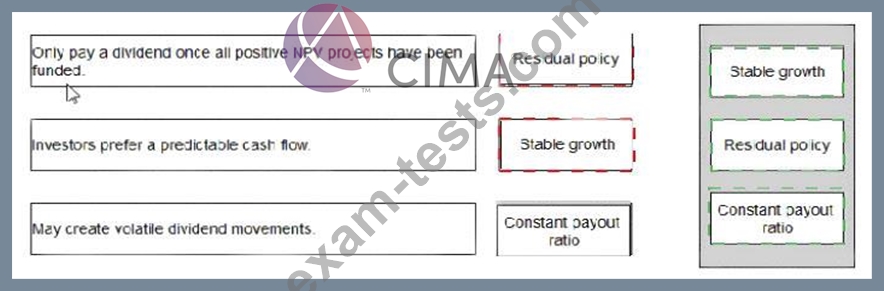

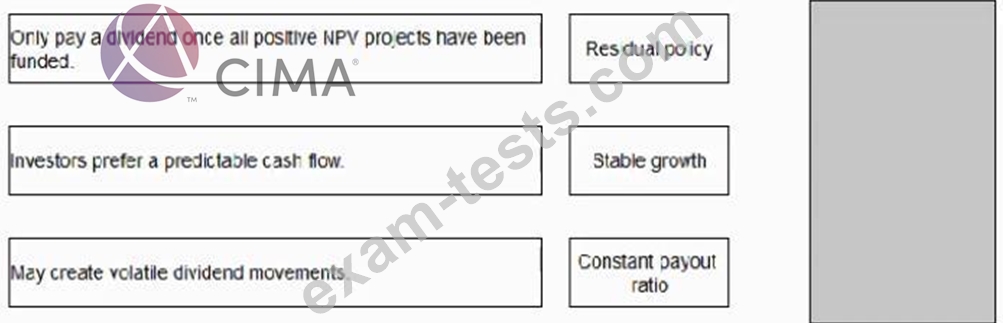

Question 51

Select the most appropriate divided for each of the following statements:

Question 52

A company has undertaken a transaction with its shareholders which has had the following impact on its financial statements:

* Retained earnings has decreased

* Share capital has increased

* Earnings per share has decreased

* The book value of equity is unchanged

The company has undertaken a:

* Retained earnings has decreased

* Share capital has increased

* Earnings per share has decreased

* The book value of equity is unchanged

The company has undertaken a:

Question 53

A listed company follows a policy of paying a constant dividend. The following information is available:

* Issued share capital (nominal value $0.50) $60 million

* Current market capitalisation $480 million

The shareholders are requesting an increased dividend this year as earnings have been growing. However, the directors wish to retain as much cash as possible to fund new investments. They therefore plan to announce a

1-for-10 scrip dividend to replace the usual cash dividend.

Assuming no other influence on share price, what is the expected share price following the scrip dividend?

Give your answer to 2 decimal places.

* Issued share capital (nominal value $0.50) $60 million

* Current market capitalisation $480 million

The shareholders are requesting an increased dividend this year as earnings have been growing. However, the directors wish to retain as much cash as possible to fund new investments. They therefore plan to announce a

1-for-10 scrip dividend to replace the usual cash dividend.

Assuming no other influence on share price, what is the expected share price following the scrip dividend?

Give your answer to 2 decimal places.

Question 54

A company is owned by its five directors who want to sell the business.

Current profit after tax is $750,000.

The directors are currently paid minimal salaries, taking most of their incomes as dividends.

After the company is sold, directors' salaries will need to be increased by $50,000 each year in total.

A suitable Price/Earnings (P/E) ratio is 7, and the rate of corporate tax is 20%.

What is the value of the company using a P/E valuation?

Current profit after tax is $750,000.

The directors are currently paid minimal salaries, taking most of their incomes as dividends.

After the company is sold, directors' salaries will need to be increased by $50,000 each year in total.

A suitable Price/Earnings (P/E) ratio is 7, and the rate of corporate tax is 20%.

What is the value of the company using a P/E valuation?

Question 55

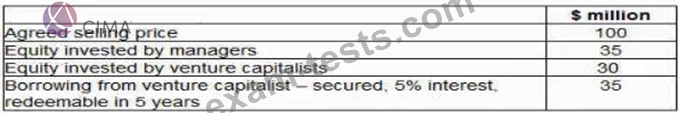

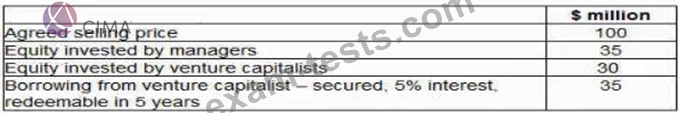

A listed entertainment and media company produces and distributes films globally. The company invests heavily in intellectual property in order to create the scope for future film projects. The company has five separate distribution companies, each managed as a separate business unit The company is seeking to sell one of its business units in a management buy-out (MBO) to enable it to raise finance for proposed new investments The business unit managers have been in discussions with a bank and venture capitalists regarding the financing for the MBO The venture capitalists are only prepared to invest a mixture of debt and equity and have suggested the following:

The venture capitalists have stated that they expect a minimum return on their equity investment of 30% a year on a compound basis over the first 5 years of the MBO No dividends will be paid during this period.

Advise the MBO team of the total amount due to the venture capitalist over the 5-year period to satisfy their total minimum return?

The venture capitalists have stated that they expect a minimum return on their equity investment of 30% a year on a compound basis over the first 5 years of the MBO No dividends will be paid during this period.

Advise the MBO team of the total amount due to the venture capitalist over the 5-year period to satisfy their total minimum return?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: