Question 21

An organization is considering purchasing a new machine which will cost $600,000. The new machine will generate cost savings of $200,000 each year for five years. The cost of capital is 12%.

The profitability index (PI) for the investment in the new machine is:

Give your answer to one decimal place.

The profitability index (PI) for the investment in the new machine is:

Give your answer to one decimal place.

Question 22

Which of the following statements is true?

Question 23

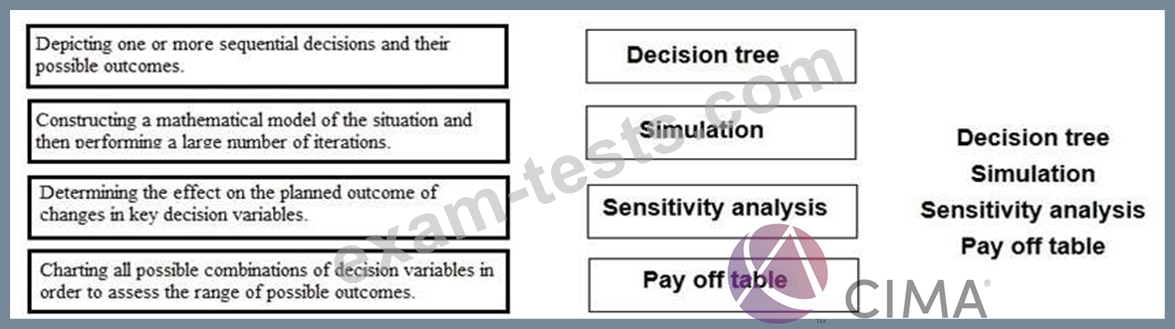

Place each method of analysing risk and uncertainty against the statement that describes it correctly.

Question 24

A company is considering investing $150,000 in a project which will generate the following contributions during the first three years.

Tax depreciation allowance is 25% each year of the reducing balance.

The taxation rate is 30% of taxable profits and tax is payable in the year after that in which it arises.

To the nearest $10, what is the forecast total project cash flow in year 3?

Tax depreciation allowance is 25% each year of the reducing balance.

The taxation rate is 30% of taxable profits and tax is payable in the year after that in which it arises.

To the nearest $10, what is the forecast total project cash flow in year 3?

Question 25

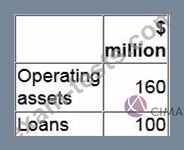

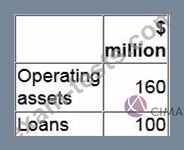

The following summarised financial statements have been prepared by JNM's North subsidiary for the year just ended:

Calculate the North subsidiary's Residual Income, assuming that JNM's cost of capital is 10%.

Give your answer to the nearest $ million.

Calculate the North subsidiary's Residual Income, assuming that JNM's cost of capital is 10%.

Give your answer to the nearest $ million.