Question 51

A consultancy company is dependent for profits and growth on the high value individuals it employs.

The company has relatively few tangible assets.

Select the most appropriate reason for the net asset valuation method being considered unsuitable for such a company.

The company has relatively few tangible assets.

Select the most appropriate reason for the net asset valuation method being considered unsuitable for such a company.

Question 52

If a company's bonds are currently yielding 8% in the marketplace, why would the entity's cost of debt be lower than this?

Question 53

The ex div share price of Company A's shares is $.3.50

An investor in Company A currently holds 2,000 shares.

Company A plans to issue a script divided of 1 new shares for every 10 shares currently held.

After the scrip divided, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

An investor in Company A currently holds 2,000 shares.

Company A plans to issue a script divided of 1 new shares for every 10 shares currently held.

After the scrip divided, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

Question 54

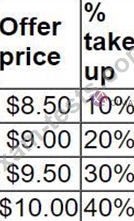

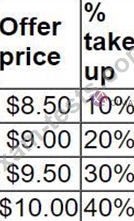

A listed company is planning a share repurchase.

Research into different offer prices has given the following data with regards acceptance by the shareholders at different prices:

What price should be offered to shareholders if the retained earnings of the company are to remain unchanged?

Research into different offer prices has given the following data with regards acceptance by the shareholders at different prices:

What price should be offered to shareholders if the retained earnings of the company are to remain unchanged?

Question 55

A company is currently all-equity financed.

The directors are planning to raise long term debt to finance a new project.

The debt:equity ratio after the bond issue would be 40:60 based on estimated market values.

According to Modigliani and Miller's Theory of Capital Structure without tax, the company's cost of equity would:

The directors are planning to raise long term debt to finance a new project.

The debt:equity ratio after the bond issue would be 40:60 based on estimated market values.

According to Modigliani and Miller's Theory of Capital Structure without tax, the company's cost of equity would:

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: