Question 71

A listed company is considering either a one-off special divided or a share repurchase scheme to reduce its surplus cash level.

Identify TWO advantages that a one-off special payment has over a share repurchase scheme.

Identify TWO advantages that a one-off special payment has over a share repurchase scheme.

Question 72

M is an accountant who wishes to take out a forward rate agreement as a hedging instrument but the company treasurer has advised that a short-term interest rate future would be a better option.

Which of the following is true of a short-term interest rate

Which of the following is true of a short-term interest rate

Question 73

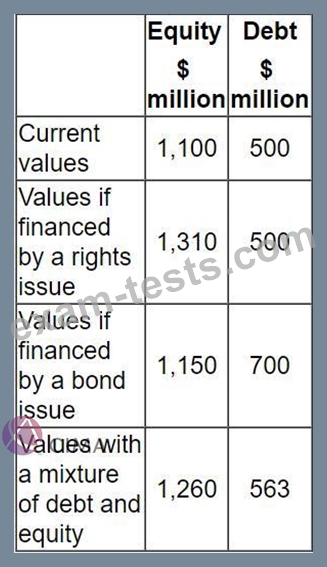

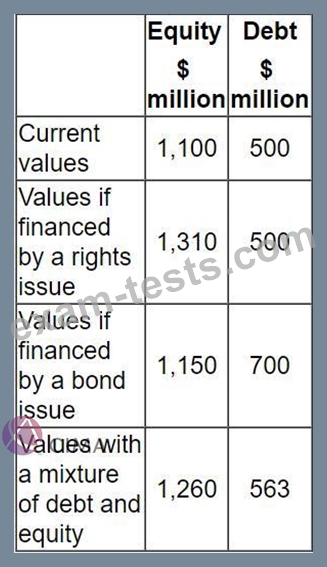

A company is financed by debt and equity and pays corporate income tax at 20%.

Its main objective is the maximisation of shareholder wealth.

It needs to raise $200 million to undertake a project with a positive NPV of $10 million.

The company is considering three options:

* A rights issue.

* A bond issue.

* A combination of both at the current debt to equity ratio.

Estimations of the market values of debt and equity both before and after the adoption of the project have been calculated, based upon Modigliani and Miller's capital theory with tax, and are shown below:

Under Modigliani and Miller's capital theory with tax, what is the increase in shareholder wealth?

Its main objective is the maximisation of shareholder wealth.

It needs to raise $200 million to undertake a project with a positive NPV of $10 million.

The company is considering three options:

* A rights issue.

* A bond issue.

* A combination of both at the current debt to equity ratio.

Estimations of the market values of debt and equity both before and after the adoption of the project have been calculated, based upon Modigliani and Miller's capital theory with tax, and are shown below:

Under Modigliani and Miller's capital theory with tax, what is the increase in shareholder wealth?

Question 74

A company's dividend policy is to pay out 50% of its earnings.

Its most recent earnings per share was $0.50, and it has just paid a dividend per share of $0.25.

Currently, dividends are forecast to grow at 2% each year in perpetuity and the cost of equity is 10.5%.

In order to grow its earnings and dividends, the company is considering undertaking a new investment funded entirely by debt finance. If the investment is undertaken:

* Its cost of equity will immediately increase to 12% due to the increased finance risk.

* Its earnings and dividends will immediately commence growing at 4% each year in perpetuity.

Which of the following is the expected percentage change in the share price if the new investment is undertaken?

Its most recent earnings per share was $0.50, and it has just paid a dividend per share of $0.25.

Currently, dividends are forecast to grow at 2% each year in perpetuity and the cost of equity is 10.5%.

In order to grow its earnings and dividends, the company is considering undertaking a new investment funded entirely by debt finance. If the investment is undertaken:

* Its cost of equity will immediately increase to 12% due to the increased finance risk.

* Its earnings and dividends will immediately commence growing at 4% each year in perpetuity.

Which of the following is the expected percentage change in the share price if the new investment is undertaken?

Question 75

A listed company with a growing share price plans to finance a four-year research project with debt.

The main criterion for the finance is to minimise the annual cashflow payments on the debt.

The research will be sold at the end of the project.

Which of the following would be the most suitable financing method for the company?

The main criterion for the finance is to minimise the annual cashflow payments on the debt.

The research will be sold at the end of the project.

Which of the following would be the most suitable financing method for the company?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: