Question 106

Which THREE of the following non-financial objectives would be most appropriate for a listed company in the food retailing industry?

Question 107

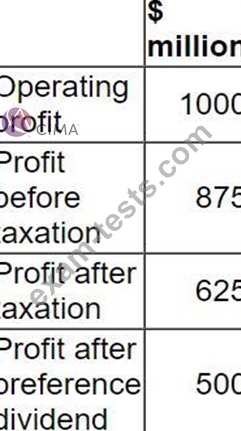

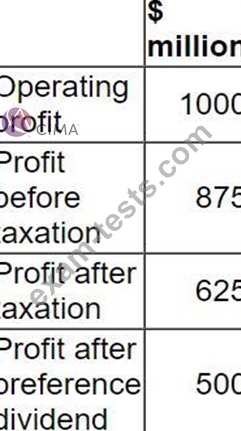

Extracts from a company's profit forecast for the next financial year as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 1,250 million ordinary shares currently in issue and canceling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 1,250 million ordinary shares currently in issue and canceling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

Question 108

A company is considering the issue of a convertible bond compared to a straight bond issue (non- convertible bond).

Director A is concerned that issuing a convertible bond will upset the shareholders for the following reasons:

* it will dilute their control

* the interest payments will be higher therefore reducing liquidity

* it will increase the gearing ratio therefore increasing financial risk Director B disagrees, and is preparing a board paper to promote the issue of the convertible bond rather than a non-convertible.

Advise the Director B which THREE of the following statements should be included in his board paper to promote the issue of the convertible bond?

Director A is concerned that issuing a convertible bond will upset the shareholders for the following reasons:

* it will dilute their control

* the interest payments will be higher therefore reducing liquidity

* it will increase the gearing ratio therefore increasing financial risk Director B disagrees, and is preparing a board paper to promote the issue of the convertible bond rather than a non-convertible.

Advise the Director B which THREE of the following statements should be included in his board paper to promote the issue of the convertible bond?

Question 109

A company has:

* $7 million market value of equity

* $5 million market value of debt

* WACC of 9.375%

* Corporate income tax rate of 15%

According to Modigliani and Miller's theory of capital structure with tax, what is the ungeared cost of equity?

* $7 million market value of equity

* $5 million market value of debt

* WACC of 9.375%

* Corporate income tax rate of 15%

According to Modigliani and Miller's theory of capital structure with tax, what is the ungeared cost of equity?