which Kaizen costing has been successful in achieving the required unit cost for the product?

The selling price of the product must be $72 per unit and this selling price has been maintained for two years.

Two years ago the product's cost was $3 per unit more than its selling price. Kaizen costing has achieved an 8% reduction from the previous period's unit cost in each of the past two years. The organization expects to continue to achieve the same rate of cost reduction next year.

Which of the following statements provides an accurate analysis of the extent to which Kaizen costing has been successful in achieving the required unit cost for the product?

Question 5

An organization has carried out a risk assessment for a project.

Which of the following possible outcomes are examples of upside risk?

Select ALL that apply.

Which of the following possible outcomes are examples of upside risk?

Select ALL that apply.