Question 56

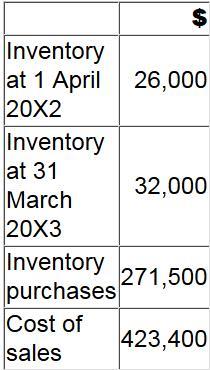

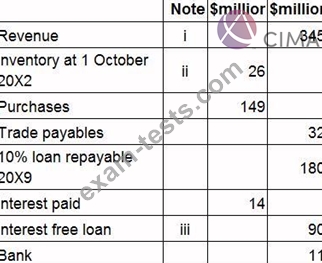

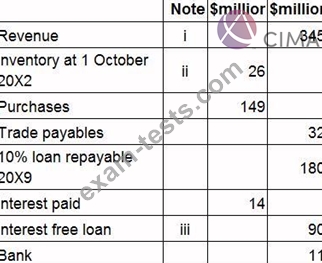

The following data has been extracted from GH's accounting records:

What is GH's average inventory days for the year ended 31 March 20X3?

What is GH's average inventory days for the year ended 31 March 20X3?

Question 57

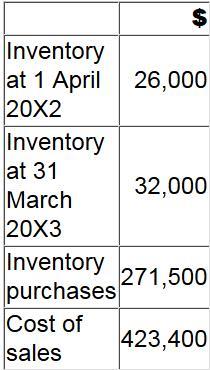

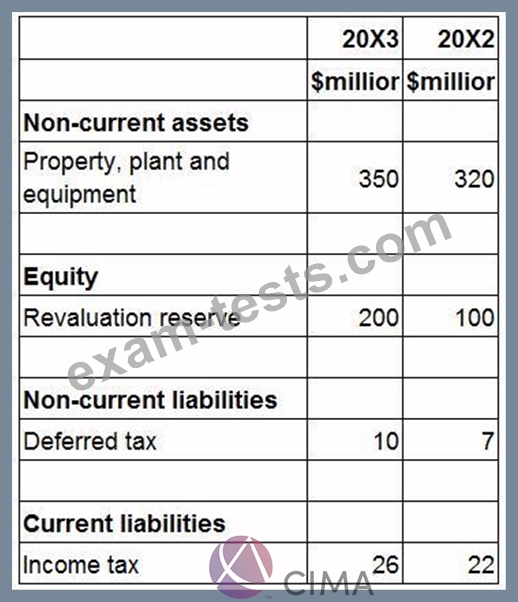

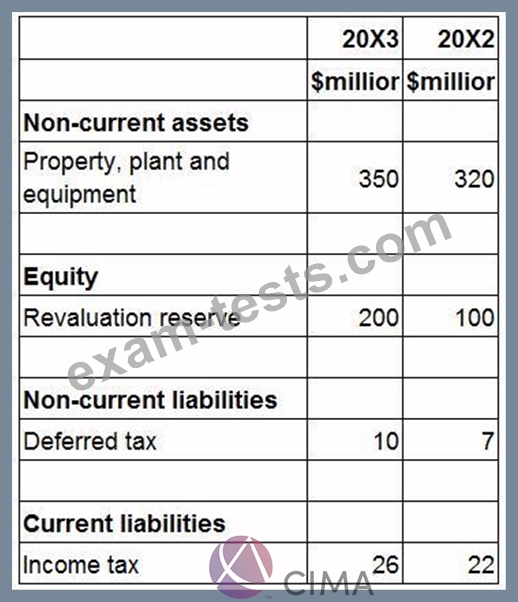

The following information is extracted from the statement of financial position for ZZ at 31 March 20X3:

Included within cost of sales in the statement of profit or loss for the year ended 31 March 20X3 is $20 million relating to the loss on the sale of plant and equipment which had cost $100 million in June 20X1.

Depreciation is charged on all plant and equipment at 25% on a straight line basis with a full year's depreciation charged in the year of acquisition and none in the year of sale.

The revaluation reserve relates to the revaluation of ZZ's property.

The total depreciation charge for property, plant and equipment in ZZ's statement of profit of loss for the year ended 31 March 20X3 is $80 million.

The corporate income tax expense in ZZ's statement of profit or loss for year ended 31 March 20X3 is

$28 million.

ZZ is preparing its statement of cash flows for the year ended 31 March 20X3.

What cash outflow figure should be included within cash flows from investing activities for the purchase of property, plant and equipment?

Included within cost of sales in the statement of profit or loss for the year ended 31 March 20X3 is $20 million relating to the loss on the sale of plant and equipment which had cost $100 million in June 20X1.

Depreciation is charged on all plant and equipment at 25% on a straight line basis with a full year's depreciation charged in the year of acquisition and none in the year of sale.

The revaluation reserve relates to the revaluation of ZZ's property.

The total depreciation charge for property, plant and equipment in ZZ's statement of profit of loss for the year ended 31 March 20X3 is $80 million.

The corporate income tax expense in ZZ's statement of profit or loss for year ended 31 March 20X3 is

$28 million.

ZZ is preparing its statement of cash flows for the year ended 31 March 20X3.

What cash outflow figure should be included within cash flows from investing activities for the purchase of property, plant and equipment?

Question 58

XYZ operates in Country A where tax rules state that entertaining costs and donations to political parties are disallowable for tax purposes.

XYZ calculated both its accounting and taxable profits for the year ended 31 December 20X2 after deducting $10,000 of entertaining costs.

It is considering what impact the ruling that "entertaining costs are disallowable for tax purposes" will have on its two profit figures.

Which of the following correctly states the impact of the ruling on the profits already calculated?

XYZ calculated both its accounting and taxable profits for the year ended 31 December 20X2 after deducting $10,000 of entertaining costs.

It is considering what impact the ruling that "entertaining costs are disallowable for tax purposes" will have on its two profit figures.

Which of the following correctly states the impact of the ruling on the profits already calculated?

Question 59

The following information is extracted from the trial balance of YY at 30 September 20X3.

i. Included in revenue is a refundable deposit of $20 million for a sales transaction that is due to take place on 14 October 20X3.

ii. The cost of closing inventory is $28 million, however, the net realisable value is estimated at $25 million.

iii. The interest free loan was obtained on 1 January 20X3. The loan is repayable in 12 quarterly installments starting on 31 March 20X3. All installments to date have been paid on time.

Calculate the cost of sales that would be shown in YY's statement of profit or loss for the year ended 30 September 20X3.

Give your answer to the nearest $ million.

i. Included in revenue is a refundable deposit of $20 million for a sales transaction that is due to take place on 14 October 20X3.

ii. The cost of closing inventory is $28 million, however, the net realisable value is estimated at $25 million.

iii. The interest free loan was obtained on 1 January 20X3. The loan is repayable in 12 quarterly installments starting on 31 March 20X3. All installments to date have been paid on time.

Calculate the cost of sales that would be shown in YY's statement of profit or loss for the year ended 30 September 20X3.

Give your answer to the nearest $ million.

Question 60

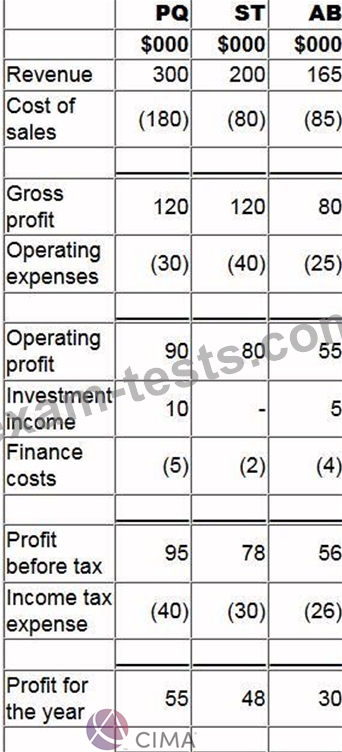

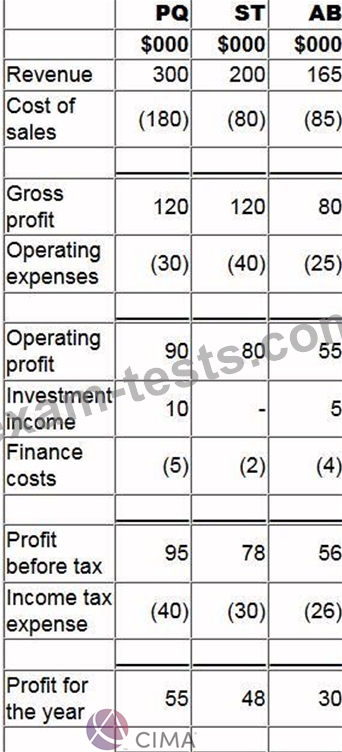

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September

20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

What is the revenue figure to be included in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0?

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September

20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

What is the revenue figure to be included in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0?