Question 26

Which THREE of the following are the most likely exit routes that apply to a venture capitalist?

Question 27

XYZ is a multi-national group with subsidiary AA in Country A and subsidiary BB in Country B.

The capital structures of AA and BB are set up to take advantage of the lower tax rate in Country A Thin capitalisation rules in Country B will limit the ability for either AA or BB to claim tax relief on:

The capital structures of AA and BB are set up to take advantage of the lower tax rate in Country A Thin capitalisation rules in Country B will limit the ability for either AA or BB to claim tax relief on:

Question 28

The directors of a financial services company need to calculate a valuation of their company's equity in preparation for an upcoming initial Public Offering (IPO) of shares. At a recent board meeting they discussed the various methods of business valuation.

The Chief Executive suggested using a Price-earing (P./E) method of valuation, but the finance Director argued that a valuation based on forecast cash flows to equity would be more appropriate.

Which THREE of the following are advantages of valuation based on forecast cash flows to equity, compared to a valuating using a price earnings methods?

The Chief Executive suggested using a Price-earing (P./E) method of valuation, but the finance Director argued that a valuation based on forecast cash flows to equity would be more appropriate.

Which THREE of the following are advantages of valuation based on forecast cash flows to equity, compared to a valuating using a price earnings methods?

Question 29

A company is planning a share repurchase programme with the following details:

* Repurchased shares will be immediately cancelled.

* The shares will be purchased at a premium to the market share price.

The current market share price is greater than the nominal value of the shares.

Which of the following statements about the impact of the share repurchase programme on the company's financial statements is correct?

* Repurchased shares will be immediately cancelled.

* The shares will be purchased at a premium to the market share price.

The current market share price is greater than the nominal value of the shares.

Which of the following statements about the impact of the share repurchase programme on the company's financial statements is correct?

Question 30

Company HJK is planning to bid for listed company BNM

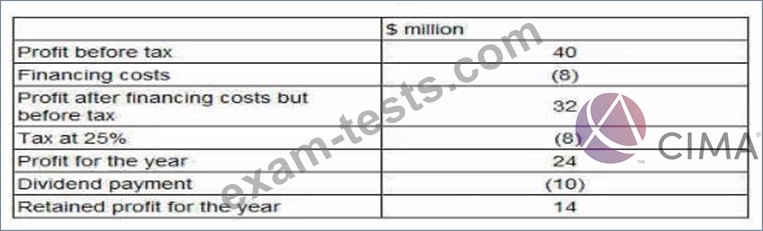

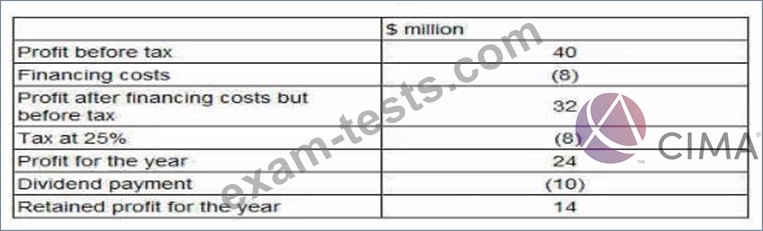

Financial data for BNM for the financial year ended 31 December 20X1:

HJK is not forecasting any growth in these figures for the foreseeable future Profit and cost data above should be assumed to be equivalent to cash flow data when answenng this question Which THREE of the following approaches would be most appropriate for HJK to use to value the equity of BNM?

Financial data for BNM for the financial year ended 31 December 20X1:

HJK is not forecasting any growth in these figures for the foreseeable future Profit and cost data above should be assumed to be equivalent to cash flow data when answenng this question Which THREE of the following approaches would be most appropriate for HJK to use to value the equity of BNM?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: