Question 36

Company A plans to acquire Company B in a 1-for-1 share exchange.

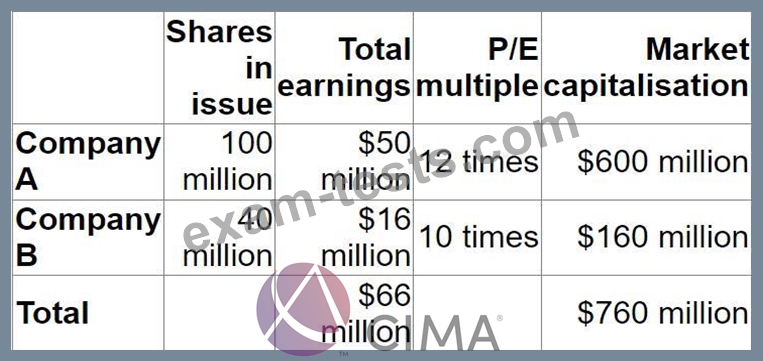

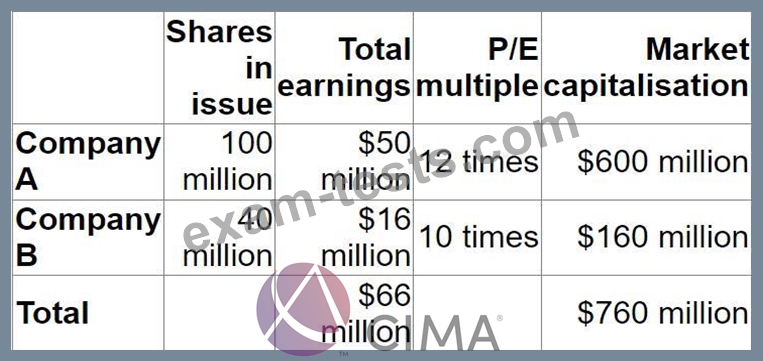

Pre-acquisition information is as follows:

Post-acquisition information is as follows:

* Annual earnings are expected to increase by $4 million.

* The P/E multiple of the combined company is expected to be 12 times.

If the acquisition proceeds, what is the expected percentage increase in the post acquisition share price of Company A?

Pre-acquisition information is as follows:

Post-acquisition information is as follows:

* Annual earnings are expected to increase by $4 million.

* The P/E multiple of the combined company is expected to be 12 times.

If the acquisition proceeds, what is the expected percentage increase in the post acquisition share price of Company A?

Question 37

A company is based in Country Y whose functional currency is YS. It has an investment in Country Z whose functional currency is ZS This year the company expects to generate ZS20 million profit after tax.

Tax Regime

* Corporate income tax rate in Country Y is 60%

* Corporate income tax rate in Country Z Is 30%

* Full double tax relief is available

Assume an exchange rate of YS1 = ZS5

What is the expected profit after tax in YS if the ZS profit is remitted to Country Y?

Tax Regime

* Corporate income tax rate in Country Y is 60%

* Corporate income tax rate in Country Z Is 30%

* Full double tax relief is available

Assume an exchange rate of YS1 = ZS5

What is the expected profit after tax in YS if the ZS profit is remitted to Country Y?

Question 38

A listed company plans to raise $350 million to finance a major expansion programme.

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of 3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of 3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

Question 39

Which THREE of the following statements are correct?

Question 40

A company is currently all-equity financed with a cost of equity of 8%.

It plans to raise debt with a pre-tax cost of 4% in order to buy back equity shares.

After the buy-back, the debt-to-equity ratio at market values will be 1 to 2.

The corporate income tax rate is 30%.

Which of the following represents the company's cost of equity after the buy-back according to Modigliani and Miller's Theory of Capital Structure with taxes?

It plans to raise debt with a pre-tax cost of 4% in order to buy back equity shares.

After the buy-back, the debt-to-equity ratio at market values will be 1 to 2.

The corporate income tax rate is 30%.

Which of the following represents the company's cost of equity after the buy-back according to Modigliani and Miller's Theory of Capital Structure with taxes?