Question 46

Company A is located in Country A, where the currency is the A$.

It is listed on the local stock market which was set up 10 years ago.

It plans a takeover of Company B, which is located in Country B where the currency is the B$, and where the stock market has been operating for over 100 years.

Company A is considering how to finance the acquisition, and how the shareholders of Company B might respond to a share exchange or cash (paid in B$).

Which of the following is likely to explain why the shareholders of Company B would prefer a share exchange as opposed to a cash offer?

It is listed on the local stock market which was set up 10 years ago.

It plans a takeover of Company B, which is located in Country B where the currency is the B$, and where the stock market has been operating for over 100 years.

Company A is considering how to finance the acquisition, and how the shareholders of Company B might respond to a share exchange or cash (paid in B$).

Which of the following is likely to explain why the shareholders of Company B would prefer a share exchange as opposed to a cash offer?

Question 47

When valuing an unlisted company, a P/E ratio for a similar listed company may be used but adjustments to the P/E ratio may be necessary.

Which THREE of the following factors would justify a reduction in the proxy p/e ratio before use?

Which THREE of the following factors would justify a reduction in the proxy p/e ratio before use?

Question 48

Company B is an all equity financed company with a cost of equity of 10%.

It is considering issuing bonds in order to achieve a gearing level of 20% debt and 80% equity.

These bonds will pay a coupon rate of 5% and have an interest yield of 6%.

Company B pays corporate tax at the rate of 25%.

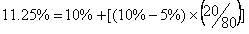

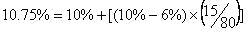

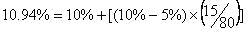

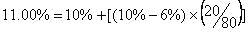

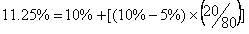

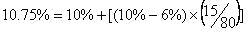

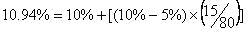

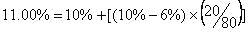

According to Modigliani and Miller's theory of capital structure with tax, what will be Company B's new cost of equity?

A)

B)

C)

D)

It is considering issuing bonds in order to achieve a gearing level of 20% debt and 80% equity.

These bonds will pay a coupon rate of 5% and have an interest yield of 6%.

Company B pays corporate tax at the rate of 25%.

According to Modigliani and Miller's theory of capital structure with tax, what will be Company B's new cost of equity?

A)

B)

C)

D)

Question 49

Company U has made a bid for the entire share capital of Company B.

Company U is offering the shareholders in Company B the option of either a share exchange or a cash alternative.

Advise the shareholders in Company B which THREE of the following would be considered disadvantages of accepting the cash consideration?

Company U is offering the shareholders in Company B the option of either a share exchange or a cash alternative.

Advise the shareholders in Company B which THREE of the following would be considered disadvantages of accepting the cash consideration?

Question 50

A company generates and distributes electricity and gas to households and businesses.

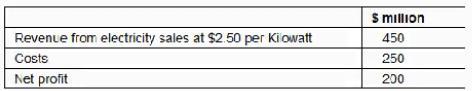

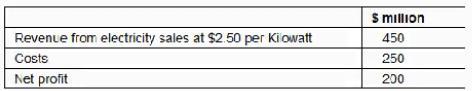

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to: