Question 66

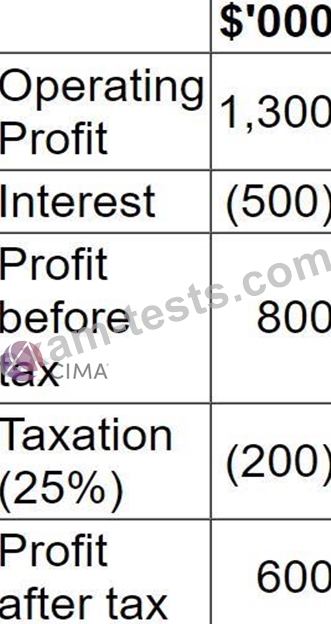

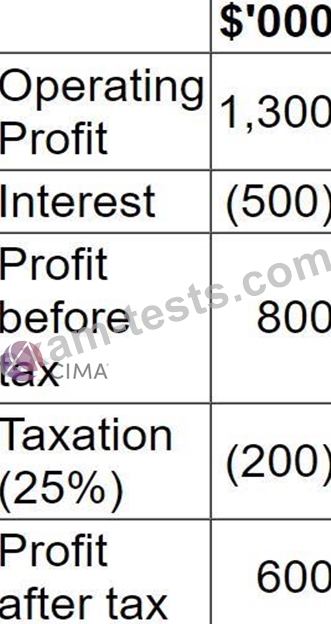

A company has forecast the following results for the next financial year:

The following is also relevant:

* Profit after tax for the year can be assumed to be equivalent to free cash flow for the year.

* Debt finance comprises a $10 million floating rate loan which currently carries an interest rate of 5%.

* $400,000 investment in non-current assets is required to achieve required growth, all of which is to financed from next year's free cash flow.

* The company plans to pay a dividend of $150,000 next year, financed from next year's free cash flow.

The company is concerned that interest rates could rise next year to 6% which could then affect their investment plans.

If interest rates were to rise to 6% and the company wishes to maintain its dividend amount, the planned investment expenditure will decrease by:

The following is also relevant:

* Profit after tax for the year can be assumed to be equivalent to free cash flow for the year.

* Debt finance comprises a $10 million floating rate loan which currently carries an interest rate of 5%.

* $400,000 investment in non-current assets is required to achieve required growth, all of which is to financed from next year's free cash flow.

* The company plans to pay a dividend of $150,000 next year, financed from next year's free cash flow.

The company is concerned that interest rates could rise next year to 6% which could then affect their investment plans.

If interest rates were to rise to 6% and the company wishes to maintain its dividend amount, the planned investment expenditure will decrease by:

Question 67

A company's gearing is well below its optimal level and therefore it is considering implementing a share re-purchase programme.

This programme will be funded from the proceeds of a planned new long-term bond issue.

Its financial projections show no change to next year's expected earnings.

As a result, the company plans to pay the same total dividend in future years.

If the share re-purchase is implemented, which THREE of the following measures are most likely to decrease?

This programme will be funded from the proceeds of a planned new long-term bond issue.

Its financial projections show no change to next year's expected earnings.

As a result, the company plans to pay the same total dividend in future years.

If the share re-purchase is implemented, which THREE of the following measures are most likely to decrease?

Question 68

Company B is an all equity financed company with a cost of equity of 10%.

It is considering issuing bonds in order to achieve a gearing level of 20% debt and 80% equity.

These bonds will pay a coupon rate of 5% and have an interest yield of 6%.

Company B pays corporate tax at the rate of 25%.

According to Modigliani and Miller's theory of capital structure with tax, what will be Company B's new cost of equity?

It is considering issuing bonds in order to achieve a gearing level of 20% debt and 80% equity.

These bonds will pay a coupon rate of 5% and have an interest yield of 6%.

Company B pays corporate tax at the rate of 25%.

According to Modigliani and Miller's theory of capital structure with tax, what will be Company B's new cost of equity?

Question 69

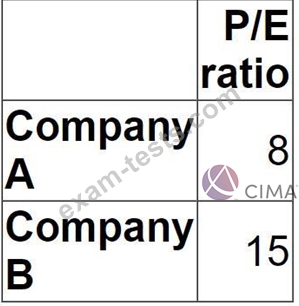

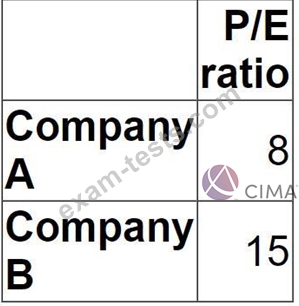

Two companies that operate in the same industry have different Price/Earnings (P/E) ratios as follows:

Which of the following is the most likely explanation of the different P/E ratios?

Which of the following is the most likely explanation of the different P/E ratios?

Question 70

Which THREE of the following would be most important if a hospital wishes to review the effectiveness of its services?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: