Question 31

A company financed by equity and debt can be valued by discounting:

Question 32

Company A, a listed company, plans to acquire Company T, which is also listed.

Additional information is:

* Company A has 150 million shares in issue, with market price currently at $7.00 per share.

* Company T has 120 million shares in issue,. with market price currently at $6.00 each share.

* Synergies valued at $50 million are expected to arise from the acquisition.

* The terms of the offer will be 2 shares in A for 3 shares in T.

Assuming the offer is accepted and the synergies are realised, what should the post-acquisition price of each of Company A's shares be?

Give your answer to two decimal places.

Additional information is:

* Company A has 150 million shares in issue, with market price currently at $7.00 per share.

* Company T has 120 million shares in issue,. with market price currently at $6.00 each share.

* Synergies valued at $50 million are expected to arise from the acquisition.

* The terms of the offer will be 2 shares in A for 3 shares in T.

Assuming the offer is accepted and the synergies are realised, what should the post-acquisition price of each of Company A's shares be?

Give your answer to two decimal places.

Question 33

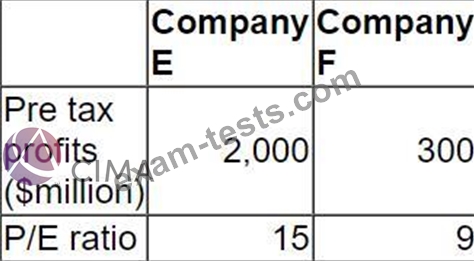

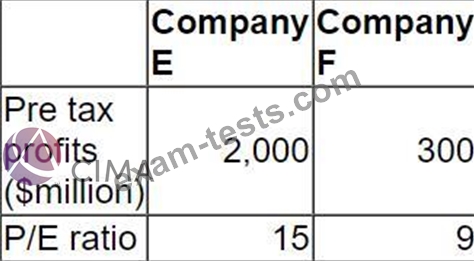

Company E is a listed company. Its directors are valuing a smaller listed company, Company F, as a possible acquisition.

The two companies operate in the same markets and have the same business risk.

Relevant data on the two companies is as follows:

Both companies are wholly equity financed and both pay corporate tax at 30%.

The directors of Company E believe they can "bootstrap" Company F's earnings to improve performance.

Calculate the maximum price that Company E should offer to Company F's shareholders to acquire the company.

Give your answer to the nearest $million.

The two companies operate in the same markets and have the same business risk.

Relevant data on the two companies is as follows:

Both companies are wholly equity financed and both pay corporate tax at 30%.

The directors of Company E believe they can "bootstrap" Company F's earnings to improve performance.

Calculate the maximum price that Company E should offer to Company F's shareholders to acquire the company.

Give your answer to the nearest $million.

Question 34

A company needs to raise $20 million to finance a project.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.

Question 35

An all equity financed company plans an issue of new ordinary shares to the general public to raise finance for a new project The following data applies:

* 10 million ordinary shares are currently in issue with a market value of S3 each share

* The new project will cost S2.88 million and is expected to give a positive NPV of S1 million

* The issue will be priced at a AaA discount to the current share price.

What gam or loss per share will accrue to the existing shareholders?

* 10 million ordinary shares are currently in issue with a market value of S3 each share

* The new project will cost S2.88 million and is expected to give a positive NPV of S1 million

* The issue will be priced at a AaA discount to the current share price.

What gam or loss per share will accrue to the existing shareholders?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: