Question 61

AAA has the following working capital ratios at 30 March 20X4:

During the year ended 30 March 20X4 credit purchases were $3,600 and at 30 March 20X4 the outstanding trade payables amounted to $522.

The year ended 30 March 20X4 was not a leap year.

Calculate the working capital cycle for AAA.

Give your answer to one decimal place.

During the year ended 30 March 20X4 credit purchases were $3,600 and at 30 March 20X4 the outstanding trade payables amounted to $522.

The year ended 30 March 20X4 was not a leap year.

Calculate the working capital cycle for AAA.

Give your answer to one decimal place.

Question 62

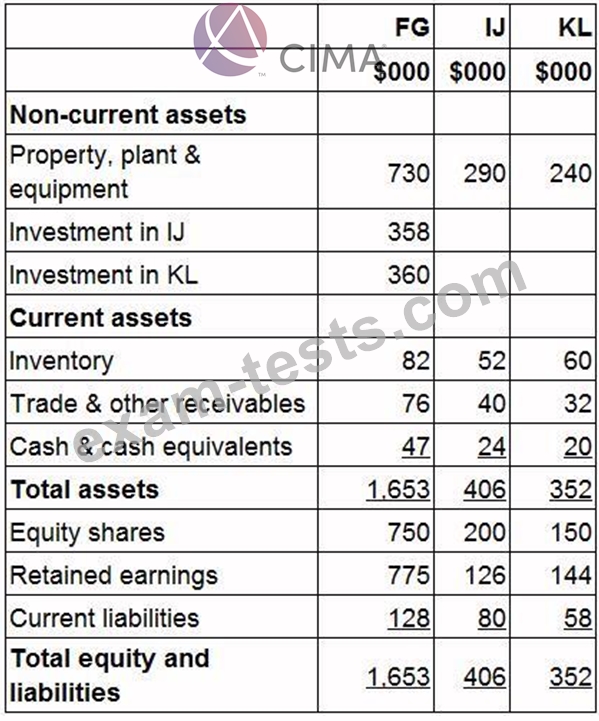

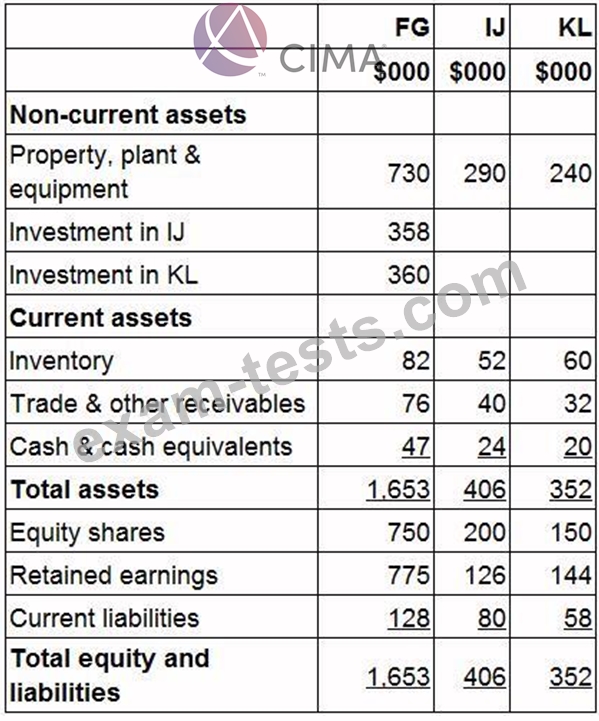

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were

$98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the total goodwill to be included in FG's consolidated statement of financial position as at 31 December 20X5.

Give your answer to the nearest whole $.

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were

$98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the total goodwill to be included in FG's consolidated statement of financial position as at 31 December 20X5.

Give your answer to the nearest whole $.

Question 63

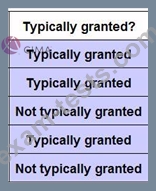

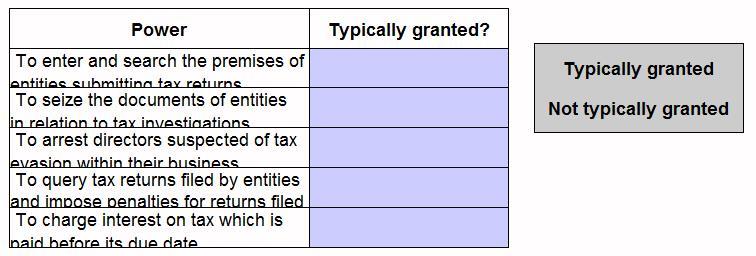

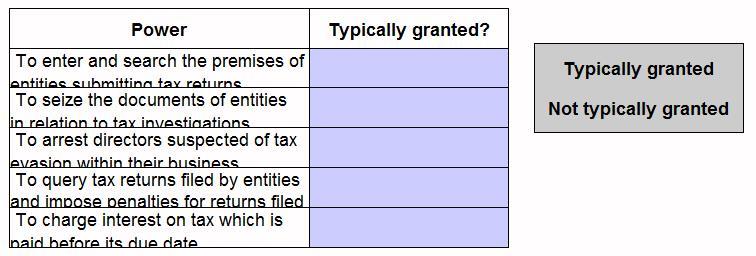

Identify which of the following are powers that a government would typically grant it's tax authority by placing the appropriate response beside each power.

Question 64

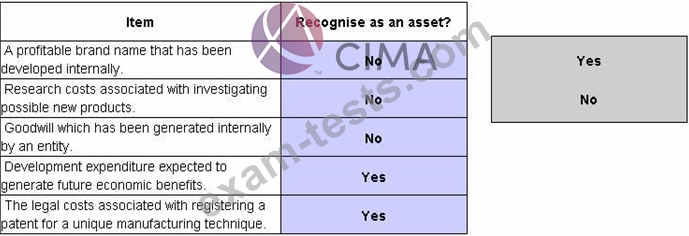

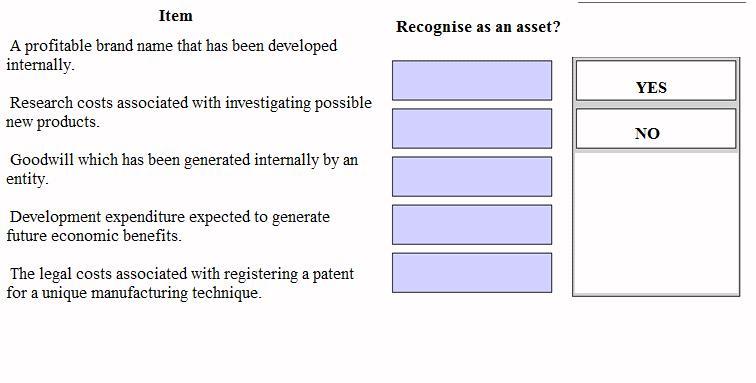

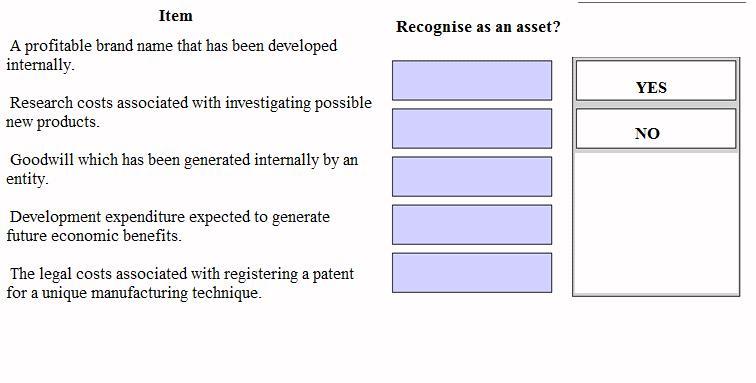

Identify from the list below which items can be recognised as assets within the financial statements of an entity in accordance with IAS 38 Intangible Assets. Place either yes or no as appropriate against each item.

Question 65

Which THREE of the following are included in the International Accounting Standards Board's "The Conceptual Framework for Financial Reporting"?