Question 1

Company W is a manufacturing company with three divisions, all of which are making profits:

* Division A which manufactures cars

* Division B which manufactures trucks

* Division C which manufactures agricultural machinery

Company W is facing severe competitive pressure in all of its markets, and is currently operating with a high level of gearing Company W's latest forecasts suggest that it needs to raise cash to avoid breaching loan covenants on its existing debt finance in 6 months' time In a recent strategy review. Divisions A and B were identified as being the core divisions of Company W The management of Division C is known to be interested in the possibility of a management buy-out.

Company Z is known to be interested in making a takeover bid for Company W's truck manufacturing division A rival to Company W has recently successfully demerged its business, this was well received by the Financial markets Which of the following exit strategies will be most suitable for company W?

* Division A which manufactures cars

* Division B which manufactures trucks

* Division C which manufactures agricultural machinery

Company W is facing severe competitive pressure in all of its markets, and is currently operating with a high level of gearing Company W's latest forecasts suggest that it needs to raise cash to avoid breaching loan covenants on its existing debt finance in 6 months' time In a recent strategy review. Divisions A and B were identified as being the core divisions of Company W The management of Division C is known to be interested in the possibility of a management buy-out.

Company Z is known to be interested in making a takeover bid for Company W's truck manufacturing division A rival to Company W has recently successfully demerged its business, this was well received by the Financial markets Which of the following exit strategies will be most suitable for company W?

Question 2

The directors of a multinational group have decided to sell off a loss-making subsidiary and are considering the following methods of divestment:

1. Trade sale to an external buyer

2. A management buyout (MBC)

The MDO team and the external buyer have both offered the same price to the parent company for the subsidiary.

Which of the following is an advantage to the parent company of opting for a MBO compared to a trade sale as the preferred method of divestment?

1. Trade sale to an external buyer

2. A management buyout (MBC)

The MDO team and the external buyer have both offered the same price to the parent company for the subsidiary.

Which of the following is an advantage to the parent company of opting for a MBO compared to a trade sale as the preferred method of divestment?

Question 3

A company wishes to raise new finance using a rights issue to invest in a new project offering an IRR of 10% The following data applies:

* There are currently 1 million shares in issue at a current market value of $4 each.

* The terms of the rights issue will be $3.50 for 1 new share for 5 existing shares.

* The company's WACC is currently 8%.

What is the yield-adjusted theoretical ex-rights price (TERP)?

Give your answer to 2 decimal places.

$ ?

* There are currently 1 million shares in issue at a current market value of $4 each.

* The terms of the rights issue will be $3.50 for 1 new share for 5 existing shares.

* The company's WACC is currently 8%.

What is the yield-adjusted theoretical ex-rights price (TERP)?

Give your answer to 2 decimal places.

$ ?

Question 4

ADC is planning to acquire DEF in order to benefit from the expertise of DEF's owner 'managers Both are Listed companies. ADC is trying to decide whether to offer cash or shares in consideration for DEF's shares.

Which THREE of the following are advantages to ABC of offering shares to acquire CEF?

Which THREE of the following are advantages to ABC of offering shares to acquire CEF?

Question 5

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

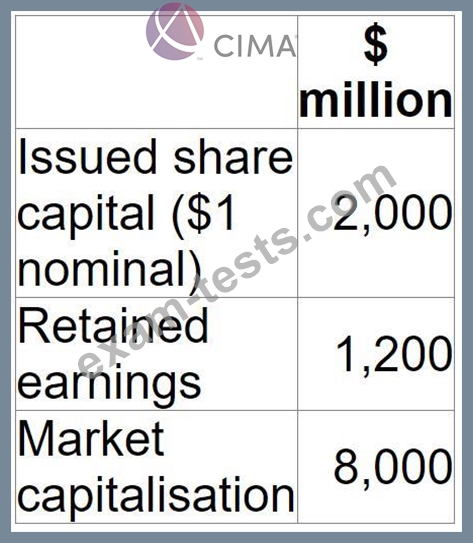

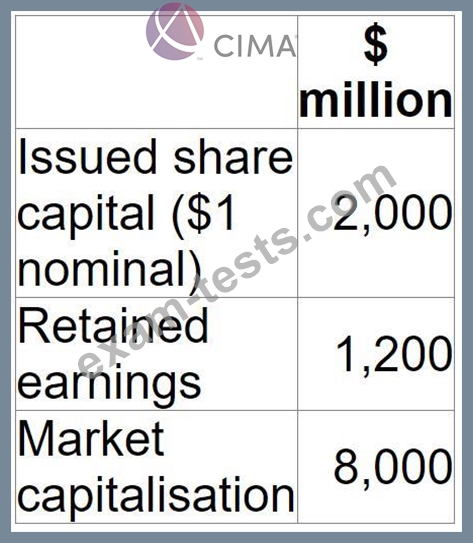

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?