Question 11

Company C has received an unwelcome takeover bid from Company P.

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

Question 12

When valuing an unlisted company, a P/E ratio for a similar listed company may be used but adjustments to the P/E ratio may be necessary.

Which THREE of the following factors would justify a reduction in the proxy p/e ratio before use?

Which THREE of the following factors would justify a reduction in the proxy p/e ratio before use?

Question 13

A listed company has suffered a period of falling revenues and profit margins. It has been obliged to issue a profit warning to the market and its share price has fallen sharply. The company relies heavily on debt finance and is discussing with its banks possible refinancing options to assist with a restructuring programme.

Which THREE of the following are likely to be of MOST interest to the company's banks when they review the refinancing requests?

Which THREE of the following are likely to be of MOST interest to the company's banks when they review the refinancing requests?

Question 14

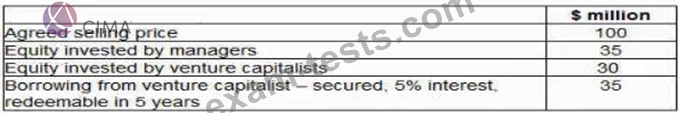

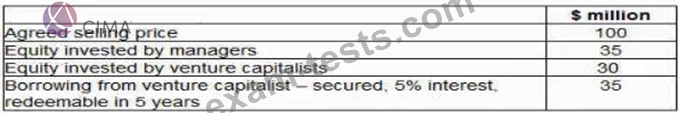

A listed entertainment and media company produces and distributes films globally. The company invests heavily in intellectual property in order to create the scope for future film projects. The company has five separate distribution companies, each managed as a separate business unit The company is seeking to sell one of its business units in a management buy-out (MBO) to enable it to raise finance for proposed new investments The business unit managers have been in discussions with a bank and venture capitalists regarding the financing for the MBO The venture capitalists are only prepared to invest a mixture of debt and equity and have suggested the following:

The venture capitalists have stated that they expect a minimum return on their equity investment of 30% a year on a compound basis over the first 5 years of the MBO No dividends will be paid during this period.

Advise the MBO team of the total amount due to the venture capitalist over the 5-year period to satisfy their total minimum return?

The venture capitalists have stated that they expect a minimum return on their equity investment of 30% a year on a compound basis over the first 5 years of the MBO No dividends will be paid during this period.

Advise the MBO team of the total amount due to the venture capitalist over the 5-year period to satisfy their total minimum return?

Question 15

Company Z has just completed the all-cash acquisition of Company A.

Both companies operate in the advertising industry.

The market considered the acquisition a positive strategic move by Company Z.

Which THREE of the following will the shareholders of Company Z expect the company's directors to prioritise following the acquisition?

Both companies operate in the advertising industry.

The market considered the acquisition a positive strategic move by Company Z.

Which THREE of the following will the shareholders of Company Z expect the company's directors to prioritise following the acquisition?