Question 16

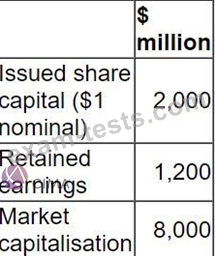

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

Question 17

A company plans to raise $12 million to finance an expansion project using a rights issue.

Relevant data:

* Shares will be offered at a 20% discount to the present market price of $15.00 per share.

* There are currently 2 million shares in issue.

* The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

Relevant data:

* Shares will be offered at a 20% discount to the present market price of $15.00 per share.

* There are currently 2 million shares in issue.

* The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

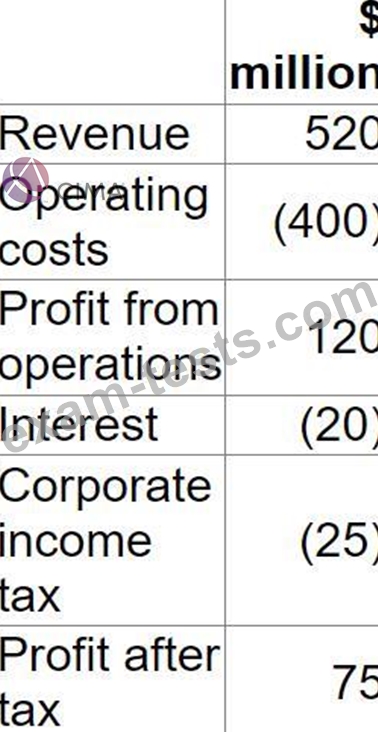

Question 18

The table below shows the forecast for a company's next financial year:

The forecast incorporates the following assumptions:

* 25% of operating costs are variable

* Debt finance comprises a $400 million fixed rate loan at 5%

* Corporate income tax is paid at 25%

The company plans to do the following next year from the forecast earnings on the assumption that earnings will be equivalent to free cash flow:

* Pay a total dividend of $20 million

* Invest $40 million in new projects

What is the maximum % reduction in operating activity that could occur next year before the company's dividend and investment plans are affected?

Give your answer to the nearest 0.1%.

The forecast incorporates the following assumptions:

* 25% of operating costs are variable

* Debt finance comprises a $400 million fixed rate loan at 5%

* Corporate income tax is paid at 25%

The company plans to do the following next year from the forecast earnings on the assumption that earnings will be equivalent to free cash flow:

* Pay a total dividend of $20 million

* Invest $40 million in new projects

What is the maximum % reduction in operating activity that could occur next year before the company's dividend and investment plans are affected?

Give your answer to the nearest 0.1%.

Question 19

A company currently has a 6.25% fixed rate loan but it wishes to change the interest style of the loan to variable by using an interest rate swap directly with the bank.

The bank has quoted the following swap rate:

* 5.50% - 5.55% in exchange for LIBOR

LIBOR is currently 5%.

If the company enters into the swap and LIBOR remains at 5%, what will the company's interest cost be?

The bank has quoted the following swap rate:

* 5.50% - 5.55% in exchange for LIBOR

LIBOR is currently 5%.

If the company enters into the swap and LIBOR remains at 5%, what will the company's interest cost be?

Question 20

A company plans to raise S15 million to finance an expansion project using a rights issue Relevant data

* Shares will be offered at a 20% discount to the present market price of S12 50 per share

* There are currently 3 million shares in issue

* The project is forecast to yield a positive NPV of $9 million

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

* Shares will be offered at a 20% discount to the present market price of S12 50 per share

* There are currently 3 million shares in issue

* The project is forecast to yield a positive NPV of $9 million

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?