Question 66

A company's latest accounts show profit after tax of $20.0 million, after deducting interest of $5.0 million. The company expects earnings to grow at 5% per annum indefinitely.

The company has estimated its cost of equity at 12%, which is included in the company WACC of 10%.

Assuming that profit after tax is equivalent to cash flows, what is the value of the equity capital?

Give your answer to the nearest $ million.

$ ? million

The company has estimated its cost of equity at 12%, which is included in the company WACC of 10%.

Assuming that profit after tax is equivalent to cash flows, what is the value of the equity capital?

Give your answer to the nearest $ million.

$ ? million

Question 67

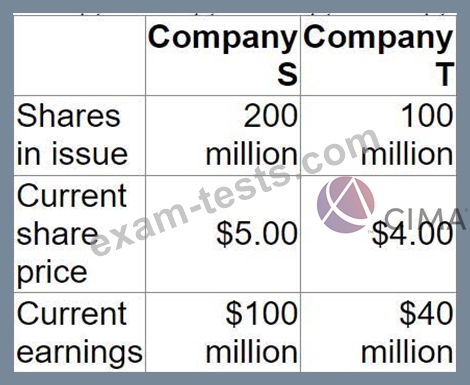

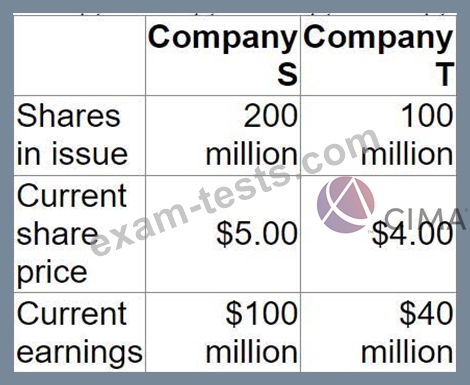

Company S is planning to acquire Company T.

The shareholders in Company T will receive new shares in Company S in an all-share consideration.

Relevant information:

The shareholders in Company T want sufficient shares to receive a 25% premium on the pre-acquisition value of their shares, based on the pre-acquisition share price.

Which of the following share-for-share offers will achieve the desired result?

The shareholders in Company T will receive new shares in Company S in an all-share consideration.

Relevant information:

The shareholders in Company T want sufficient shares to receive a 25% premium on the pre-acquisition value of their shares, based on the pre-acquisition share price.

Which of the following share-for-share offers will achieve the desired result?

Question 68

A company aims to increase profit before interest and tax (PBIT) each year.

The company reports in A$ but has significant export sales priced in B$.

All other transactions are priced in A$.

In 20X1, the company reported:

In 20X2, the only changes expected are:

* An increase in export prices of 10%, but no change to units sold.

* A rise in the value of the B$ to A$/B$ 2.500 (that is, A$ 1 = B$ 2.5) Is it likely that the company would still meet its objective to grow PBIT between 20X1 and 20X2?

The company reports in A$ but has significant export sales priced in B$.

All other transactions are priced in A$.

In 20X1, the company reported:

In 20X2, the only changes expected are:

* An increase in export prices of 10%, but no change to units sold.

* A rise in the value of the B$ to A$/B$ 2.500 (that is, A$ 1 = B$ 2.5) Is it likely that the company would still meet its objective to grow PBIT between 20X1 and 20X2?

Question 69

Company A is planning to acquire Company B.

Company A's managers think they can improve the performance of Company B to the extent that its own P/E ratio should be applied to Company B's earnings.

Relevant Data:

What is the expected synergy if the acquisition goes ahead?

Give your answer to the nearest $ million.

$ ? million

Company A's managers think they can improve the performance of Company B to the extent that its own P/E ratio should be applied to Company B's earnings.

Relevant Data:

What is the expected synergy if the acquisition goes ahead?

Give your answer to the nearest $ million.

$ ? million

Question 70

Company A plans to acquire Company B.

Both firms operate as wholesalers in the fashion industry, supplying a wide range of ladies' clothing shops.

Company A sources mainly from the UK, Company B imports most of its supplies from low-income overseas countries.

Significant synergies are expected in management costs and warehousing, and in economies of bulk purchasing.

Which of the following is likely to be the single most important issue facing Company A in post-merger integration?

Both firms operate as wholesalers in the fashion industry, supplying a wide range of ladies' clothing shops.

Company A sources mainly from the UK, Company B imports most of its supplies from low-income overseas countries.

Significant synergies are expected in management costs and warehousing, and in economies of bulk purchasing.

Which of the following is likely to be the single most important issue facing Company A in post-merger integration?