Question 51

Company C has received an unwelcome takeover bid from Company P.

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

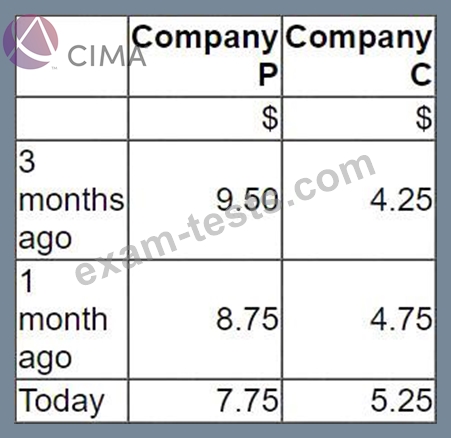

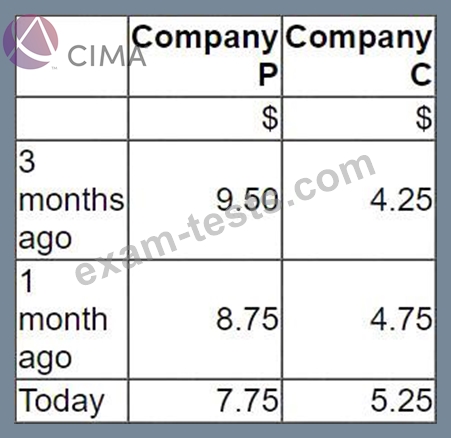

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

Question 52

Company A is unlisted and all-equity financed. It is trying to estimate its cost of equity.

The following information relates to another company, Company B, which operates in the same industry as Company A and has similar business risk:

Equity beta = 1.6

Debt:equity ratio 40:60

The rate of corporate income tax is 20%.

The expected premium on the market portfolio is 7% and the risk-free rate is 5%.

What is the estimated cost of equity for Company A?

Give your answer to one decimal place.

? %

The following information relates to another company, Company B, which operates in the same industry as Company A and has similar business risk:

Equity beta = 1.6

Debt:equity ratio 40:60

The rate of corporate income tax is 20%.

The expected premium on the market portfolio is 7% and the risk-free rate is 5%.

What is the estimated cost of equity for Company A?

Give your answer to one decimal place.

? %

Question 53

Company X is based in Country A, whose currency is the A$.

It trades with customers in Country B, whose currency is the B$.

Company X aims to maintain its revenue from exports to Country B at 25% of total revenue.

Company A has the following forecast revenue:

The forecast revenue from Country B has assumed an exchange rate of A$1/B$2, that is A$1 = B$2.

If the B$ depreciates against the A$ by 10%, the ratio of revenue generated from Country B as a percentage of total revenue will:

It trades with customers in Country B, whose currency is the B$.

Company X aims to maintain its revenue from exports to Country B at 25% of total revenue.

Company A has the following forecast revenue:

The forecast revenue from Country B has assumed an exchange rate of A$1/B$2, that is A$1 = B$2.

If the B$ depreciates against the A$ by 10%, the ratio of revenue generated from Country B as a percentage of total revenue will:

Question 54

H Company has a fixed rate load at 10.0%, but wishes to swap to variable. It can borrow at LIBOR 8%.

The bank is currently quoting swap rates of 3.1% (bid) and 3.5% (ask).

What net rate will H Company pay if it enters into the swap?

The bank is currently quoting swap rates of 3.1% (bid) and 3.5% (ask).

What net rate will H Company pay if it enters into the swap?

Question 55

Assume today is 31 December 20X1.

A listed mobile phone company has just launched a new phone which is proving to be a great success.

As a direct result of the product's success, earnings are forecast to increase by:

* 5% a year in each of years 20X2 - 20X6

* 3% from 20X7 onwards

Market analysts were very excited to hear the news of the success of the product and future growth forecasts.

Assuming a semi-efficient market applies, which of the following company valuation methods is likely to give the best estimate of the company's equity value today?

A listed mobile phone company has just launched a new phone which is proving to be a great success.

As a direct result of the product's success, earnings are forecast to increase by:

* 5% a year in each of years 20X2 - 20X6

* 3% from 20X7 onwards

Market analysts were very excited to hear the news of the success of the product and future growth forecasts.

Assuming a semi-efficient market applies, which of the following company valuation methods is likely to give the best estimate of the company's equity value today?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: