Question 56

A company's main objective is to achieve an average growth in dividends of 10% a year.

In the most recent financial year:

Sales are expected to grow at 8% a year over the next 5 years.

Costs are expected to grow at 5% a year over the next 5 years.

What is the minimum dividend payout ratio in 5 years' time that would allow the company to achieve its objective?

In the most recent financial year:

Sales are expected to grow at 8% a year over the next 5 years.

Costs are expected to grow at 5% a year over the next 5 years.

What is the minimum dividend payout ratio in 5 years' time that would allow the company to achieve its objective?

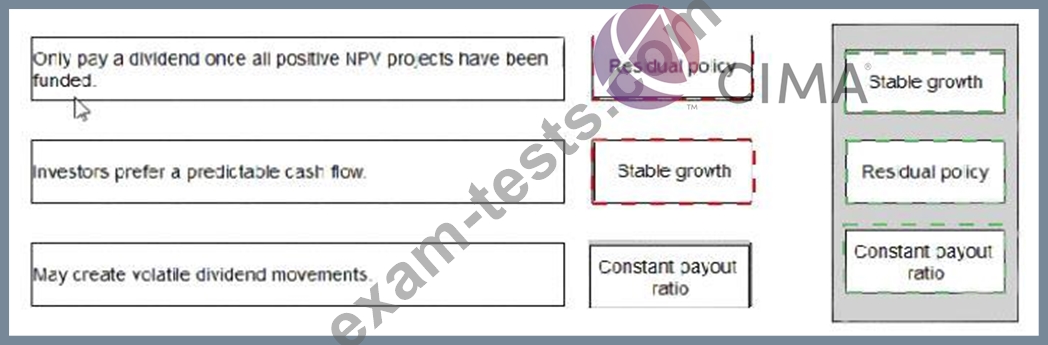

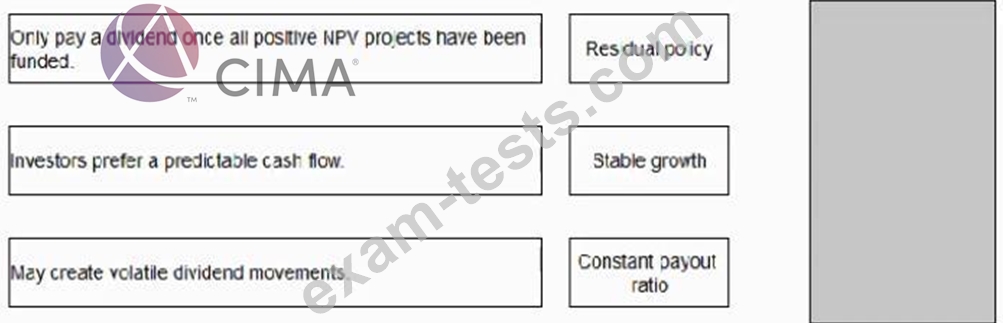

Question 57

Select the most appropriate divided for each of the following statements:

Question 58

Company W has received an unwelcome takeover bid from Company B.

The offer is a share exchange of 3 shares in Company B for 5 shares in Company W or a cash alternative of $5.70 for each Company W share.

Company B is approximately twice the size of Company W based on market capitalisation. Although the two companies have some common business interested the main aim of the bid is diversification for Company B.

Company W has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

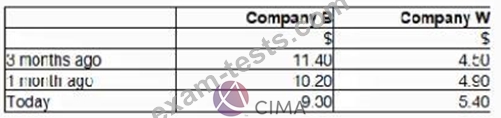

The following share price information is relevant.

Which of the following would be the most appropriate action by Company W's directors following receipt of this hostile bid?

The offer is a share exchange of 3 shares in Company B for 5 shares in Company W or a cash alternative of $5.70 for each Company W share.

Company B is approximately twice the size of Company W based on market capitalisation. Although the two companies have some common business interested the main aim of the bid is diversification for Company B.

Company W has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant.

Which of the following would be the most appropriate action by Company W's directors following receipt of this hostile bid?

Question 59

The directors of a financial services company need to calculate a valuation of their company's equity in preparation for an upcoming initial Public Offering (IPO) of shares. At a recent board meeting they discussed the various methods of business valuation.

The Chief Executive suggested using a Price-earing (P./E) method of valuation, but the finance Director argued that a valuation based on forecast cash flows to equity would be more appropriate.

Which THREE of the following are advantages of valuation based on forecast cash flows to equity, compared to a valuating using a price earnings methods?

The Chief Executive suggested using a Price-earing (P./E) method of valuation, but the finance Director argued that a valuation based on forecast cash flows to equity would be more appropriate.

Which THREE of the following are advantages of valuation based on forecast cash flows to equity, compared to a valuating using a price earnings methods?

Question 60

A company intends to sell one of its business units. Company W, by a management buyout (MBO). A selling price of S200 million has been agreed.

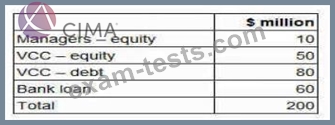

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal.

The VCC requires a minimum return on its equity investment In the MBO of 35% a year on a compound basis over 5 years What is the minimum total equity value of Company W in 5 years time in order to meet the VCC's required return? Give your answer to one decimal place.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal.

The VCC requires a minimum return on its equity investment In the MBO of 35% a year on a compound basis over 5 years What is the minimum total equity value of Company W in 5 years time in order to meet the VCC's required return? Give your answer to one decimal place.

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: